Writing a Demand Letter for Personal Injury

Before you start drafting a personal injury demand letter, it’s essential to understand what it really is. This isn't just some formal request for money; it's your first—and often most critical—strategic move in the entire settlement negotiation. A sharp, well-written letter sets the tone for everything that follows, and it can mean the difference between a quick, fair settlement and a long, drawn-out fight.

The Strategic Role of Your Demand Letter

Think of the demand letter as your opening argument in a case you plan to win without ever seeing the inside of a courtroom. It’s a persuasive story, backed by cold, hard evidence, that lays out your client’s claim in the most compelling way possible. The real goal here is to make the strength of your case so obvious that the insurance company sees the financial risk in trying to deny a reasonable settlement.

A truly effective demand letter accomplishes several things at once:

- It frames the narrative. You get to tell the story of what happened and the impact of the injuries on your terms, establishing the other party's liability right from the start.

- It shows you mean business. A professional, organized, and meticulously detailed letter signals to the adjuster that you are serious and fully prepared to pursue the claim.

- It gets the ball rolling on negotiations. By presenting a specific monetary demand based on thoroughly documented damages, you formally open the door for settlement talks.

- It creates an official record. The letter and all its attachments become the foundation of your claim, which you can always refer back to if the case needs to escalate.

Thinking Like an Adjuster

You have to remember who you're writing for. Insurance adjusters are professionals trained to evaluate claims based on risk and financial exposure. They aren't swayed by emotional appeals; they respond to facts, clear liability, and solid documentation. A powerful demand letter speaks their language. It methodically presents the facts of the incident, proves the defendant’s fault, and breaks down every single dollar of damages.

Having a solid grasp of the key aspects of personal injury law is crucial. This context helps you understand why a structured, evidence-first approach is so persuasive to an insurer.

Key Takeaway: Your demand letter is your best shot at building a case so solid that the adjuster’s only logical move is to negotiate, not litigate. The goal is to make a trial look like a much more expensive and risky proposition for their side.

The reality of the legal system really drives this point home. While somewhere between 300,000 to 500,000 personal injury cases are filed each year in the U.S., a staggering over 95% of them are resolved through out-of-court settlements. Those settlements almost always begin with the demand letter, making it the linchpin document in the overwhelming majority of successful claims.

To give your demand letter the best chance of success, it needs to include several non-negotiable elements. Here’s a quick-reference table outlining what those are and why they matter.

Table: Core Components of an Effective Demand Letter

| Component | Purpose |

|---|---|

| Clear Identification | States the claimant, insured party, date of loss, and claim number for immediate reference. |

| Factual Narrative | Presents a concise, chronological account of the incident, establishing how it occurred. |

| Liability Argument | Clearly explains why the insured party is legally at fault, citing relevant statutes or negligence. |

| Injury & Treatment Summary | Details the client's injuries and the full scope of medical treatment received to date. |

| Damages Calculation | Itemizes all economic (medical bills, lost wages) and non-economic (pain and suffering) damages. |

| Specific Monetary Demand | States the total settlement amount you are demanding to resolve the claim. |

| Supporting Documentation | Attaches all necessary evidence, including medical records, bills, photos, and police reports. |

Including each of these components in a logical, organized manner is fundamental to creating a professional and persuasive document.

Setting the Stage for Success

Ultimately, you want to make the adjuster’s job easy. By presenting a clear, logical, and evidence-backed package, you eliminate the guesswork and friction that can slow things down. This isn’t just about listing injuries; it's about constructing an airtight argument that fully justifies the settlement figure you’re demanding.

For a deeper look into these fundamentals, check out our guide on https://areslegal.ai/blog/what-is-a-demand-letter. Getting this first step right can dramatically improve your chances of securing a fair resolution for your client without unnecessary delays.

Building a Factual Narrative of the Incident

This is where you lay the foundation for your entire claim. Your job is to take a chaotic, often traumatic event and distill it into a clear, logical story of negligence. The goal is to build a factual narrative so tight and well-supported that the insurance adjuster has no room to poke holes in it or downplay their insured's fault.

This isn't the place for emotion. It's about building an undeniable case, one concrete fact at a time, starting with the exact date, time, and location.

Setting the Scene with Precision

Before you get into the other party's actions, you need to paint a clear picture of the environment. Vague descriptions leave too much open to interpretation and give the adjuster an opening to shift blame.

Be specific. Provide details that frame the situation without ambiguity:

- Environmental Conditions: Was it a clear, sunny day, or was it raining with slick roads and poor visibility? Mention the weather and road conditions.

- Location Specifics: Don’t just say "on Main Street." Get granular: "I was traveling northbound on Main Street in the right-hand lane, approximately 100 feet south of the intersection with Oak Avenue."

- Your Actions: Clearly state what you were doing legally and safely. For instance, "I was operating my vehicle at the posted speed limit of 35 MPH and proceeded through the intersection on a green light."

This level of detail immediately establishes you as a careful, law-abiding individual and preemptively shuts down arguments that you or the environment contributed to the incident.

Weaving in the Critical Evidence

As you walk the adjuster through the sequence of events, this is your chance to integrate evidence directly into the story. Don't just save your proof for a list at the end; embed it into the narrative to give each statement instant credibility.

For example, instead of a generic "there was a witness," you'd write: "The collision was witnessed by Jane Doe, who was standing on the northeast corner and provided a sworn statement to the responding officer." This turns your account into a well-supported argument from the first paragraph.

Pro Tip: Always reference key documents by their official numbers. Citing "as documented in Police Report #2024-12345" adds a layer of authority. It shows the adjuster your claims are already part of an official record, making them much harder to dispute.

By tying each fact to a piece of evidence, you’re not just telling the adjuster what happened; you’re showing them proof every step of the way. It’s a methodical approach that signals you’ve done your homework and are taking this claim very seriously.

The Language of Liability

The words you choose here matter immensely. Steer clear of emotional, accusatory, or exaggerated phrasing. Words like "recklessly" or "carelessly" are conclusions; they sound like opinion. A factual description of the action is far more powerful. Let the facts do the heavy lifting.

Consider the difference:

- Weak: "The other driver came speeding out of nowhere and slammed into me."

- Strong: "Your insured, operating a blue sedan, failed to stop at the posted stop sign and entered the intersection, striking the passenger side of my vehicle."

The second example is objective, specific, and laser-focused on the action that constitutes negligence. It leaves no doubt about what occurred and who was responsible. This professional, fact-based tone shows the insurer you're serious and focused on the merits of the case, encouraging a more productive negotiation right from the start.

Your narrative should lead the adjuster to one simple, undeniable conclusion: their client was at fault.

Painting the Picture: Your Injuries and Medical Journey

Once you've firmly established liability, the demand letter needs to shift to its core emotional and factual anchor: the story of your client's injuries. This is where you connect the defendant's negligence to the real-world pain, suffering, and grueling path to recovery. You're translating raw physical trauma into a documented, credible account that an insurance adjuster simply can't skim over.

Your mission is to build an undeniable bridge from the incident to its consequences. You accomplish this by weaving a detailed, chronological narrative of the entire medical journey. This isn't just a dry list of injuries; it's a timeline that captures the full scope of treatment and its profound impact on your client's life.

Crafting a Clear Medical Timeline

For your narrative to be persuasive, it has to be methodical. Start right at the scene of the incident and move forward, hitting every single touchpoint with the healthcare system. The adjuster needs to follow a clear, unbroken chain of treatment flowing directly from the accident.

Your timeline must include every key event:

- The Initial Trauma: The ambulance ride, the ER visit, and those first critical diagnoses.

- Hospital Stays & Procedures: Any inpatient admissions or surgeries needed to stabilize and repair the damage.

- Specialist Follow-Ups: Every appointment with orthopedists, neurologists, pain management doctors, and other specialists.

- The Long Haul of Rehab: All physical therapy, occupational therapy, or chiropractic care.

- Objective Medical Evidence: MRIs, CT scans, X-rays, and any other diagnostics that visually confirm the injuries.

This step-by-step approach does more than list treatments—it powerfully demonstrates your client's commitment to getting better and substantiates the true severity of their condition. Keeping this all straight is a huge task, which is why a solid system for how to organize medical records is non-negotiable for building a strong case.

Using Precise Language to Describe Real-World Impact

While the story needs to be clear, the language must be precise. Lean on the exact medical terminology found in the records. Instead of saying your client had a "badly broken arm," you state they suffered a "comminuted fracture of the distal radius." This professional language adds instant credibility and signals that your demand is grounded in medical fact, not just emotion.

But clinical terms alone aren't enough. You have to show what these injuries mean in the real world. This is where you bring the human element to the forefront.

Expert Insight: An adjuster sees a "lumbar strain" on paper and might mentally check it off as a minor sprain. But when you describe it as "chronic lower back pain that prevents him from lifting his own child, sitting for more than 20 minutes without agonizing discomfort, or enjoying his passion for gardening," the injury suddenly has a tangible, relatable cost.

Translate the diagnosis into daily struggles and lost moments. Talk about the family gatherings missed, the simple personal care tasks they could no longer do alone, and the constant, nagging pain that ruined sleep and focus. This context is what gives weight to your demand for pain and suffering damages.

Assembling Your Medical Evidence Package

Every medical claim in your letter must be backed by cold, hard proof. This evidence becomes a set of organized exhibits attached to the demand. The idea is to hand the adjuster a complete, turn-key package that verifies every single detail of the medical journey and its associated costs.

Your evidence package should always include:

- Complete Medical Records: This means everything—admission notes, physician reports, surgical summaries, and therapy progress notes.

- Itemized Medical Bills: Gather every last bill from every provider. Think hospitals, surgeons, anesthesiologists, labs, and pharmacies.

- Proof of Lost Wages: Use recent pay stubs and a letter from the employer to document the income lost while your client was out of work.

- Supporting Photographs: Don't underestimate the power of visuals. Clear photos of visible injuries, taken at various stages of healing, provide undeniable proof of suffering.

By meticulously documenting the medical journey and its real-world fallout, you transform a list of injuries into a compelling story of loss and resilience. This comprehensive approach gives the insurance adjuster everything they need to grasp the full value of the claim and gets you much closer to a fair settlement.

Calculating and Justifying Your Settlement Demand

This is where the rubber meets the road. After laying out a compelling narrative of fault and your client's painful recovery, you have to put a number on the table. This isn't a guess; a strong settlement demand is the logical, evidence-based conclusion of everything you've presented so far.

The figure you demand is built on two distinct types of damages. Getting this part right is what separates a quick, fair settlement from a protracted fight.

Nailing Down the Economic Damages

First, let's talk about the hard numbers. These are the economic damages, sometimes called "special damages," and they represent every tangible, out-of-pocket loss your client has incurred. Think of this as the concrete foundation of your demand. Your goal is to account for every single penny the incident cost your client, leaving no room for the adjuster to argue.

To do this effectively, present a crystal-clear, itemized breakdown. Don't just give them a total—show them your math.

Your list must include specific line items for things like:

- Medical Bills: Every single charge, from the ambulance and ER visit to surgeries, specialist follow-ups, prescriptions, and medical equipment.

- Future Medical Costs: If the recovery is ongoing, you need to account for it. This requires a solid estimate from a medical expert for future therapy, procedures, or long-term care.

- Lost Income: Document every cent of lost wages. This means providing pay stubs and a letter from the employer that confirms the client's pay rate and the exact time they missed.

- Loss of Earning Capacity: In cases with life-altering injuries, this is crucial. It calculates the income your client will never earn because they can no longer do their job. This calculation almost always requires a formal report from an economist.

For a deeper dive into how these factors play into the final number, it's worth reviewing this complete guide on car accident settlements, which breaks down how adjusters approach valuation.

The Art of Valuing Pain and Suffering

Next comes the more subjective part: non-economic damages, or "general damages." This is where you assign a monetary value to your client’s human suffering—the pain, the emotional trauma, and the loss of life's simple pleasures. While you can't produce a receipt for suffering, there are established methods to arrive at a fair and defensible number.

The most common approach is the multiplier method. You start with the total hard number for economic damages and multiply it by a factor, usually somewhere between 1.5 and 5. The key is choosing—and justifying—the right multiplier for your specific case.

Key Takeaway: The multiplier is driven almost entirely by the severity of the injury and the impact on your client's life. A straightforward soft-tissue case might get a 1.5x multiplier. But a case involving permanent scarring, a long-term disability, or chronic pain could easily justify a 4x or 5x multiplier.

You can't just pick a number out of thin air. You have to connect your chosen multiplier back to your client's story. Remind the adjuster why this case warrants a higher figure by highlighting:

- The intensity and duration of the physical pain.

- The permanence of any disfigurement or physical limitations.

- The psychological fallout, like PTSD, anxiety, or depression.

- The damage to personal relationships and the inability to enjoy hobbies.

Remember, a staggering number of personal injury cases—over 99% by some estimates—settle before they ever see a courtroom. This makes the demand letter the single most important financial document you will produce in the case. A well-justified demand is non-negotiable.

Stating Your Bottom Line

Finally, after detailing the economic and non-economic damages, you present your total settlement demand. State the final figure with confidence. It shouldn't feel arbitrary; it should feel like the unavoidable sum of the evidence you've meticulously laid out.

This initial demand is an opening bid, so it should be ambitious but credible. Asking for an outrageous number that has no basis in reality will only signal to the adjuster that you're not serious and will likely get your letter tossed to the bottom of the pile. By building your demand logically, piece by piece, you put yourself in a position of strength for the negotiation ahead.

Bringing It All Home: Finalizing Your Letter and Setting the Terms

The closing paragraphs of your demand letter are where you land the plane. You’ve painstakingly laid out the facts, built a compelling narrative, and justified every dollar of your demand. Now, you need to bring it all to a sharp, actionable conclusion. This is your moment to state your terms and define the rules of engagement, leaving no room for misunderstanding. A strong, professional closing cements your position and sets the stage for a successful negotiation.

Your conclusion must be direct. State the total settlement amount you are demanding to resolve the claim in its entirety. This isn't a suggestion; it's a serious offer to settle the matter before formal litigation becomes necessary. The number itself should feel like the inevitable result of all the evidence and analysis you've just presented.

Setting a Firm but Fair Deadline

You can't let your demand package gather dust on an adjuster's desk. Creating a sense of urgency is crucial, and the best way to do that is by setting a clear, reasonable deadline for their response.

In my experience, 30 days from the date the insurer receives the letter is the industry standard. It’s widely considered a fair window, giving the adjuster enough time to conduct a thorough review without letting things drag on. More importantly, setting a firm deadline signals that you are organized, serious, and in control of the process.

A Quick Tip on Phrasing: The goal is to be assertive, not aggressive. A professional closing that gets the point across might sound something like this: "We look forward to receiving a written response to this settlement demand within 30 days of your receipt of this letter. Should we not receive a substantive response by that date, we will be forced to explore all available legal remedies to protect our client's interests."

This kind of language works because it isn't a threat—it's a professional statement of consequence. It clearly communicates that filing a lawsuit is the logical next step if your demand is ignored, which is a powerful motivator for any adjuster.

The All-Important Final Checklist

Before that letter ever leaves your office, a meticulous final review is absolutely non-negotiable. Even a small typo or a missing document can chip away at your credibility. Remember, personal injury claims are incredibly common—with roughly 39.5 million injury cases needing medical attention in the U.S. each year—so adjusters have seen it all. They will pounce on any sign of sloppiness.

Run through this checklist to make sure your final package is pristine:

- Polished Formatting: Is the letter clean, well-organized, and free of typos? Are the headings clear?

- Exhibits Accounted For: Double-check that every single piece of evidence you mentioned, from the police report to the final physical therapy bill, is attached and clearly labeled.

- Signatures and Dates: Is the letter properly signed and dated? A simple but costly oversight.

- Contact Info: Are your name, firm, address, and phone number easy to find?

Pulling together all these documents, especially a mountain of medical records, is a huge time-sink. To make this part of the process less painful, it’s worth looking into methods outlined in our guide on how to create a medical record summary.

One last thing, and this is critical: always send the complete package via certified mail with a return receipt requested. This is non-negotiable. That signed green card is your undeniable proof of when the insurance company received your letter, officially starting the clock on your deadline. It completely shuts down any "lost in the mail" excuses and shows you mean business from the get-go.

Common Questions About Personal Injury Demand Letters

When you're trying to write a personal injury demand letter, it’s natural to have a lot of questions. Getting them answered upfront is crucial for building a strong case and avoiding the simple, yet surprisingly costly, mistakes I see all the time. Let's walk through some of the most common uncertainties people face.

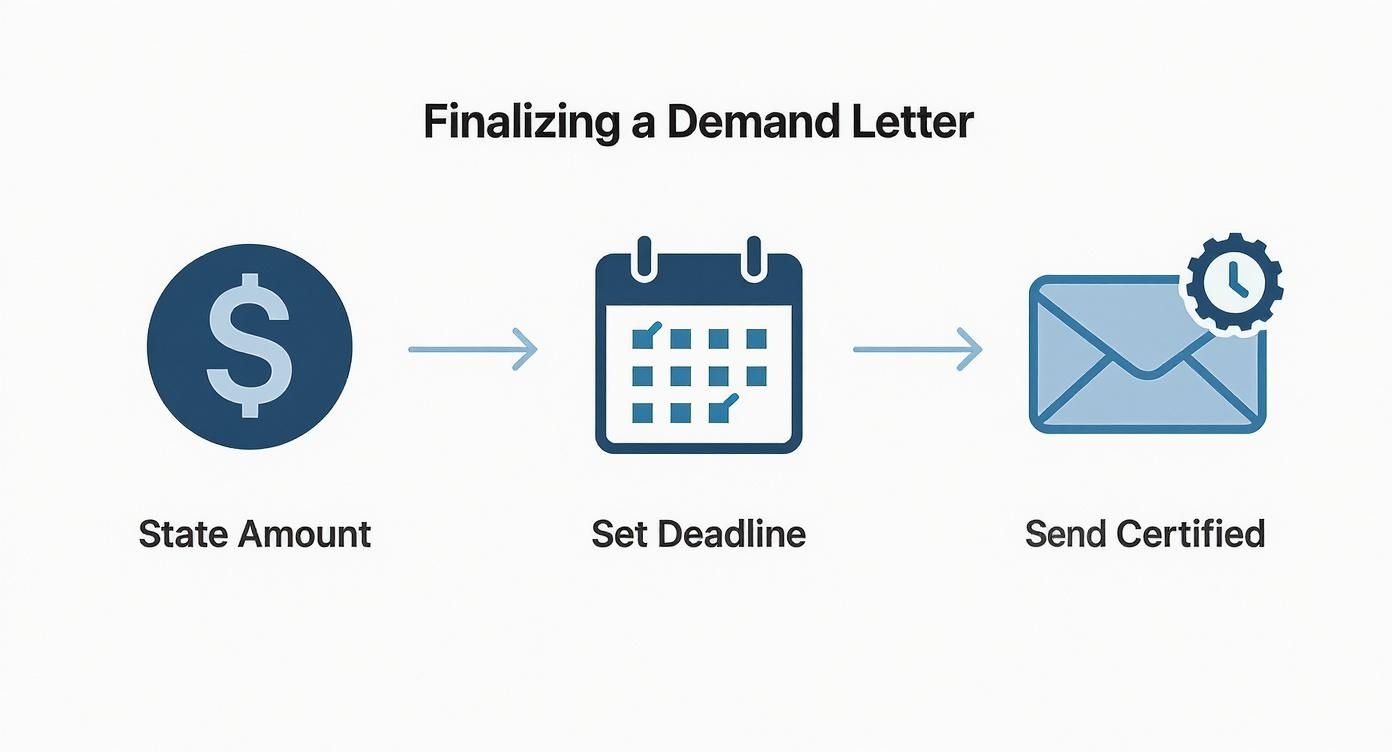

This infographic lays out the final, simple workflow for getting your demand letter out the door and into the adjuster's hands.

It’s a great visual reminder of the last few critical actions: state your number, give them a deadline, and send it via certified mail. That last part is non-negotiable—it creates an official record that they received it.

Can I Write a Personal Injury Demand Letter Myself?

The short answer is yes, you can. For smaller claims where liability is crystal clear and the injuries were minor, writing the letter yourself can be a perfectly fine approach. Think of a straightforward fender-bender with a couple of trips to the chiropractor. A DIY letter can save you legal fees and get the job done.

However, the game changes completely when you're dealing with serious injuries, a dispute over who was at fault, or the need for long-term medical care. The stakes are just too high. In those situations, bringing in an experienced attorney is a smart move. They know how to value complex damages—including future medical needs and lost earning capacity—and let's be honest, insurance companies simply take a letter from a law firm more seriously.

What Are the Biggest Mistakes to Avoid?

A few key missteps can completely torpedo your claim before you even start negotiating. Most of these errors boil down to a lack of objectivity or a simple failure to pay attention to detail.

Here are the critical mistakes I see people make over and over:

- Demanding an unrealistic amount. Throwing out a wild, unsubstantiated number makes the adjuster dismiss you from the get-go.

- Admitting any fault. Even a seemingly harmless phrase like, "I probably could have stopped sooner," can be used against you.

- Exaggerating injuries. Your medical records will always tell the real story. Any inconsistencies will make you look dishonest and kill your credibility.

- Using emotional or angry language. Keep it professional. An adjuster isn't going to be persuaded by aggression; they respond to facts and evidence.

- Forgetting to include proof. Your demand is only as strong as the evidence you provide. If a document is missing, it weakens your entire position.

How Long Should I Give the Insurer to Respond?

Setting a firm deadline is standard practice. The industry norm is to give the insurance company 30 days to review your letter and provide a response. This is widely considered a reasonable timeframe for an adjuster to go through your documentation, do their own internal review, and come back with an offer.

This isn't just about pushing them along; it signals that you are organized, professional, and serious about resolving the claim. If you hear nothing by your deadline, the next move is a polite but firm follow-up letter. If they continue to stonewall you, that's a pretty clear sign it might be time to get a lawyer involved.

Key Insight: That first settlement offer from an adjuster? It's almost always a lowball. It's a test to see if you're desperate enough to take a quick, cheap payout. Don't see it as their final number—see it as the opening bell for negotiations.

Should I Take the First Settlement Offer?

Almost never. Accepting the first offer is rarely in your best interest. Think of it as the starting point for a conversation, not the final word.

Your response should be a counteroffer. Pick a number that's a bit lower than your initial demand but still firmly grounded in the value of your claim. When you send it, briefly reiterate the key pieces of evidence that support your valuation. This back-and-forth is a completely normal part of the process. Patience and a willingness to negotiate from a position of strength will be your best allies here.

Crafting a powerful demand letter hinges on meticulous organization and a command of the facts. The team at Ares Legal built an AI-powered platform that can take a mountain of chaotic medical records and turn it into an organized, case-ready summary and a solid demand letter draft in minutes. You can cut out hours of tedious manual work and build a stronger, data-backed case to settle your claims faster. See how to supercharge your workflow at https://areslegal.ai.