What Is a Medical Lien? Your Guide to Personal Injury Settlements

A medical lien is a healthcare provider's legal claim against a patient's future personal injury settlement. It's a powerful tool that ensures doctors, hospitals, and therapists who provide treatment today get paid from the financial recovery their patient secures tomorrow.

Essentially, it's a secured IOU against the case's final outcome.

Understanding What a Medical Lien Really Means

Think of it like a reservation placed on settlement funds. For an injured client who can't possibly afford steep medical costs out-of-pocket, a lien acts as a critical lifeline. It bridges that financial gap, giving them access to necessary care without demanding immediate payment.

This mechanism is a cornerstone of personal injury law. Victims often rack up huge medical bills long before their case ever sees a resolution. In fact, 39.5 million Americans seek medical care for personal injuries each year, and a significant portion of them rely on liens to get treatment without devastating their finances upfront.

To get the full picture, you can find more personal injury statistics and industry trends to better understand the scale of this issue.

The Dual Role of a Medical Lien

For any personal injury firm, a medical lien is a classic double-edged sword. On one side, it's the very tool that makes it possible for your client to get the medical attention they desperately need. On the other, it represents a major financial obligation that your firm must clear before anyone—your client or your practice—sees a dime.

The lienholder always gets the first cut of the settlement funds.

To truly appreciate the implications of a lien, it helps to first grasp the fundamentals of medical billing, since that's what generates the charges a lien is based on.

For busy legal professionals, here's a quick breakdown of a lien's core components in a personal injury context.

Core Components of a Medical Lien at a Glance

| Characteristic | Description in a Personal Injury Context |

|---|---|

| Legal Claim | A formal, legally enforceable right asserted by a healthcare provider. It attaches to the proceeds of a personal injury case, not the patient's personal assets. |

| Secured Debt | The provider's payment is "secured" by the future settlement or judgment. If there's no recovery, the provider typically gets nothing (though this depends on the lien's terms). |

| Condition of Treatment | Often, providers will only treat an uninsured or underinsured accident victim if they agree to a lien. It's the provider's assurance of payment for services rendered on credit. |

| Priority Payment | Lienholders have a right to be paid from the settlement funds before the client receives their net proceeds. The attorney is ethically and legally bound to honor valid liens. |

| Negotiable Instrument | The final amount paid to the lienholder is often subject to negotiation. A skilled attorney or paralegal can frequently reduce the lien amount, increasing the client's take-home recovery. |

This table provides a high-level view, but the real-world application requires a deeper understanding of the strategic implications.

A medical lien ensures that the cost of care is tied directly to the successful outcome of the legal case. It aligns the interests of the provider with the patient and their attorney, but it also adds a layer of complexity that must be managed carefully from day one.

Getting a handle on this foundational concept isn't just about paperwork; it's the first step toward managing your client’s expectations and protecting your firm’s bottom line. Properly identifying, verifying, and negotiating these claims is a core component of an effective legal strategy, not just an administrative task.

The Different Kinds of Liens You Will Face

Not all liens are the same, and if you don't know the difference, it can seriously derail your case strategy. In personal injury law, liens aren't a single, straightforward problem. They show up in several distinct forms, each with its own set of rules, legal standing, and negotiation quirks. Getting a handle on these categories is the first step to building a plan that protects your client's bottom line.

Think of it this way: some liens are created automatically by law, while others are the result of a specific contract. The first thing you have to do is figure out which kind you’re dealing with.

Statutory and Hospital Liens

The most common liens you'll run into are statutory liens. These are legal claims granted to a provider directly by state law. A perfect example is a hospital lien. Many states have laws on the books that automatically give a hospital a right to a piece of the settlement to cover emergency treatment after an accident.

What’s unique here is that the patient doesn't have to sign anything extra. The hospital’s right to get paid is baked into the law from the moment they provide the care. But there's a catch: these laws are often incredibly technical. They usually have strict deadlines and rules for how the hospital must notify the patient and their attorney. If the hospital slips up on these procedures, the lien could be invalid—a powerful piece of leverage for you.

Contractual and Equitable Liens

Next up are contractual liens, which, as the name suggests, come from a direct agreement. Imagine your client needs physical therapy to recover but doesn't have insurance. The PT clinic might agree to treat them now if the client signs a "letter of protection," which is essentially a contract promising to pay the bill directly from their future settlement funds.

These are private agreements, and their terms are just as binding as any other contract. You’ll also see these from third-party medical funding companies that pay for a client's care upfront and expect to be repaid from the settlement.

A less frequent but important type is an equitable lien. This isn't created by a law or a contract but is instead imposed by a court to prevent an unfair outcome, like one party being "unjustly enriched." It’s a judicial tool used to ensure someone who has a right to payment from a specific fund—like your client's settlement—actually gets paid.

The core distinction is simple: statutory liens are creatures of state law, while contractual liens are born from private agreements. Each demands a completely different game plan for verification and negotiation. You have to adapt your strategy to the specific lien in front of you.

Government Super Liens

Finally, we have the heavyweights: government payers. Liens from Medicare, Medicaid, and the VA are often called "super liens" for a reason. Their right to get their money back is cemented in federal law, giving them a priority claim that trumps almost everyone else.

These government programs are secondary payers by design. They cover the medical bills upfront with the full legal expectation of being reimbursed from any settlement or judgment your client receives. Their rules are notoriously strict, and their power to collect is immense.

- Medicare Liens: Federal law gives Medicare an almost absolute right of recovery. You must report the case, and they will provide a summary of payments that has to be resolved from the settlement.

- Medicaid Liens: While states manage their own Medicaid programs, the right to reimbursement is still federally protected. Each state has its own agency that will come knocking to collect on its claim.

- VA and Military Health Liens: The federal government also has the right to seek repayment for care given to veterans or service members through the VA or TRICARE.

Unlike private or hospital liens, your negotiation options with these government giants are extremely limited. You can—and should—dispute any charges that aren't related to the accident, but getting them to reduce the actual amount they're owed is a tough, uphill battle. Dealing with these super liens demands meticulous compliance. Any misstep can lead to serious consequences for both your client and you.

How Liens Shape Your Settlement Strategy

From the moment you take on a case, medical liens aren't just a future bill to be paid—they're a core strategic element that dictates your every move. Think of the total lien value as the absolute minimum settlement you can even consider. If the liens add up to $50,000, a $40,000 offer isn't just a bad deal; it's an impossible one that leaves your client empty-handed.

This is why managing liens has to be a proactive part of your case strategy, not an afterthought you deal with once the money comes in. For clients recovering from injuries and seeking treatment for car accident related pain, this can be a hard truth to swallow. But ignoring or underestimating these claims is a massive risk for your firm, potentially leading to personal liability if you distribute settlement funds without paying off a valid lien.

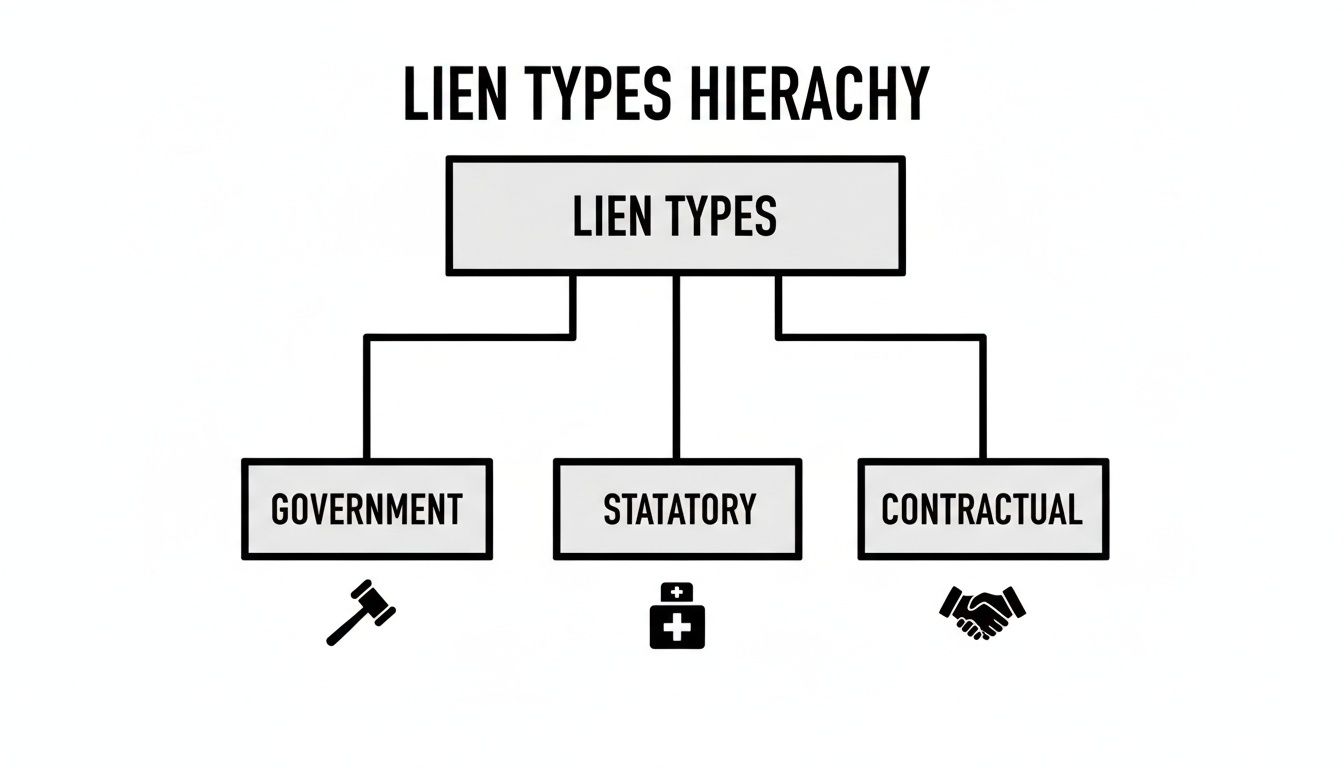

Lien Priority: The Pecking Order of Payments

You absolutely have to know who gets paid first. This concept, known as lien priority, is the pecking order for dividing up the settlement funds. Government liens—think Medicare or Medicaid—are the top dogs. They often have what’s called "super-priority," meaning they get their cut before almost anyone else. After them, you'll typically find statutory and then contractual liens, each with its own place in line.

Getting this order wrong can land you in serious legal and ethical hot water. A solid strategy involves identifying every potential lienholder as early as possible, verifying the exact amount they claim, and locking down their priority. Once you have that clarity, you can negotiate with adjusters from a position of strength, knowing precisely what financial obligations must be covered by any settlement.

This infographic lays out the typical hierarchy of lien types your firm will run into.

As you can see, Government liens sit at the top, followed by liens created by state law (Statutory), and finally, those based on private agreements (Contractual).

Turning Liens into Leverage

When you handle the lien resolution process well, it becomes more than just a defensive move to avoid risk—it becomes a source of leverage. A precise, fully verified accounting of all medical costs strengthens your demand package with undeniable evidence. This approach eliminates the last-minute surprises that can completely derail negotiations and helps you secure a higher net recovery for your client in the end. A clear understanding of the personal injury settlement timeline is crucial for managing these moving parts effectively.

The sheer prevalence of medical debt is what fuels many of these claims. In fact, a recent study revealed that a staggering 36% of U.S. households were shouldering medical debt. In personal injury cases, that debt often takes the form of a lien as providers fight for a guaranteed payback. For attorneys, this means liens can easily eat up 10-30% of a settlement's value, making sharp negotiation skills an absolute necessity, not just a nice-to-have.

Your Playbook for Finding and Validating Medical Liens

Let’s be honest: uncovering every single medical lien is one of the most painstaking parts of handling a personal injury case. But it’s also non-negotiable. Missing a claim isn't just an oversight; it can blow up into a serious legal and financial mess for your client and your firm. You absolutely need a systematic, repeatable process to protect everyone involved.

The hunt for liens starts from day one. You have to treat it like a detective's investigation, because clues are often hiding in plain sight across piles of case documents. Your team needs to be trained to spot them everywhere—not just in the obvious places.

Think of it as casting a wide net. You can't just assume a provider doesn't have a claim. You have to proactively look for it and confirm one way or the other.

Where to Look for Potential Liens

Finding every claim is all about knowing where to dig. Information is rarely handed to you on a silver platter; it's usually scattered across dozens, if not hundreds, of pages. The best practice is to have a firm-wide checklist that ensures no stone is left unturned during the initial case workup.

Here are the essential documents to scrutinize:

- Client Intake Forms: This is your starting point. These forms should prompt the client to list every doctor, hospital, physical therapist, and even ambulance service they can remember.

- Medical Records and Bills: Go through these with a fine-tooth comb. Every page could contain a clue—provider names, service dates, or specific language mentioning a third-party claim or a letter of protection.

- Health Insurance Correspondence: Don't ignore Explanation of Benefits (EOB) statements. They are a goldmine for identifying payments made by insurers who likely have subrogation rights they'll want to enforce.

Once you’ve compiled a master list of every potential provider, the next move is to send out your letter of representation. This officially puts them on notice that a PI claim is active and essentially forces their hand to assert any lien they believe they hold.

How to Validate Each Lien Claim

Just because a provider sends you a bill doesn’t mean they have a valid, enforceable lien. Many claims that land on your desk are legally flawed or improperly calculated. This is where your diligence becomes a direct financial benefit to your client.

Here's how to break down the validation process:

- Demand Formal Documentation: Never accept a simple bill as proof of a lien. You need to request a signed lien agreement or a copy of their official statutory lien filing. If they can't produce it, they may not have a real lien.

- Scrutinize the Itemized Bills: This is critical. Compare every single line item on the bill against the corresponding medical records. You're looking for red flags: charges for unrelated treatments, inflated "upcoding" for services, or bills that seem wildly out of sync with what was actually done.

- Confirm Statutory Compliance: If the provider claims a statutory lien (like a hospital lien), you have to verify that they followed the law to the letter. Did they meet all filing deadlines? Did they provide proper notice? Missing a single mandatory step can invalidate their entire claim.

This manual verification is a notorious time-suck for any law firm. But this is exactly where technology can give you a massive leg up. For example, AI-powered platforms can instantly scan an entire medical file and automatically surface a list of providers and potential lienholders.

What was once a manual slog becomes a much faster, more accurate workflow. It ensures no provider is missed without your team spending days on a painful page-by-page review. Learning how to organize medical records properly from the start makes using these tools even more effective.

Key Takeaway: A medical lien is only as strong as the paper it's written on. Always demand proof. Always challenge discrepancies. This is how you protect your client from paying for unreasonable charges or, worse, for treatment that had nothing to do with their injury.

Proven Tactics for Lien Negotiation and Resolution

Successfully slashing a medical lien is where a good lawyer becomes a great one. This is the moment you put real, tangible money back into your client's pocket, turning a gross settlement figure into a net recovery they can actually use to rebuild their life.

This isn’t about just asking nicely for a discount. It’s about building a solid, evidence-backed argument that lienholders simply can't ignore. Lienholders—whether they’re a hospital, a third-party financing company, or a government agency—are ultimately businesses. They speak the language of risk, cost, and the time value of money. Your job is to translate your client's situation into that language and create leverage.

Knowing the bigger picture helps. With medical collections now a $194 billion issue and providers getting squeezed by rising costs, the market for medical lien funding is only getting bigger. You can get a sense of where things are heading from these predictions for medical lien funding in 2025. Understanding these economic pressures gives you a strategic advantage at the negotiation table.

Key Arguments for Lien Reduction

Your negotiation strategy needs to be a layered attack, not a single shot. By combining several proven legal and practical arguments, you build a case for reduction that’s both fair and incredibly difficult to refuse.

Here are a few of the most effective tactics:

- Argue Procurement Costs: Start by reminding the lienholder that without your firm’s investment of time, expertise, and cold, hard cash, there would be no settlement fund at all. They need to share in the cost of creating that fund. Your argument is simple: their claim should be reduced proportionally to account for your attorney's fees and litigation expenses.

- Contest Unreasonable Charges: Get out your red pen and scrutinize every single line item on the bill. You’re looking for charges that are inflated, unrelated to the accident, or improperly coded. This isn't a quick scan; it requires a meticulous, side-by-side comparison of the billing statements against the actual medical records.

- Highlight Litigation Risks: Did the case settle for less than its full value because of tricky liability facts or a defendant with shallow pockets? If so, the lienholder has to share in that compromise. It's completely unreasonable for them to expect a 100% payout when your client had to accept a discounted settlement.

Leveraging State-Specific Legal Protections

Beyond these universal negotiation points, your state’s laws might hand you some powerful ammunition. These legal doctrines aren't just suggestions; they can provide a firm legal foundation for demanding a major reduction.

The most powerful tool in your arsenal is often your state's specific legal framework. Doctrines like the 'made whole' rule aren't just negotiation points—they can be legally binding requirements that force a lienholder's hand.

Take the “made whole” doctrine, which is the law in many states. It essentially says that a lienholder can’t get a dime until the injured person has been fully compensated for all of their damages. If the settlement isn’t enough to make your client whole, you have a rock-solid legal basis to argue for wiping out the lien entirely or, at the very least, reducing it drastically.

Similarly, the “common fund” doctrine legally requires the lienholder to chip in for the attorney’s fees, since your work created the "common fund" from which they're being paid.

The Power of a Data-Driven Request

A quick letter asking for a reduction is easy to toss aside. A detailed reduction request—backed by a clear medical summary, an organized chronology, and copies of the relevant records—is not.

This is where having your evidence perfectly structured becomes a game-changer. An organized timeline makes it painfully simple for the adjuster on the other end to see which treatments were directly caused by the accident and which ones weren't.

When you present the lienholder with an airtight, data-driven argument, you change the entire dynamic of the conversation. You’re no longer just asking for a favor; you're presenting a logical case that makes your proposed reduction the only reasonable outcome. You can find more strategies like this in our guide on how to negotiate a personal injury settlement. By mastering these tactics, you’ll consistently secure better results and ensure your clients walk away with the compensation they truly deserve.

Common Questions About Medical Liens

When you're deep in the trenches of a personal injury case, medical liens can feel like a minefield. You're trying to get the best possible outcome for your client, but these claims can pop up and create serious headaches. Let's walk through some of the questions I hear most often from other attorneys and paralegals.

Can a Medical Lien Take the Entire Settlement?

It’s the nightmare scenario every attorney wants to avoid: a medical lien so large it eats up the entire settlement, leaving your client with nothing. While it's rare, it can happen, especially when catastrophic injuries meet low insurance policy limits.

This is exactly why understanding state-specific protections is so critical. Many states have a 'made whole doctrine', which essentially says a provider can't get their money back until your client has been fully compensated for all their losses. It’s a powerful tool to protect your client's recovery.

Remember, a lien is just a claim on the settlement funds—it's not a guarantee that the provider gets paid every last penny. You have every right to negotiate. I've often seen reductions based on litigation risks, arguments over shared fault, or simply reminding the provider that your firm's hard work and expense are the only reason they're seeing any money at all.

What Happens If a Case Is Settled Without Resolving a Lien?

Ignoring a valid medical lien is one of the fastest ways to get into serious trouble. It doesn't just go away. The lienholder's claim is still very much alive, and they can come after both your client and you.

First, the provider can sue your client directly for the full, unpaid bill. Suddenly, the injury case you just closed has turned into a new financial crisis for them. Even worse, the lienholder can often sue the attorney or law firm directly for improperly distributing funds they had a legal right to. This can make the attorney personally liable for the entire debt, which is a massive financial hit and a serious ethical violation.

How Do Medicare and Medicaid Liens Work?

Government liens are a different beast entirely. Medicare and Medicaid liens are often called "super liens" for a good reason—their right to get paid back is backed by federal law, putting them at the front of the line.

These agencies act as secondary payers, covering medical bills on the condition that they'll be reimbursed from any settlement. Here’s what you absolutely have to know:

- Reporting is Mandatory: You have a legal duty to report any case involving a Medicare or Medicaid beneficiary to the correct agency. No exceptions.

- Negotiation is Limited: Forget about the kind of negotiating you do with private providers. You can—and should—dispute any charges that aren't related to the accident, but getting them to reduce the final lien amount is a tough, uphill battle.

- Resolution is Required: The government gets its money back from the settlement before your client gets theirs. It's a non-negotiable part of the process.

How Can Technology Make Lien Management Easier?

This is where things have really changed for the better. Instead of having a paralegal spend days sifting through a mountain of medical records, AI-powered tools can do the heavy lifting in minutes. It's about working smarter, not harder.

Think about it: these platforms can automatically scan thousands of pages, pulling out every provider, treatment date, and diagnosis to build a clean medical chronology. This makes it incredibly easy to spot treatment for a pre-existing condition or other billing errors you can use as leverage when you negotiate. It’s not just about saving time; it’s about reducing the risk of a missed lien and arming your team with the data to negotiate from a position of strength.

Juggling the endless details of medical liens can feel like a full-time job. Ares is an AI platform designed specifically for personal injury firms to take over the tedious work of medical record review, data organization, and even drafting demand letters. If you want to cut 10+ hours of manual work per case and go into negotiations better prepared, check out how it works at https://areslegal.ai.