Mastering the Personal Injury Claim Life Cycle

The claim life cycle in personal injury law is the entire path a case follows, from the moment a potential client first calls your office to the final disbursement of funds. For any modern firm, getting this workflow right isn't just about good practice—it’s about survival. You're constantly balancing the need for rigorous, detailed case work against the pressure to resolve cases efficiently and stay profitable.

Mapping the Modern Claim Journey

This process is the operational heartbeat of every PI firm. It's how we turn a client’s traumatic experience into a just resolution. But let's be honest: the old ways of doing things, with mountains of paper and endless manual follow-ups, are collapsing. They simply can’t keep up with today’s complex cases and clients who expect instant updates.

The modern claim journey isn't a straight line of siloed tasks. It's a dynamic, interconnected system where every step directly impacts the next.

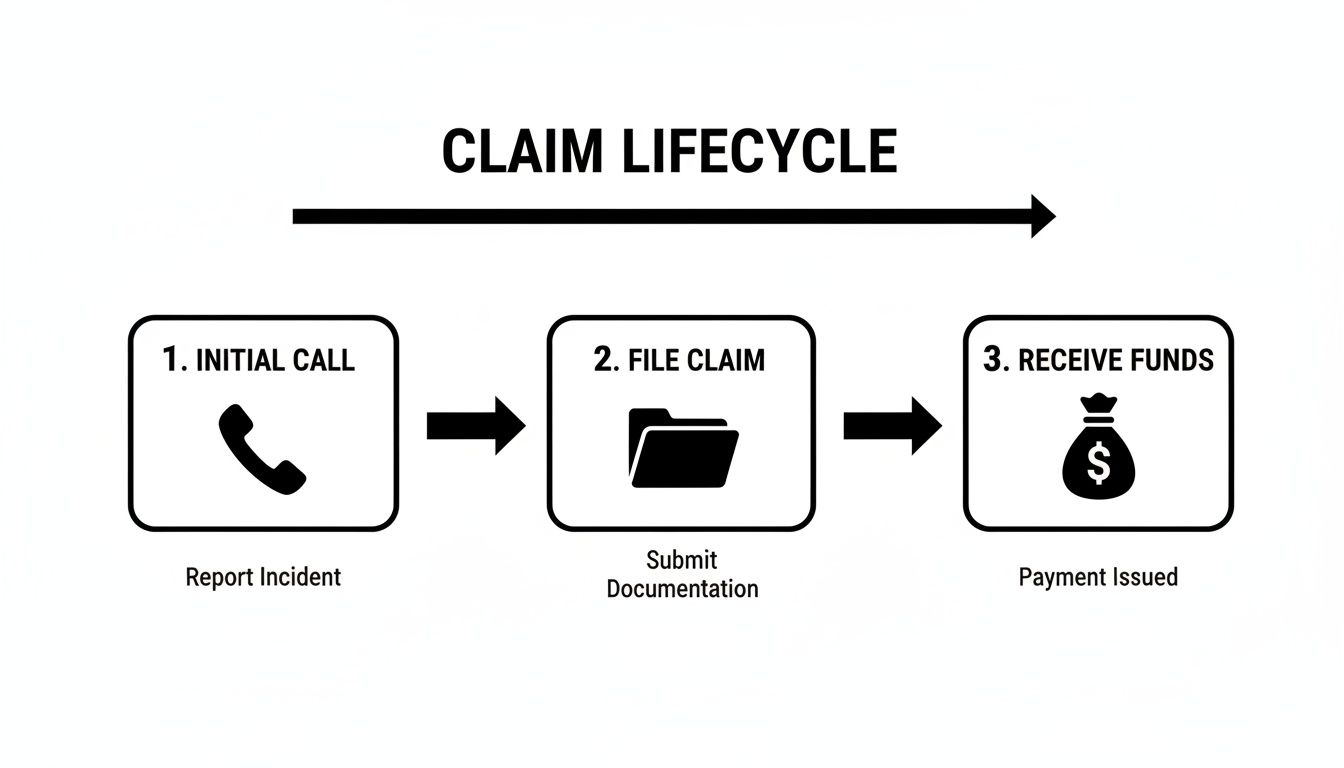

This diagram offers a high-level look at the process, from the first call to getting the client paid.

Looks simple, right? But as any practitioner knows, each of those boxes hides a world of complexity, deadlines, and potential roadblocks. Technology is no longer a luxury; it's the glue holding these stages together, making sure critical information moves smoothly and nothing gets lost in the shuffle.

The Pressure to Perform

The sheer volume of work is staggering. Just look at the numbers. In the first quarter of 2025 alone, Texas insurers handled over 160,000 personal insurance claims. That's a massive workload.

For our firms, the biggest time sink is almost always medical records. We see paralegals buried for 10+ hours per case, just trying to sort through disorganized stacks of paper to piece together a coherent treatment timeline.

A deep dive into claims data analytics can provide invaluable insights throughout the entire personal injury claim life cycle, chronicling the patient's journey from incident to resolution.

This guide will walk you through each stage of that journey, showing you how the best firms are breaking free from outdated, inefficient methods. We’ll dig into the common pitfalls and opportunities at every turn, including:

- Intake and Investigation: How to capture the client's full story and lock down crucial evidence from day one.

- Medical Development: The art of turning a chaotic medical history into a powerful, clear narrative.

- Demand and Negotiation: Building a bulletproof demand package that forces the adjuster to see your case's true value.

- Litigation and Settlement: Navigating the final, often complex, steps to get the case across the finish line.

By treating these phases as parts of a single, integrated system, you can build a practice that’s not only more profitable but also delivers better results and a better experience for your clients.

Building a Rock-Solid Foundation with Intake and Investigation

The first 48 hours after an incident can make or break a personal injury case. This is ground zero. It's where the claim life cycle truly begins, and it’s where your most powerful evidence is often found—or lost forever. The top-performing firms know that the Intake and Investigation phases aren’t just about filling out forms; they’re about laying the bedrock for the entire case.

Think of it like building a house. You wouldn't just start pouring a concrete foundation without knowing the lay of the land or having a detailed blueprint. Rushing this stage is a recipe for disaster, creating foundational cracks that will threaten the whole structure down the line.

Perfecting the Client Intake Process

That first call with a potential client is so much more than a fact-finding mission. Of course, you need the "who, what, where, and when." But the real art is in capturing the human story behind the incident. This conversation sets the tone for your entire relationship and is your first chance to uncover the kind of details that an insurance adjuster can't just brush aside.

Your intake process needs to be a guided conversation, not an interrogation. You want the client to feel heard and understood while you methodically capture every critical piece of information. To get this right, you can learn more by exploring our deep dive into the role of the intake specialist in a law firm.

Key goals during intake include:

- Establishing a real connection to build trust and get the client to open up.

- Documenting the incident narrative in the client's own words to preserve the raw, emotional context.

- Identifying every potential defendant and all possible sources of insurance coverage right from the start.

- Managing client expectations about what’s ahead in the claims process.

Launching an Immediate and Thorough Investigation

As soon as that intake call ends, the clock is ticking. The investigation phase is a flat-out race against time to preserve evidence before it vanishes, gets wiped, or memories fade. Sitting back and waiting is one of the biggest mistakes a firm can make. You have to be aggressive and proactive.

This means getting an investigator to the scene right away for photos and videos. It means finding and talking to witnesses while the incident is still fresh in their minds. It means sending out spoliation letters to lock down crucial evidence. The goal is to build an airtight fortress of proof around your client's claim. And as you gather evidence, it's crucial to stay on the right side of the law, which includes knowing things like whether is it legal to record a conversation without consent to ensure everything you collect is admissible.

From the moment a client calls, every single document, photo, statement, and report needs to be organized in a central, digital case file. Having this single source of truth is the only way to avoid the data silos and lost details that can completely derail a case months or even years later.

A powerful investigation is your firm’s first offensive play. When you secure the police report, canvass the area for surveillance cameras, and document property damage, you're collecting the hard, objective evidence that backs up your client's story. This early, aggressive work sends a clear signal to the other side: you are prepared, and you are building an undeniable case. That sets a powerful tone for the rest of the claim life cycle.

Transforming Medical Records from Chaos to Clarity

After the initial investigation wraps up, a personal injury claim moves into what is often its most time-consuming and frustrating stage: medical record development. This is where the real story of your client's injury, pain, and recovery unfolds. Unfortunately, that story is usually buried in thousands of pages of dense, unorganized documents from a dozen different providers.

For most firms, this phase is a major bottleneck that can bring a case to a screeching halt.

It’s like being handed a 10,000-piece jigsaw puzzle without the box lid for reference. Paralegals and case managers burn countless hours chasing down, compiling, and manually sifting through mountains of records. They're on a treasure hunt for those critical links between diagnoses, treatments, and the client's day-to-day suffering. It’s a painstaking process that drains your team's energy and, more importantly, delays justice for your client.

The Problem with Manual Record Review

Relying on a manual review of medical records isn't just inefficient—it's risky. It's incredibly easy to miss a key detail, misinterpret a timeline, or just get completely overwhelmed by the sheer volume of information. Every doctor's office, hospital, and physical therapist uses different formats, terminologies, and documentation styles, creating a chaotic mess.

This disorganization directly impacts your claim's value. Without a clear, chronological narrative of the client’s medical journey, building a powerful demand letter that justifies a fair settlement is nearly impossible. The longer this manual process drags on, the more leverage you hand over to the insurance company.

AI as the Ultimate Organizational Tool

This is where technology changes the entire equation. An AI-powered platform like Ares acts as a powerful catalyst, taking that chaotic pile of medical documents and turning it into a clear, structured, and compelling story. Instead of a paralegal spending days reading line-by-line, the process becomes automated, accurate, and incredibly fast.

Here’s a quick look at how it works:

- Centralized Upload: You can upload all medical records into one secure platform, regardless of their source or format.

- AI-Powered Analysis: The AI engine reads and understands every single page, instantly pulling out key information like diagnoses, treatment dates, providers, medications, and reported symptoms.

- Chronological Storytelling: The system then arranges all this extracted data into an easy-to-follow chronology. It builds a timeline that clearly illustrates the progression of your client’s injuries and treatment from day one.

This shift from manual drudgery to automated analysis is the single most impactful improvement a firm can make to the middle stage of the claim life cycle. It turns weeks of work into minutes, freeing up your team to focus on high-value legal strategy instead of administrative tasks.

To truly appreciate the difference, let's compare the old way with the new.

Manual Review vs AI-Powered Analysis

| Metric | Manual Process | AI-Powered Process |

|---|---|---|

| Time | 10-20+ hours per case | Under 15 minutes per case |

| Cost | High paralegal/attorney hourly rates | Low, predictable SaaS fee |

| Accuracy | Prone to human error, missed details | Highly accurate, consistent data extraction |

| Risk | High risk of overlooking key evidence | Minimal risk, comprehensive data capture |

As you can see, the contrast is stark. The AI-powered approach not only delivers massive time and cost savings but also significantly de-risks a critical part of case development.

Personal injury case managers often struggle with huge record volumes, which delays the crucial step of summarizing the medicals to build a compelling narrative. Ares tackles this head-on with its AI analysis, producing case-ready insights by extracting symptom chronologies and provider details. This reduces manual review time from days to mere minutes and sharpens trial strategies. In fact, firms using this approach report saving 10+ hours per case.

From Data Points to a Bulletproof Case

Armed with an AI-generated medical summary, your team has a powerful new tool. You can quickly spot gaps in treatment, identify pre-existing conditions that need to be addressed, and pinpoint the most persuasive evidence to support your claim for damages. Our guide on crafting a medical record summary dives deeper into how to perfect this essential document.

This level of clarity and organization becomes the undeniable backbone of your case. When it's time to write the demand letter, you aren't starting from scratch. You have a perfectly organized, data-driven foundation that tells a powerful story, all backed by irrefutable evidence. This is how you move into the negotiation phase with maximum leverage and complete confidence.

Crafting a Demand Letter That Commands Attention

After weeks, or even months, of painstaking investigation and medical development, this is where the rubber meets the road. You’ve built the foundation of your case, and now it’s time to go on the offensive. The demand and negotiation stage is where all your hard work starts to translate into real value for your client.

Think of the demand letter as more than just a summary. It's your opening argument—a persuasive narrative that lays out the defendant's liability, details the full scope of your client’s damages, and justifies every single dollar you're asking for. It’s your first move, and it sets the tone for the entire negotiation to come.

Structuring a Powerful Demand

A truly compelling demand letter is built on a bedrock of indisputable facts. That chaotic mountain of medical records you started with has been transformed into an organized, easy-to-follow chronology, making your job far more manageable. Now you can craft a powerful story that draws a straight line from the incident to your client’s pain, suffering, and financial losses.

A demand that gets an adjuster’s attention has a few key ingredients:

- A Clear Liability Argument: A concise, firm explanation of why the other party is at fault, backed by the evidence you've gathered.

- The Medical Narrative: A detailed, chronological story of the client’s injuries, treatments, and recovery, pulled directly from their organized medical records.

- A Comprehensive Damages Breakdown: A line-by-line accounting of all economic damages like medical bills and lost wages, plus a well-reasoned calculation for non-economic damages.

- A Confident Settlement Demand: A specific, well-supported number that accurately reflects the full value of the claim.

The strength of your demand letter is directly proportional to the quality of the evidence supporting it. An AI-organized medical chronology allows you to present a fact-based narrative that is difficult for an adjuster to dispute, immediately putting them on the defensive.

This is exactly where a tool like Ares gives you a serious advantage. By automating the creation of that crucial medical timeline, it helps ensure no detail gets missed and you don't accidentally leave money on the table. For a deeper dive, check out our in-depth article on writing a demand letter for personal injury.

Navigating the Negotiation Table

Once you send the demand, the game shifts to negotiation. It’s a delicate dance, and insurance adjusters have a playbook of tactics designed to pay out as little as possible. Their entire job is to find weak spots in your case, question the severity of the injuries, and justify a lowball offer.

You've probably seen these tactics before:

- Delaying Tactics: They drag their feet on responses, hoping to put financial pressure on your client to take a quick, low offer.

- Disputing Medical Treatment: They'll question whether a certain procedure was really necessary or if the billing was reasonable.

- Low Initial Offers: They throw out a ridiculously low number first, trying to anchor the negotiation in their favor.

- Requesting Unnecessary Records: The classic fishing expedition, asking for unrelated medical history to find a pre-existing condition to blame.

This is where your meticulous, data-driven preparation becomes your greatest asset. When an adjuster tries to poke holes in the injury timeline, you can immediately counter with a provider-verified chronology. When they question a treatment, you have the doctor’s notes and diagnosis organized and at your fingertips.

This level of preparedness completely changes the negotiation dynamic. You're no longer just trading opinions—you’re presenting an organized body of evidence they can’t just wave away. You control the conversation because you control the facts. This confident, evidence-based approach is essential for mastering this pivotal stage of the claim life cycle and securing the best possible result for your client.

Deciding Between a Strategic Settlement and Litigation

The demand letter is out, and the first round of negotiations is over. Now comes the most critical fork in the road for any personal injury claim: do you take the settlement, or do you file a lawsuit? This isn't just about accepting an offer; it’s a strategic calculation that shapes the final chapter of your client's case and your firm's bottom line.

Choosing to settle can give your client a definite and timely outcome, sidestepping the immense emotional and financial toll of a court battle. But getting a settlement finalized is its own high-stakes process. The settlement documents have to be drafted with surgical precision to shield your client from future liabilities and leave absolutely no room for misinterpretation. Every single detail, from confidentiality clauses to the final release of claims, has to be perfect.

On the other hand, deciding to litigate means you’re escalating the fight. It's a commitment to a much longer, more adversarial path filled with discovery, depositions, and the ever-present possibility of a trial. This is often the only way forward when an insurance company simply refuses to see the real value of a claim, even when you’ve laid out overwhelming evidence on a silver platter.

Weighing the Pros and Cons

The choice to settle or sue is rarely black and white. It’s a delicate balancing act, where you have to weigh everything from the strength of your evidence to your client's appetite for risk. This is where having a perfectly organized case file, managed in a platform like Ares, gives you the clarity to make this critical decision confidently. When you can see the entire evidentiary landscape in one place, assessing your position becomes much simpler.

Here are a few of the key factors your team should be discussing:

- Strength of Evidence: How bulletproof is your liability argument? How well-documented are the damages?

- Client's Needs: Does your client need a faster resolution, or are they emotionally and financially prepared for a protracted legal war?

- Insurer's Offer: Is their final pre-suit offer in the ballpark of reasonable, or is it a lowball tactic that practically begs for litigation?

- Potential for a Higher Award: Does the chance of a much larger jury verdict justify the significant risks and costs of taking the case to trial?

The Power of Preparation in Litigation

If you do decide to file suit, all the meticulous groundwork you laid in the earlier stages of the claim life cycle will pay off in a big way. The discovery process is notoriously intense. Opposing counsel will pick apart every document, every deposition transcript, and every medical record, searching for any tiny inconsistency they can use against you.

A flawlessly organized and summarized case file becomes your greatest asset in litigation. It enables rapid, accurate responses to discovery requests and arms your attorneys with the facts they need to control depositions and motion practice.

This is the phase where a disorganized case file can quickly sink your ship. When your team has a clear, AI-generated medical chronology and a central hub for every piece of evidence, you stay one step ahead. You can see the defense's arguments coming from a mile away and be ready to counter them with precise, documented facts.

This level of readiness often forces a more favorable outcome, whether it's through a summary judgment, a better settlement on the courthouse steps, or a winning verdict. A strong litigation posture frequently brings the insurer back to the table with a much-improved offer long before a trial ever begins. That strategic advantage is a direct result of the diligence and organization you invested from day one.

Ensuring a Flawless Finish with Post-Settlement Closing

Getting the settlement check feels like a major victory, but it’s not the end of the claim life cycle. The post-settlement closing stage is where your firm’s reputation for professionalism and client care is truly cemented. Think of it as the final lap of a race; a clumsy finish can tarnish an otherwise perfect performance.

This administrative phase is about far more than just cutting checks. It’s a series of precise, high-stakes tasks that, if fumbled, can easily lead to compliance issues, financial penalties, and a damaged client relationship. After all the hard work, this is your last chance to deliver a flawless final experience.

Mastering the Art of Disbursement

At the heart of this stage is the disbursement process. It demands meticulous accounting and successfully navigating a complex web of third-party obligations. Every single dollar must be accounted for and sent to the right place, starting with your firm’s trust account.

From there, the funds are allocated to several key parties before the client ever sees their net amount. This is where absolute transparency isn't just a good idea—it's essential.

The typical disbursement waterfall includes:

- Attorney's Fees and Case Costs: This covers reimbursing the firm for its work and all the expenses advanced throughout the case.

- Medical Liens and Subrogation: You'll need to satisfy claims from healthcare providers, government insurers like Medicare and Medicaid, and private health or auto insurance companies.

- Other Third-Party Obligations: This bucket covers any other outstanding debts tied to the case, such as litigation funding or expert witness fees.

Negotiating down medical liens is often the final hurdle. Securing meaningful reductions can significantly increase your client’s take-home amount, showing that your firm is committed to maximizing their recovery even after the settlement is signed. It's a powerful final demonstration of your value.

A smooth, error-free closing process doesn't just ensure compliance—it leaves a lasting positive impression. This final, professional touch turns a successful case into a powerful source of future referrals and five-star reviews, which is exactly how your firm grows.

Finalizing the Client Experience

Once every last obligation is met, the final step is to prepare a clear, easy-to-understand closing statement for the client. This document needs to transparently break down every single deduction from the gross settlement amount, leaving absolutely no room for questions or confusion.

Presenting this statement along with the final check is a huge moment of closure for your client. It concludes a difficult chapter in their life and solidifies their trust in your firm. An organized platform like Ares ensures you have all the case costs and details right at your fingertips, making this final accounting both straightforward and accurate.

By executing this last stage with precision and care, you reinforce the competence and dedication you’ve shown throughout the entire case. It's the professional finish that confirms your client made the right choice in hiring you, completing the claim life cycle on the strongest possible note.

Frequently Asked Questions

Managing the personal injury claim life cycle is a constant juggling act. Below are some practical answers to the questions we hear most often from attorneys and paralegals looking to get a better handle on the process.

How Long Should a Typical Claim Life Cycle Take?

This is the million-dollar question, and the honest answer is: it depends. A straightforward, clear-liability case might wrap up in six to nine months.

But when you're dealing with complex injuries, disputed fault, or a stubborn insurance carrier, a case can easily stretch to 18-24 months or even longer, especially if it heads into litigation. The real goal isn't just raw speed; it's about maintaining consistent, forward momentum at every stage.

This is where smart tools can make a huge difference. For instance, using AI for the medical review can shave weeks, sometimes months, off the total timeline by speeding up demand preparation and getting you to the negotiation table faster.

What Are the Most Common Bottlenecks?

For most personal injury firms, the biggest logjam by far is the medical development stage. It's a notoriously slow and manual part of the job.

Think about it: you're requesting records, chasing down providers who don't respond, and then sifting through thousands of pages of medical jargon. It’s a massive time sink and ripe for human error. This one delay creates a domino effect, stalling the demand letter and pushing back the start of any meaningful negotiations.

Other common holdups include waiting on police reports right after intake or getting stuck in a slow back-and-forth with adjusters during the negotiation phase of the claim life cycle.

How Can Technology Improve Negotiation Outcomes?

Modern tech gives you a much stronger hand to play in negotiations by helping you build a rock-solid, meticulously organized demand package. That’s its biggest impact.

By systematically extracting every diagnosis, treatment date, and provider note, AI ensures your demand letter is comprehensive and factually irrefutable, leaving no money on the table. It builds a clear, undeniable chronology of the client's medical journey and suffering.

When you present a case built on this kind of data-driven foundation, it becomes much tougher for an adjuster to poke holes in your argument or downplay the client's injuries. You often see better initial offers and can negotiate from a position of strength, not desperation.

Is Using an AI Platform for PHI Secure?

Yes, as long as you're working with a reputable platform built specifically for the legal field. The leading solutions are designed with enterprise-grade security and are HIPAA compliant, which means they adhere to strict federal laws for protecting patient health information (PHI).

Your data is encrypted from the moment it leaves your system to when it’s stored, and tight access controls mean only authorized people can view case files. Frankly, this level of security is often a significant improvement over the risks of managing paper files in an office or sending unencrypted documents via email.

Ready to eliminate bottlenecks and master every stage of the claim life cycle? Ares provides the AI-powered platform your firm needs to organize medical records in minutes, build stronger demands, and settle cases faster.