What is a Demand Letter: Quick Guide to Negotiations

Before a lawsuit ever gets filed, there’s a crucial step that can make or break a personal injury claim: the demand letter. At its core, a demand letter is a formal document sent to the at-fault party (or, more often, their insurance company) laying out your client's case and demanding a specific settlement amount.

Think of it as the opening statement in a negotiation. It's your first, best chance to tell your client's story, present the evidence, and justify the compensation you're seeking—all before anyone sets foot in a courtroom.

Understanding the Role of a Demand Letter

If you picture a personal injury claim as a high-stakes chess match, the demand letter is your opening move. It's not an aggressive attack, but a calculated, strategic proposal that lays everything out on the table for the other side to see. The primary goal here is to create a formal, pre-litigation opportunity to resolve the claim fairly and efficiently.

This isn't just a simple request for money. A strong demand letter is an official notification that details exactly what happened, why the recipient is legally responsible, and how your client has suffered as a result. It methodically breaks down every category of damages—from hard numbers like medical bills and lost wages to the more nuanced, non-economic damages like pain and suffering.

The Strategic Value of a Pre-Litigation Approach

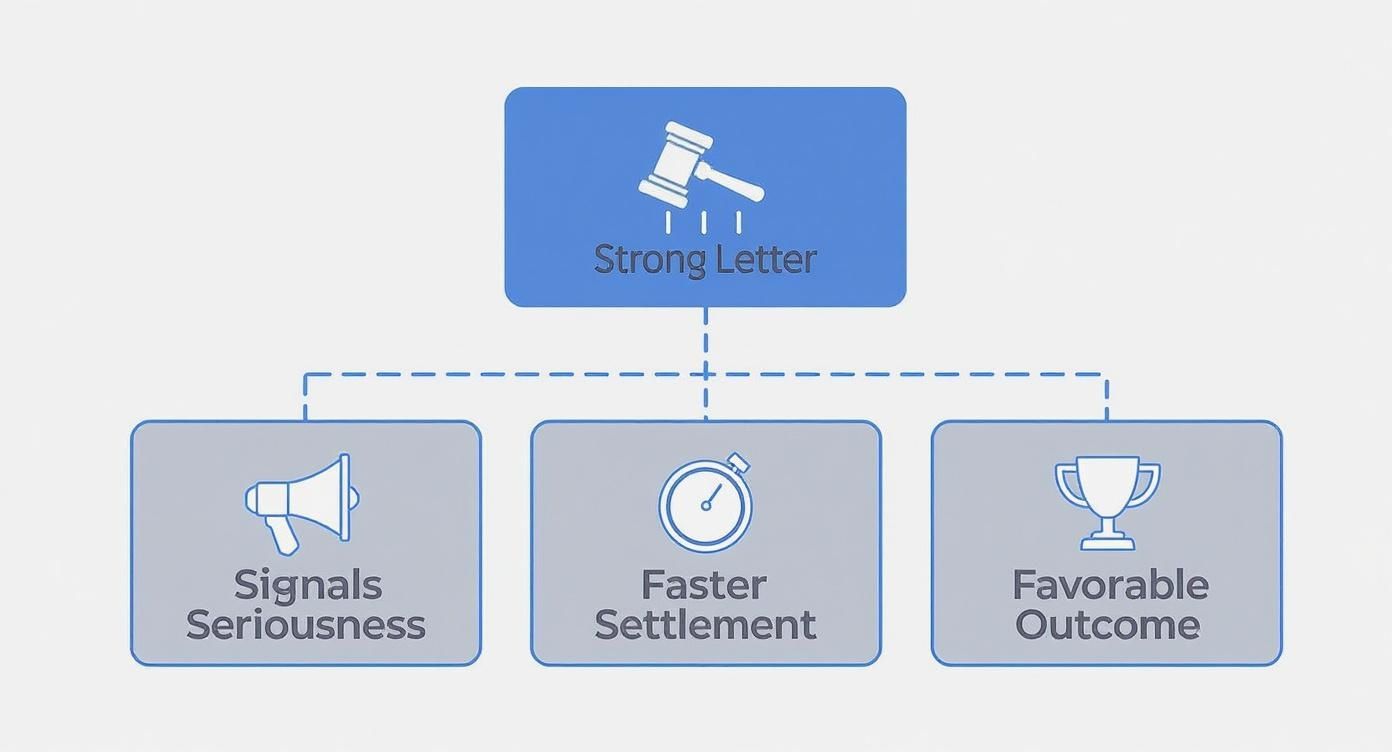

A well-drafted demand letter does more than just ask for a settlement; it sends a powerful message. It tells the insurance adjuster you're serious, organized, and fully prepared to file a lawsuit if a fair offer isn't made. At the same time, it gives them a clear, logical path to avoid the time, expense, and uncertainty of litigation.

In essence, the demand letter is a strategic tool designed to anchor the negotiation in your favor. It frames the narrative from day one. You can find more practical insights into the essential components of a demand letter at Ortega Group Law.

A demand letter acts as the foundation for the entire settlement process. It summarizes your case, quantifies the damages, and establishes a clear expectation for resolution. To better understand its role, let's look at its core functions.

Key Functions of a Personal Injury Demand Letter

| Function | Purpose |

|---|---|

| Initiate Negotiation | Opens the door to settlement discussions and sets the initial demand amount. |

| Present the Case | Provides a comprehensive summary of the facts, liability, and damages. |

| Demonstrate Seriousness | Shows the insurance company that the claim is well-documented and you are prepared for litigation. |

| Create a Formal Record | Establishes a paper trail of the settlement attempt, which can be useful later in court. |

| Expedite Resolution | Aims to achieve a fair settlement without the need for a costly and lengthy lawsuit. |

By serving these functions, the demand letter becomes the most important document in the pre-litigation phase, setting the stage for all discussions that follow.

Why a Strong Demand Letter Matters for Your Claim

Think of a well-written demand letter as the opening argument in your personal injury case, not just some formal notice. It's your first—and often best—chance to shape the entire negotiation. When an insurance adjuster sees a professional, detailed, and evidence-packed letter, it sends a clear message: you're serious, you're organized, and you're ready for a fight if they don't play fair.

This first impression sets the tone for everything that follows. A weak or sloppy demand letter practically invites a lowball offer. It suggests the claim might have holes or that you aren't prepared for a real battle. On the flip side, a powerful, well-organized case summary makes the idea of a drawn-out court fight look like a very expensive and risky gamble for the insurance company.

Shifting the Negotiation Dynamics

Never underestimate the psychological power of a great demand letter. It immediately puts you in the driver's seat of the negotiation. By laying out a clear story of what happened, backed up by medical records, police reports, and a logical calculation of your damages, you force the adjuster to start the conversation from your number, not theirs.

You're essentially controlling the narrative from day one. This makes the insurance company react to your position instead of letting them dictate the terms right out of the gate.

A powerful demand letter does more than just state facts; it builds a compelling argument that makes a fair settlement seem like the most logical and efficient resolution for everyone involved. It frames the choice for the insurer: negotiate reasonably now or face a more costly and uncertain fight later.

The numbers back this up. In the United States, over 90% of civil lawsuits kick off with a formal notice like a demand letter. For personal injury claims, these letters are the workhorse of the settlement process. In fact, reports show that 60-80% of cases that start with a solid demand settle without ever seeing the inside of a courtroom. You can find more details about the role of demand letters in legal strategy here.

Ultimately, this document can be the difference between a quick, fair settlement and a long, exhausting legal battle. Putting in the effort upfront builds the foundation for a successful outcome. That’s why many forward-thinking firms now use tools like the Ares Legal AI platform to help them review case files and draft demands, making sure every letter is built on a rock-solid analysis of the facts.

The Essential Elements of an Effective Demand Letter

To get an adjuster to take you seriously, a demand letter has to be more than just a request for money. It needs to be a compelling, evidence-backed argument that lays out your entire case on paper. Think of it as the opening argument of a trial you’re trying to avoid. Each section must flow logically into the next, building a narrative so clear and well-supported that settling becomes the obvious choice for the other side.

A powerful letter starts by setting the scene with a clear, concise, and factual account of what happened. This isn't the time for flowery or emotional language. Your job is to establish the timeline, location, and critical events that caused the injury, presenting an undeniable version of the facts.

Establishing Clear Liability

After laying out the incident, the next crucial step is to connect the dots and explain precisely why the other party is legally responsible. This is where you anchor the facts of the case to legal principles like negligence. You have to clearly articulate how the defendant breached their duty of care and how that specific breach was the direct cause of your client’s harm.

For example, you’d detail how a distracted driver was texting, violating their duty to operate their vehicle safely. That breach directly led to the collision, which in turn caused your client's injuries. This logical chain is the legal backbone of your entire demand.

Quantifying the Damages

Once liability is established, you need to provide a meticulous breakdown of the damages. This is where you translate your client’s pain, suffering, and financial losses into a specific dollar amount. It’s absolutely critical to be thorough and organized, separating the damages into distinct categories.

Economic Damages: These are the tangible, out-of-pocket losses. This includes all medical bills incurred to date, expert projections for future medical care, lost wages from time away from work, and any impact on future earning capacity. Every single number should be backed by documentation—bills, pay stubs, and expert reports.

Non-Economic Damages: This category covers the intangible, human cost of the injury. It includes physical pain and suffering, emotional distress, loss of enjoyment of life, and any permanent disfigurement or impairment. While these are harder to put a number on, they are a vital component of the total demand.

The infographic below shows how a demand letter built on these core elements can directly influence the success of your claim.

This visual drives home a key point: combining a clear story with documented damages and solid legal arguments is how you create a document that commands respect and pushes for a fair resolution.

Attaching Overwhelming Evidence

Finally, your words mean nothing without proof. A demand letter's credibility is only as strong as the evidence supporting it. Every claim you make, from the mechanics of the accident to the severity of the injuries, must be substantiated with hard proof.

A demand letter without evidence is just an opinion. A demand letter with meticulously organized exhibits is a credible threat of litigation that an insurance adjuster cannot ignore.

Your evidence package should aim to be comprehensive and irrefutable. We're talking police reports, witness statements, complete medical records, photos of the scene and injuries, expert opinions, and proof of lost income. By presenting an undeniable mountain of evidence from the outset, you make it incredibly difficult for the opposing side to poke holes in your claim.

For more strategies on building compelling legal arguments, you can explore additional resources on the Ares Legal blog.

Common Mistakes That Can Weaken Your Demand Letter

Knowing what to put in a demand letter is only half the battle. Just as important is knowing what to leave out. A single misstep can sink your credibility, giving an insurance adjuster an easy excuse to dismiss the claim or come back with a lowball offer.

Even the strongest, most well-documented case can be sabotaged by simple, avoidable errors. These mistakes generally fall into two buckets: what you say (content) and how you say it (procedure). Both are equally capable of torpedoing your negotiation before it even gets off the ground.

By steering clear of these common pitfalls, you can draft a letter that is professional, compelling, and sets the stage for a much better outcome.

Substantive and Tonal Errors

Let's start with the letter's content. A classic mistake is letting emotion take over. While your client is certainly going through a difficult time, the demand letter is a business document. It needs to be professional and fact-based, not a platform for threats or insults. That kind of language only puts the adjuster on the defensive and makes you look amateurish.

Just as damaging are factual inaccuracies. Get a date wrong, misspell a street name, or misstate a medical detail, and you've handed the other side a reason to question everything else you've written. This is where meticulous attention to detail is non-negotiable.

Here are a few critical content errors to avoid at all costs:

Vague or Unsupported Claims: You must draw a clear, straight line from the defendant's actions to your client's injuries, backed by evidence every step of the way.

Incomplete Damages: Forgetting to account for future medical needs, lost earning capacity, or the full scope of non-economic damages is like leaving money on the table.

Exaggerating Injuries: This is a credibility killer. If you overstate the injuries and the medical records don't back you up, you’ve lost the adjuster’s trust for good.

Critical Procedural Missteps

How you send the letter is just as important as what’s in it. Sending it to the wrong person—like the at-fault driver instead of their insurance carrier—causes needless delays. You have to make sure your demand lands on the desk of someone with the authority to actually settle the claim.

Failing to use a trackable delivery method is another huge oversight. Always send a demand letter via certified mail with a return receipt. This creates an official paper trail proving the letter was sent and, more importantly, received. That little green card is your best friend if the other side ever tries to claim, "We never got it."

A demand letter isn't just a negotiation tool; in some cases, it's a legal prerequisite. Failing to adhere to procedural requirements can have serious consequences, potentially jeopardizing your client's ability to file a lawsuit later.

In some jurisdictions, these steps aren't just best practices—they're required by law. For instance, in Massachusetts, certain consumer protection cases mandate a formal "30-Day Demand Letter" before a lawsuit can even be filed. This underscores why proof of delivery is so important and why procedural details can make or break a case.

What to Expect After You Send the Demand Letter

Sending out a well-crafted demand letter feels like a major step forward, and it is. But it's important to remember this is the opening bell for negotiations, not the finish line. Once that letter is in the insurance adjuster's hands, the ball is officially in their court.

What happens next will set the stage for everything to follow. My advice? Be patient. Insurance companies operate on their own timeline, and a quick response is the exception, not the rule. They'll need to do their own internal review, and how they reply will tell you a lot about the road ahead.

Common Responses from the Opposing Party

The adjuster's first move is a critical piece of intel. While you shouldn't expect them to mail a check for the full amount you demanded—that almost never happens—their initial response gives you a clear window into their strategy and how seriously they're taking your client's claim.

Here are the four replies you'll see most often:

A Counter-Offer: This is the most frequent response and, frankly, the one you're hoping for. It means the insurance company accepts at least some liability and is ready to talk numbers. Their first offer will almost always be a lowball, but that's just the start of the dance. It's an invitation to negotiate.

A Request for More Information: You might hear the adjuster say they need more records—a specific MRI report, a pay stub, you name it—before they can make an offer. Sometimes this is a legitimate need, but just as often, it's a stalling tactic designed to drag things out and test your resolve.

A Denial of Liability: In this scenario, the insurer flatly rejects the claim. They'll argue their insured wasn't at fault or that your client's injuries weren't caused by the incident. This is a hard-line position, and it’s often a clear signal that you may be heading toward litigation.

Silence: Getting no response at all is also a response—and a very telling one. It usually means the insurer is stonewalling you, hoping the claim will just fade away. If you've followed up and are still met with silence, it's often the clearest sign that filing a lawsuit is the only way to get their attention.

Handling these responses effectively means having every detail of your case at your fingertips. And as you manage this back-and-forth, remember that you're handling highly sensitive client information. It's crucial to be diligent about protecting case data with enterprise-grade security to maintain both your ethical obligations and your clients' trust.

Answering Your Questions About Demand Letters

When you're navigating a personal injury claim, a lot of questions pop up, especially around a document as important as the demand letter. Getting clear on its purpose and the unwritten rules of the road is crucial for setting realistic expectations. Let's tackle some of the most common questions we hear from clients and law firms alike.

First up: Do you really need a lawyer to write one? Technically, anyone can draft a demand letter. However, a letter arriving on a law firm's letterhead immediately tells the insurance company you mean business and are ready to take things to the next level if necessary. An experienced attorney also knows exactly how to calculate the full scope of your damages and frame them within legal standards, which dramatically improves your chances of a serious settlement offer.

Handling Timelines And Responses

Another question we get all the time is about response times. A professionally drafted demand letter should always include a clear deadline for a reply, usually giving the other party 15 to 30 days. This is widely seen as a reasonable window for them to conduct their own review, talk to their own lawyers, and put together a formal response.

But what if they just... don't respond?

When a demand letter is met with silence, it’s not just rude—it’s a strong signal that the other side isn't willing to negotiate fairly. That silence can be the final confirmation you need to move forward with a lawsuit.

An ignored demand isn't a setback; it's a strategic advantage. It demonstrates to the court that you made a good-faith effort to settle the matter out of court before taking up their time. This simple fact can cast your case in a much more favorable light, showing the judge you acted responsibly from the start.

Drafting a compelling demand letter is a critical, yet time-intensive, part of any personal injury practice. Ares Legal automates the painstaking process of reviewing medical records and drafting the initial demand, transforming hours of manual work into a few minutes of strategic oversight. Discover how our AI-powered platform helps you build stronger cases and secure settlements faster at https://areslegal.ai.