Back Injury Settlements from a Car Accident: A Guide

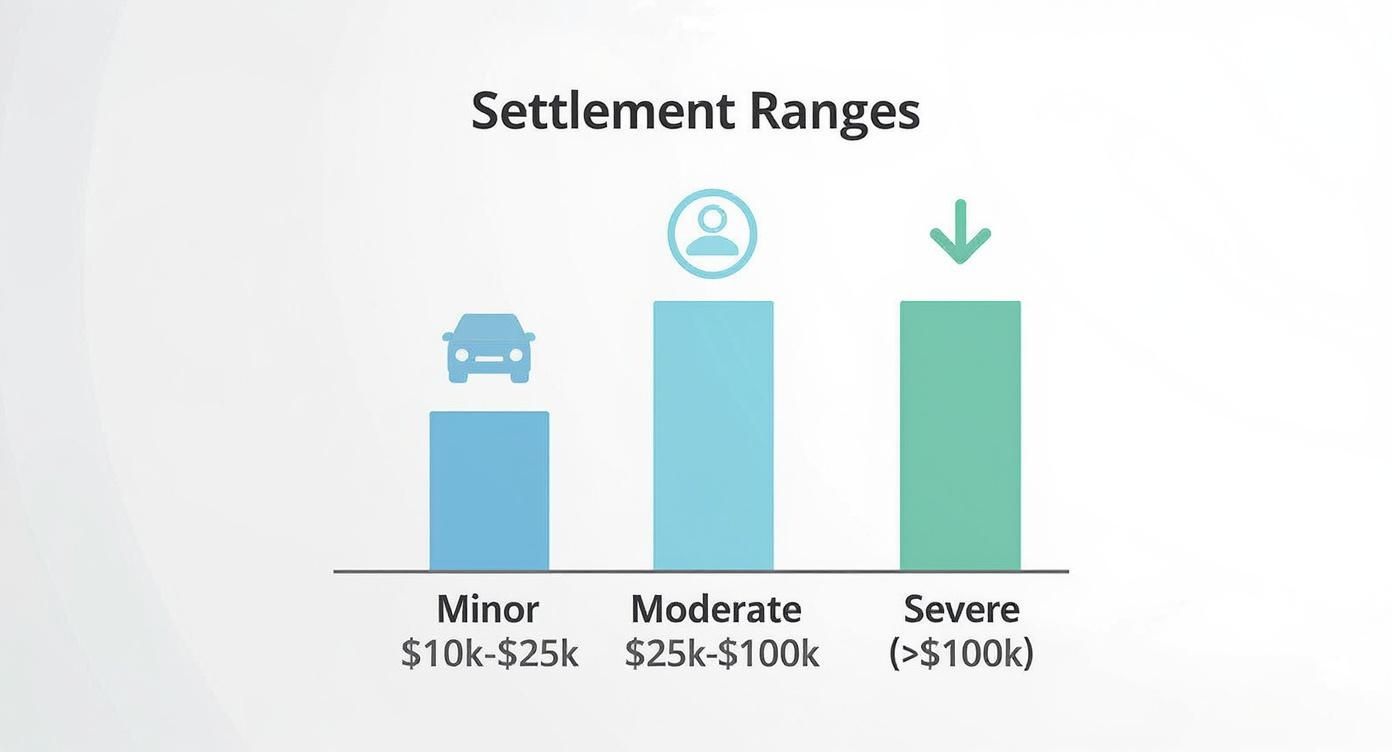

There's no magic number for a back injury settlement after a car accident. These cases vary wildly, influenced by the injury's severity, the mountain of medical bills, and the real-world impact on your life. A minor strain might close out in the $10,000 to $25,000 range, but a severe injury needing surgery can easily climb north of $100,000.

At the end of the day, the final figure is a direct reflection of your documented evidence and how well you can build your case.

Understanding Your Potential Settlement Value

When you're trying to heal from a car wreck, one of the biggest questions looming is, "What's my case actually worth?" It’s tempting to look for a quick, simple answer, but the reality is that back injury settlements from a car accident are deeply personal and unique to each situation.

It's better to think of your potential settlement not as a fixed price tag, but as a total built from different pieces of your post-accident experience. Every single medical bill, physical therapy appointment, and missed paycheck is a building block. The more serious the injury and the more intensive the treatment, the larger and more substantial that final number becomes.

This is exactly why a minor muscle sprain that heals up in a few weeks will have a completely different settlement value than a herniated disc that leads to chronic pain and a surgeon's scalpel.

Breaking Down the Settlement Ranges

To give you a clearer idea of what to expect, settlements are typically categorized by the severity of the back injury. The infographic below provides a great visual breakdown of the common settlement ranges, from minor soft tissue issues to life-altering spinal damage.

As you can see, the financial value of a claim grows exponentially with the seriousness of the diagnosis and its lasting effects on your life.

To give these ranges some context, here’s a quick-reference table that outlines potential settlement values.

Estimated Settlement Ranges by Back Injury Severity

This table provides a quick overview of potential settlement amounts based on the type and severity of the back injury sustained in a car accident.

| Injury Severity Level | Common Injury Types | Typical Settlement Range |

|---|---|---|

| Minor | Muscle strains, sprains, whiplash, soft tissue bruising | $10,000 - $25,000 |

| Moderate | Bulging discs, chronic pain, extensive PT needed | $25,000 - $100,000 |

| Severe | Herniated discs, fractured vertebrae, nerve damage | $100,000 - $500,000 |

| Catastrophic | Spinal cord injuries, paralysis, permanent disability | $500,000+ |

These figures provide a realistic framework, but they are just a starting point.

National data and trends back this up. Minor soft tissue injuries like whiplash or muscle strains generally land in that $10,000 to $25,000 settlement bracket. Moderate injuries—the kind that require long-term physical therapy or cause you to miss significant time at work—often fetch settlements from $25,000 to $100,000.

For the most serious cases involving herniated discs or fractured vertebrae, settlements regularly exceed $100,000. Catastrophic spinal cord injuries can result in payouts of $500,000 or even more. You can find more granular settlement statistics from legal experts who analyze these claims every day.

Ultimately, while averages give you a baseline, the true potential of your settlement is written in the specific, documented details of your injury, your medical journey, and your personal suffering.

How Your Specific Back Injury Shapes Your Claim Value

When an insurance adjuster looks at a back injury claim, the first thing they want to know is the specific diagnosis. In their world, not all back injuries are created equal. Each diagnosis tells a different story about your pain, the road to recovery, and what you’ll need in the future.

Think of the diagnosis in your medical records as the bedrock of your claim's value. A minor soft tissue strain that clears up after a few weeks of physical therapy is a completely different financial picture than a herniated disc that might need surgery down the line. The details here aren't just details—they're everything.

Every medical term, from a "lumbar sprain" to "spinal stenosis," signals a different level of severity and long-term impact. Getting a handle on how insurers translate these terms into dollar signs is the first step toward setting realistic settlement expectations.

From Minor Strains to Major Surgeries

The range of back injuries you can suffer in a car crash is vast, and so are the settlement values that go with them. Adjusters are trained to assign a value based on what the objective medical evidence says and the typical prognosis for that specific condition.

Let's break down how common injuries are usually viewed and valued:

- Soft Tissue Injuries (Sprains and Strains): These are by far the most common back injuries after an accident. They can be incredibly painful, but insurers often see them as temporary. The value is mostly built on the cost of physical therapy, chiropractic visits, and any wages you lost while recovering.

- Bulging or Herniated Discs: This diagnosis immediately kicks the claim's value up a few notches. An MRI provides objective, hard-to-dispute proof of the injury. It also opens the door to arguments for chronic pain, nerve issues like sciatica, and the potential need for more invasive treatments later on.

- Vertebral Fractures: A fracture is a serious, high-value injury, period. It signals a massive level of trauma and almost always involves a long, painful recovery, significant medical care, and a high chance of permanent physical limitations.

- Spinal Cord Injuries: These are the most catastrophic injuries, leading to the highest settlement values. The potential for paralysis, permanent disability, and a lifetime of medical needs drives the valuation into a completely different stratosphere.

A diagnosis isn't just a label; it's a roadmap of your future. A herniated disc tells an adjuster to account for potential nerve damage, chronic pain management, and even the high cost of future surgery, justifying a significantly higher value than a simple muscle strain.

The Financial Impact of Treatment Paths

The kind of treatment you need also has a massive impact on the settlement number. From an insurer's perspective, more invasive and expensive treatments are a clear signal of a more severe injury, which directly pumps up the claim's value.

For example, a claim for a back injury that doesn't require surgery but involves chronic pain or sciatica—requiring ongoing physical therapy, chiropractic care, or steroid injections—will often settle in the $20,000 to $100,000 range.

But if surgery is on the table, the numbers change dramatically. Cases involving spinal fusion surgery can frequently push past $250,000 because of the extensive, long-term medical needs involved. You can discover more about how injuries influence settlement outcomes from legal information centers.

Why Medical Records Are Your Most Valuable Asset

Your medical records are the official story of your injury, and they're the one an insurance company can't easily ignore. They provide the objective evidence you need to justify every single dollar you demand.

This is the documentation that builds your case:

- Initial Emergency Room Reports: These are crucial for establishing the immediate link between the crash and your injury.

- Diagnostic Imaging (X-rays, MRIs, CT Scans): This is the visual proof. It's hard for an insurer to argue an injury doesn't exist when they can see it on film.

- Physician's Notes and Treatment Plans: These records detail your symptoms, the doctor's expert opinion on your prognosis, and the recommended plan for your care.

- Referrals to Specialists: When your family doctor sends you to an orthopedist or a neurologist, it's a powerful signal. It shows your injury is serious enough to require specialized expertise.

At the end of the day, a strong back injury settlement from a car accident is built on a clear, compelling medical story. The more detailed and definitive that story is, the more leverage you'll have at the negotiating table.

What Goes Into a Back Injury Settlement Number?

When we talk about the value of a back injury claim, there’s no magic calculator that spits out a number. Instead, the final settlement is built piece by piece, reflecting the full scope of how the accident has impacted your life. These pieces generally fall into two main buckets: economic damages and non-economic damages.

Think of it this way: economic damages are the tangible, black-and-white costs. They're the stack of bills on your desk. Non-economic damages cover the human cost—the pain, the stress, and the life changes that don't come with a price tag.

H3: Tallying Up the Hard Costs

Economic damages are the bedrock of your settlement. They represent every dollar you’ve lost or had to spend because of the injury. These are the most straightforward figures to calculate because they’re backed by receipts, invoices, and pay stubs. An insurance adjuster can argue about your pain, but they can't really argue with a hospital bill.

Here’s what typically falls under this category:

- Medical Bills (Past and Future): This is everything from the ambulance ride and ER visit to complex surgeries, ongoing physical therapy, chiropractic adjustments, and prescription medications. It also includes any medical equipment you might need, like a specialized chair or back brace.

- Lost Wages: If you couldn't work because of your back injury, you're owed that lost income. This isn't just your base salary; it includes any bonuses, commissions, or overtime you missed out on.

- Loss of Earning Capacity: This is a big one for serious injuries. If your back injury permanently affects your ability to do your job or forces you into a lower-paying field, this part of the claim projects and covers that financial loss over your expected career lifetime.

Keeping meticulous records of these expenses is non-negotiable. Every bill and pay stub is a piece of evidence that solidifies the financial foundation of your claim.

H3: The Human Cost of a Back Injury

This is where things get more complex. How do you assign a dollar value to chronic pain? Or the frustration of not being able to play with your kids? That’s what non-economic damages are for.

Non-economic damages are compensation for the theft of your quality of life. They acknowledge that the true cost of an injury goes far beyond medical bills and includes the physical pain, emotional distress, and lost joy you experience every day.

Because this part of the claim is subjective, it’s almost always the most heavily debated part of a settlement negotiation. It covers areas like:

- Physical Pain and Suffering: This compensates you for the actual, physical pain you’ve endured and will likely continue to deal with.

- Emotional Distress: A serious accident is traumatic. This can include anxiety, depression, PTSD, and the mental toll of living with a debilitating injury.

- Loss of Enjoyment: This is about what you’ve lost. Can you no longer garden, play golf, or go for a run? This is meant to compensate you for the inability to enjoy the hobbies and activities that once brought you happiness.

It’s crucial to understand how an emotional pain and suffering settlement is put together, as it’s often the largest component of a serious injury claim.

To make this clearer, let's break down the two main types of damages side-by-side.

Economic vs. Non-Economic Damages in a Back Injury Claim

| Type of Damage | What It Covers | Examples |

|---|---|---|

| Economic Damages | Verifiable, out-of-pocket financial losses. | Hospital bills, surgery costs, lost salary, physical therapy sessions, prescription drug costs. |

| Non-Economic Damages | Intangible, non-financial impacts on your life. | Chronic pain, anxiety, depression, loss of hobbies, inability to perform daily tasks. |

In short, one side covers the direct hits to your wallet, while the other addresses the profound impact on your well-being and daily life.

H3: The Outside Forces That Shape Your Settlement

Beyond the damages you’ve personally suffered, a couple of major external factors can put a cap on your claim or give it a significant boost. You don't have control over these, but they play a huge role in the final number.

The two biggest game-changers are:

- Clear Proof of Fault: You only get compensated if the other driver was clearly at fault. If you share some of the blame, your settlement could be reduced—or even eliminated—depending on your state's specific negligence laws.

- The At-Fault Driver's Insurance Policy Limits: This is a hard reality of personal injury law. An insurance company will only pay up to the policy limit, no matter how severe your injuries are. If your total damages are $200,000 but the driver only has a $50,000 policy, getting the full amount becomes incredibly difficult and may require going after the driver's personal assets, which is often a long shot.

Why Your Location Matters for Back Injury Payouts

It might seem odd, but where your car accident happened can dramatically change the value of your back injury settlement. An identical injury, with the exact same medical bills, could be worth a completely different amount depending on which state—or even which county—the wreck occurred in.

This isn't arbitrary. It’s a direct reflection of different state laws, local economies, and even the legal culture in a specific area. Think of it like real estate: the value of a house depends not just on the house itself, but on the neighborhood it's in. In the same way, your claim's value is shaped by your injuries and the legal "neighborhood" where it's filed.

Getting a handle on this geographic factor is critical for setting realistic expectations and crafting a legal strategy that actually works on the ground.

State Laws and Insurance Systems

The biggest driver behind these geographic differences comes down to the state's insurance system. There are two main types—"fault" (or "tort") and "no-fault"—and they create entirely different roads to compensation.

Fault-Based States: In most states, the driver who caused the accident is responsible for the damages. To get paid for your medical bills, lost wages, or pain and suffering, you have to prove the other driver was negligent.

No-Fault States: In places like Florida or New York, you start by filing a claim with your own insurance policy. This coverage, usually called Personal Injury Protection (PIP), covers your initial medical bills and lost income, no matter who was at fault.

The catch with no-fault states is that you often have to meet a certain "threshold" of injury severity before you're even allowed to sue the at-fault driver for pain and suffering. This can make it much tougher to get a fair payout for back injuries that are serious but don't require something like major surgery.

A state's legal framework is the playing field for your claim. The rules, and the potential outcomes, are completely different for a case in a traditional fault state versus one in a complex no-fault system.

The Economic Realities of a Region

It's not just about insurance laws. Local economic conditions have a huge impact on back injury settlements from a car accident. The cost of medical care, for one, is all over the map. A spinal fusion in Manhattan is going to cost a whole lot more than the same procedure in rural Alabama, and that difference directly inflates the economic damages in the claim.

Average local wages work the same way when it comes to lost income claims. If you're out of work in a high-wage metropolitan area, your lost earning capacity claim will naturally be valued higher. Experienced attorneys and adjusters also know which local juries tend to award bigger verdicts, and that knowledge shapes settlement negotiations from day one.

The numbers really tell the story. For example, New York leads the country with an average neck and back injury settlement of around $8.6 million. Compare that to Georgia, where settlements often land near $200,000. Meanwhile, Florida, a no-fault state, sees an average settlement of $965,562. You can dig deeper into these numbers by reviewing research on the disparities in neck and back injury settlement amounts.

Building an Unbeatable Case with Strong Evidence

Winning a fair back injury settlement from a car accident isn’t just about being hurt—it’s about proving it. Your claim is a story, and without solid proof, it's just words on a page. To get what you deserve, you need to build a case file with evidence so compelling that the insurance company has no choice but to take you seriously.

Think of it like building a fortress, brick by brick. Every medical report, every pay stub, every photo of you struggling to get through the day is another stone in the wall. This collection of proof turns a simple request for compensation into a powerful narrative that an adjuster can't easily tear down or lowball.

Documenting Your Medical Journey

The absolute bedrock of any strong back injury claim is your medical paperwork. These records are the objective, third-party proof of your injuries that insurance companies need to see. It’s one thing to say your back hurts; it's another thing entirely to show them an MRI report detailing a herniated disc.

Your medical file needs to be bulletproof. Make sure it includes:

- Initial Emergency and Urgent Care Reports: These are crucial. They create the immediate, undeniable link between the car crash and the start of your back pain.

- Diagnostic Imaging Results: This means every X-ray, CT scan, and MRI. These images give adjusters concrete, visual proof of fractures, disc damage, and other structural injuries.

- Records from Specialists: Notes from an orthopedist, neurologist, or pain management doctor show that your injury is serious and requires expert care. This adds a lot of weight to your claim.

- Physical Therapy and Rehabilitation Notes: These documents tell the story of your recovery attempt. They detail your physical limits, pain levels, and any progress you've made, which helps justify the costs and your suffering.

Keeping all this straight is a job in itself. For a deeper dive, check out these strategies for how to organize medical records to keep your file clean and persuasive.

Proving Your Financial Losses

Next, you have to account for every single dollar the accident has cost you. These are your economic damages—the most black-and-white part of your settlement. When you have irrefutable proof here, there’s very little for an adjuster to argue about.

To lock this part of your case down, you’ll need:

- Pay Stubs and Income Statements: Gather statements from both before and after the crash. This creates a clear, side-by-side comparison of your lost wages.

- A Letter from Your Employer: Get an official letter stating your job title, pay rate, and the exact dates you were out of work because of the injury.

- Receipts for Out-of-Pocket Expenses: Don't let anything slip through the cracks. Keep receipts for prescription co-pays, gas for trips to the doctor, and any medical equipment you had to buy, like a back brace.

Building a truly airtight case means knowing what counts as real proof. Getting a handle on understanding documentary evidence will help you figure out which documents pack the most punch and how to present them effectively.

Capturing the Human Side of Your Injury

Medical bills and lost wages are just part of the story. The most impactful evidence often shows the human cost of your back injury. This is what brings your non-economic damages—your pain, suffering, and lost quality of life—into sharp focus for the adjuster.

Your personal story is the heart of your claim. While medical records prove the injury exists, your journal and witness statements show its devastating impact on your life, turning abstract "pain and suffering" into a real, relatable human experience.

This kind of evidence paints a vivid picture of your daily struggle:

- A Personal Pain Journal: Every day, jot down your pain level on a scale of 1-10. More importantly, write down which activities you can't do, how your sleep is disrupted, and the emotional toll it's taking on you.

- Photos and Videos: Visuals are powerful. Snap photos of your injuries, or a picture of you needing a cane to walk. A short phone video showing how hard it is to do something simple, like getting out of a chair, can be incredibly persuasive.

- Statements from Witnesses: Ask the people who see you every day—friends, family, or coworkers—to write a few sentences about the changes they’ve seen in you since the accident. Have they noticed your limited mobility, a change in your mood, or hobbies you’ve had to give up?

Navigating the Settlement Negotiation Process

When the insurance adjuster’s first settlement offer lands on your desk, it’s a big moment. But it’s almost never the end of the road. In reality, it’s just the opening bid—a purposefully low number meant to see if you’ll bite on a quick, cheap payout.

The real negotiation kicks off when you send your demand letter. This is your chance to lay out the entire story: the crash, the full scope of your injuries, and a detailed breakdown of your damages. To get this right, it's worth learning how to structure a proper demand letter to an insurance company for an auto accident.

Once the adjuster gets your demand, they'll come back with that initial offer. The trick is to not get discouraged by how low it seems. Instead, see it for what it is: an invitation to start the negotiation dance that will lead to a fair back injury settlement from a car accident.

The First Offer and Your Strategic Response

An adjuster’s primary role is to protect the insurance company's bottom line by paying out as little as possible. Their first offer is a direct reflection of that objective. Your response needs to be calm, calculated, and built on a foundation of solid evidence.

A strong counteroffer always involves a few key steps:

- Put It in Writing: Don't get drawn into verbal-only negotiations. A written counteroffer allows you to methodically dismantle their low offer and justify your position.

- Highlight Your Strongest Points: Circle back to your best evidence. Remind them of the objective findings—the MRI showing a herniated disc, the surgeon’s report, the documented need for future medical care.

- Play the Long Game: This isn’t a quick transaction. Expect several rounds of offers and counteroffers. Patience is one of your most powerful tools.

The initial settlement offer isn’t what your claim is worth; it’s a test of what you’re willing to accept. A firm, evidence-based counteroffer shows the adjuster you know the true value of your case and won’t be lowballed.

Keeping the lines of communication clear and well-documented during this back-and-forth is critical. Many legal teams rely on efficient legal documentation tools like dictation software to draft responses quickly and maintain a precise record of every conversation.

Handling Common Adjuster Tactics

Insurance adjusters are skilled negotiators with a playbook of common tactics designed to chip away at your claim’s value. Knowing what to expect is the best way to defend your settlement.

Watch out for these classic arguments:

- "It Was a Pre-Existing Condition": Adjusters love to claim your back pain was there before the accident. Your best counter is medical evidence showing a clear change in your condition or new symptoms that appeared right after the crash.

- "Your Treatment Was Unnecessary": They might argue you had too much physical therapy or that a certain procedure wasn't needed. This is where a letter of medical necessity from your doctor becomes invaluable, shutting down that line of attack.

- "You Didn't Need That Much Time Off": The insurer may question the amount of work you missed. Clear, detailed records from your employer confirming your absence and lost pay is the only proof you need.

By anticipating these moves and having your evidence ready, you stay in the driver's seat and guide the negotiation toward a figure that truly compensates you for your injuries.

Frequently Asked Questions About Back Injury Settlements

When you're recovering from a back injury after a car accident, you're bound to have questions. The entire settlement process can feel confusing and overwhelming, so let's walk through some of the most common concerns to give you some clarity.

How Long Does a Back Injury Settlement Take?

There's really no single answer to this one—the timeline can be anything from a few months to well over a year. The duration is tied directly to the specifics of your case.

For a straightforward claim with a minor injury and no argument over who was at fault, you might see a resolution in six to nine months. But for more severe injuries that involve major disputes over liability or require long-term medical care, it’s not unusual for the process to stretch to one or even two years, especially if the case ends up in court.

One of the biggest factors controlling the pace is reaching Maximum Medical Improvement (MMI). This is a critical milestone where your doctor says your condition is as good as it’s going to get. It’s a bad idea to settle before you hit MMI because you simply don’t know the full extent of your future medical needs and what they'll cost.

Can I Get a Settlement for a Pre-Existing Back Condition?

Yes, absolutely. Having a prior back issue doesn't disqualify your claim. The legal concept at play here is often called the "eggshell plaintiff" rule. In short, it means the person who caused the accident is responsible for the damage they actually caused, even if you were more fragile or susceptible to injury than the average person would have been.

The crash may have aggravated or flared up an old condition, and you have every right to be compensated for that new level of pain and limitation.

The trick is proving the accident, and not your old condition, is the source of your current problems. This is where your medical evidence becomes invaluable. You'll need a strong, detailed opinion from your doctor that draws a clear line between your pre-existing condition and the new or worsened symptoms you've experienced since the wreck. You can bet the insurance adjuster will try to pin everything on your old injury, so solid documentation is non-negotiable.

What Is the Average Pain and Suffering Multiplier?

There's no such thing as an "official" or "average" multiplier. The idea of multiplying your medical bills and lost wages by a number—typically between 1.5 and 5—is just one method lawyers and adjusters use to get a starting point for valuing the human cost of an injury, also known as non-economic damages.

The number they land on depends entirely on the unique facts of your case:

- How severe is the injury, and is it permanent?

- How long did it take you to recover?

- What has the real-world impact been on your quality of life?

A minor back sprain that heals in a few weeks might get a 1.5x multiplier. On the other hand, a devastating injury that requires spinal fusion surgery could easily command a multiplier of 4x or 5x.

Should I Accept the First Settlement Offer?

Almost never. Taking the insurance company’s first offer is rarely in your best interest.

Think of that initial offer as a starting bid, not a final number. Insurers often make a lowball offer right out of the gate to see if you know what your claim is actually worth. This first figure almost certainly doesn't account for your future medical needs, all of your lost income, or what you truly deserve for your pain and suffering.

Always see the first offer for what it is: the beginning of a negotiation.

At Ares, we know what it takes to assemble a compelling, high-value personal injury case. Our AI-assisted platform helps law firms cut through the clutter of medical records and draft powerful demand letters in a fraction of the time, making sure every crucial detail is accounted for. See how we help strengthen negotiations and secure better outcomes.