How to negotiate personal injury settlement: Tips to maximize compensation

The secret to winning a negotiation isn't just about what you say to the adjuster—it's about the exhaustive prep work you put in beforehand. The most powerful settlement strategies are built on an ironclad case foundation, long before the first offer even hits the table. This is what separates a case you control from a case that controls you.

Build an Unshakeable Case Foundation Before You Negotiate

Many lawyers think successful negotiation is all about mastering persuasive arguments. The truth is, the best arguments grow directly from a meticulously organized and deeply understood case file. Before you can demand what your client truly deserves, you have to build a narrative so compelling that the insurance company can’t ignore the risk of taking you to trial.

This is about more than just collecting papers. It's about weaving raw information—medical records, police reports, witness accounts—into a coherent story that hammers home liability and justifies every single dollar of your damages claim.

From Document Collection to Narrative Construction

First things first, you need to gather every scrap of relevant information. I’m not just talking about the obvious stuff; you need the secondary evidence that adds color and credibility to your client's story. Your mission is to leave no stone unturned.

Here’s the essential checklist:

- Official Reports: Start with the complete police or incident report. This is the official, and often unbiased, version of events.

- Medical Documentation: This is the heart of your damages. Get every bill, chart note, specialist report, and MRI film from every single provider.

- Visual Evidence: Photos and videos are powerful. Collect everything from the accident scene, the property damage, and the visible progression of your client's injuries.

- Witness Information: Lock down contact info and, if possible, get written or recorded statements from anyone who saw what happened.

- Proof of Financial Loss: Document the money trail with pay stubs, tax returns, and letters from employers to prove lost wages and future earning-capacity issues.

Once you have everything, the real work starts. As you go through the mountain of medical records and reports, applying principles of effective document analysis is crucial for spotting the details that matter. You’re playing detective, piecing together a timeline and searching for the connections that an adjuster will try to skim over.

The strength of your negotiation position is directly proportional to the quality of your preparation. An adjuster can argue with your opinion, but they cannot argue with well-documented, interconnected facts.

Identifying and Filling Evidentiary Gaps

A truly strategic approach means thinking like the other side. You have to anticipate their arguments and plug the holes in your case before they can ever exploit them. While reviewing your files, constantly ask yourself the tough questions. Is there a gap in the medical treatment timeline? Does a witness statement seem to contradict the police report?

For example, if your client waited a week to see a doctor, you can bet the defense will claim the injury wasn't serious. It's on you to find the evidence to shut that down—maybe there's a note in the initial medical visit explaining the delay, or a witness who can testify to your client's immediate and obvious pain. When you address these weaknesses head-on, you seize control of the narrative. To get deeper into this, check out these strategies on https://areslegal.ai/blog/how-to-organize-medical-records to build a rock-solid timeline.

This level of detailed organization takes an incredible amount of time. This is exactly where AI-powered tools like Ares come in. Instead of having a paralegal spend days manually sifting through documents, these platforms can rip through hundreds of pages of medical records, automatically extracting key data like diagnoses, treatment dates, and provider details. It creates a structured chronology in minutes, not days. This frees up your team from the grind of administrative work so they can focus on high-level strategy and crafting a compelling story, ensuring you walk into every negotiation from a position of undeniable strength.

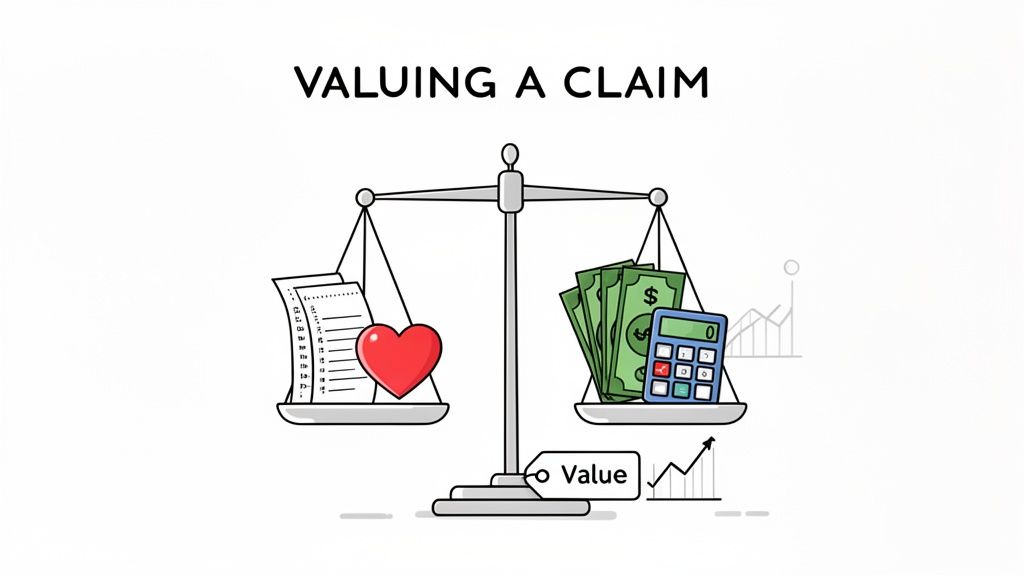

Know What Your Case is Worth Before You Ever Pick Up the Phone

Let’s be blunt: you can’t win a negotiation if you don’t know what you’re fighting for. Walking into a discussion with an adjuster without a rock-solid, evidence-backed valuation of your client's claim is a rookie mistake. It’s the fastest way to let the other side dictate the terms.

A credible settlement range is your anchor. It grounds every offer, every counter, and every strategic decision you make in logic and fact, not wishful thinking.

This isn’t about plugging a few numbers into a generic online calculator. Real case valuation is part art, part science. It involves a meticulous breakdown of every loss your client has suffered—and, just as importantly, every loss they will face in the years to come.

Nailing Down the Economic Damages

We start with the easy part: the hard costs. These are the economic damages, or "specials," and they represent the tangible, out-of-pocket expenses that have a clear paper trail. This is the concrete foundation of your entire claim.

Be exhaustive here. Your list must include:

- Past and Future Medical Bills: Don't just add up the bills that have already arrived. You need to project the cost of future surgeries, ongoing physical therapy, prescription medications, and any necessary medical equipment.

- Lost Wages: Tally every single dollar of income lost because your client couldn't work. Support this with pay stubs and a letter from their employer confirming time missed.

- Diminished Earning Capacity: This is a big one. If the injury permanently impacts your client's ability to do their job or advance in their career, this becomes a critical—and often substantial—piece of the puzzle.

- Property Damage: The cost to repair or replace a vehicle is the most common item here, but don't forget other personal property destroyed in the incident.

Gathering this documentation is tedious, but it's where cases are won. Every dollar you can tie to a receipt is a dollar an adjuster will have a very hard time arguing against.

Turning Pain into a Dollar Figure

Here’s where a seasoned practitioner really earns their keep. Non-economic damages are about compensating for the human cost of an injury. They don’t come with an invoice, but they are profoundly real and often make up the largest part of a settlement.

Your most important job is to make the intangible tangible. You have to translate your client's pain, their sleepless nights, and their lost hobbies into a clear, justifiable number that an adjuster can understand and, ultimately, approve.

These damages cover the spectrum of human suffering:

- Pain and Suffering: The raw physical pain and discomfort your client has been forced to endure.

- Emotional Distress: The anxiety, depression, PTSD, and fear that often follow a traumatic event.

- Loss of Enjoyment of Life: The inability to go for a run, play with their kids, or simply enjoy a day without pain.

A common starting point is the "multiplier method," where you multiply the total economic damages by a number, typically between 1.5 and 5, depending on the severity of the injuries. But a formula alone is weak. A compelling story, backed by evidence, is what truly drives value. For a deeper look at this, our guide on how to calculate pain and suffering damages breaks it down further.

Building a Defensible Settlement Range

Once you've calculated both the economic and non-economic damages, you can establish a practical settlement range. This should include your "walk-away" number—the absolute minimum you'll accept—and your aspirational, but still realistic, target.

The numbers at stake can be significant. The National Practitioner Data Bank, for example, recorded 10,217 medical malpractice payment events in a single year, totaling $4.33 billion. The average payout was $423,600, but the median was much higher at around $679,000, which shows how a few massive verdicts can skew the data. It's a critical distinction to understand when setting expectations.

Finally, temper your valuation with a dose of reality. You need to know the insurance policy limits—you can’t get blood from a stone. Researching recent jury verdicts for similar cases in your specific jurisdiction is also essential. This provides a powerful reality check and helps you build a valuation that is not just ambitious, but genuinely achievable.

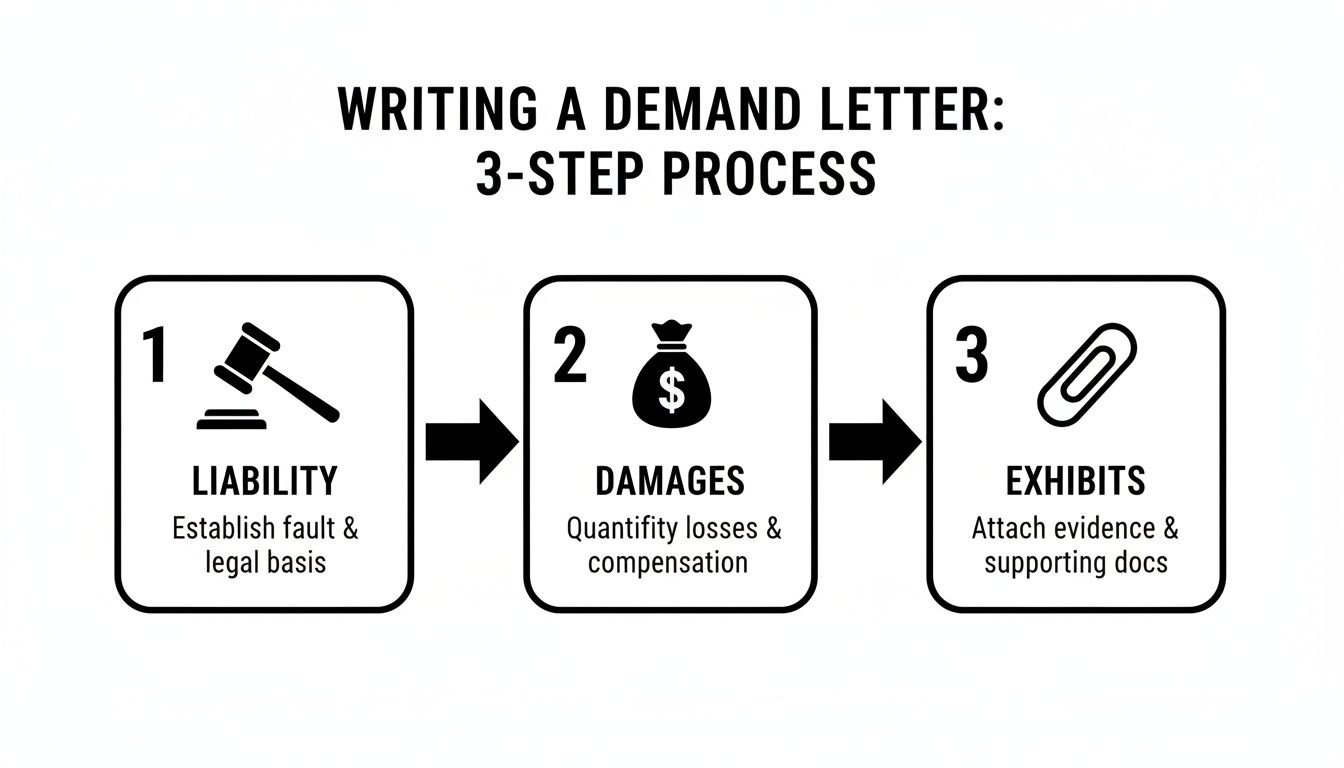

Craft a Demand Letter That Gets Results

Think of your demand letter as the opening argument in your negotiation. It’s the very first time the insurance adjuster sees your entire case laid out, from liability to damages. A sloppy, rushed letter telegraphs that you're not taking the case seriously, and you can bet you’ll get a dismissive, lowball offer in return.

But a powerful, meticulously documented demand? That forces the adjuster to sit up and take notice. It makes them rethink their initial risk assessment and understand you mean business. This isn't just a letter asking for money; it's a persuasive legal argument that sets the tone for everything to come.

First, Nail Down the Liability Argument

Before you even get to the numbers, you have to prove, unequivocally, why their insured is at fault. Your liability section should be a concise, fact-based narrative that methodically shuts down any potential counterarguments.

Start with a clear, brief summary of what happened. Pull directly from the official police report and cite the specific traffic laws the defendant violated. If you have strong witness statements, integrate key quotes. Your goal is to present an open-and-shut case on liability, making it obvious to the adjuster that fighting you on this point would be a waste of their time and money.

Then, Detail Every Single Dollar of Damages

This is the heart of your letter, and it's where all your hard work preparing the case file really shines. You must draw a straight, undeniable line from the defendant's negligence to every single injury and loss your client has suffered. Simply asking for a lump sum won't cut it; you need to itemize everything.

I always break damages down into two distinct categories:

- Economic Damages: These are the hard costs. You need a precise accounting of every medical bill from every single provider, along with documented lost wages and any other out-of-pocket expenses. Totaling these up gives you a concrete, non-negotiable floor for the negotiation.

- Non-Economic Damages: This is where you make the case for pain and suffering. Don't just throw out a number. Tell the story of your client's ordeal, using the medical records as your guide. Talk about the specific diagnoses, the painful procedures they endured, and the medications they had to take. More importantly, explain how the injuries have turned their life upside down—from being unable to work to losing the ability to enjoy their hobbies.

This is where technology can make a huge difference. For example, a tool like Ares can automatically generate summaries of complex case documents, which lets you draft a much more compelling demand letter in a fraction of the time.

When you can instantly structure dense medical data into a clean timeline, you can pull the exact facts you need to build a powerful and accurate damages narrative without getting bogged down for hours.

The Real Power is in Your Exhibits

A demand letter without exhibits is just your opinion. But a demand package with a full set of well-organized, supporting documents? That’s a credible threat. Every single claim you make in the letter, from liability to the final medical bill, must be backed up by an attached exhibit that is clearly labeled and referenced.

I’ve seen it a hundred times: a lawyer just dumps a disorganized pile of records on the adjuster's desk. That's a huge mistake. A truly great demand package acts as a roadmap, guiding the adjuster through the evidence, with each exhibit serving as another chapter in your client's story.

Your exhibit list should effectively be a table of contents for your entire case. This simple step shows the adjuster you are prepared, professional, and absolutely ready for litigation if they don't come to the table with a fair offer.

The process of drafting the letter, compiling the exhibits, and cross-referencing everything can be a massive time-sink. This is where platforms built specifically for personal injury firms, like Ares, come in. Instead of you or your paralegal spending hours manually piecing everything together, these tools can generate a comprehensive, fact-based demand letter directly from your case files.

This doesn't just save an immense amount of time—often 10+ hours per case—it also ensures every claim is perfectly aligned with the documented evidence. You end up with a stronger negotiating position right from the start.

Before sending your demand, it's worth double-checking it against the key elements that adjusters look for. A well-structured letter makes their job easier, which in turn makes them more likely to see your valuation as credible.

Key Components of a High-Impact Demand Letter

| Component | Purpose | Pro Tip |

|---|---|---|

| Clear Introduction | Immediately identifies your client, the insured, the date of loss, and the claim number. | Get straight to the point. The adjuster is busy; make it easy for them to pull up the right file. |

| Factual Summary | Provides a concise, fact-based narrative of how the incident occurred. | Stick to the facts from the police report and witness statements. Avoid emotional language here. |

| Liability Analysis | Explicitly states why the insured is at fault, citing relevant laws and evidence. | Make the argument undeniable. The goal is to show that litigating liability would be a losing proposition for them. |

| Detailed Injury List | Lists every diagnosis, supported by medical records. | Use the exact medical terminology from the records to establish credibility and seriousness. |

| Treatment Narrative | Tells the story of your client's medical journey, from the ER to physical therapy. | Connect the treatment to the client's pain and limitations. This is where you start building the non-economic damages case. |

| Itemized Economic Damages | A clear, totaled list of all medical bills, lost wages, and other hard costs. | Include a ledger or spreadsheet. The more organized you are, the less likely they are to question your numbers. |

| Non-Economic Damages Argument | Explains the human cost: pain, suffering, and impact on daily life. | Use specific examples. How has this injury affected their ability to work, sleep, or engage with their family? |

| A Specific Monetary Demand | States a clear, total settlement amount, not a vague range. | Anchor high, but make sure your number is justifiable based on the evidence you've presented. |

| Exhibit List | A numbered or lettered list of all supporting documents attached. | This acts as a table of contents and shows you are meticulously prepared. |

A demand letter that methodically checks all these boxes isn't just a request—it's a clear signal to the insurance company that you have built a case that is ready for trial, dramatically increasing your chances of a fair and timely settlement.

Master the Art of Negotiating with Insurance Adjusters

All the work you’ve put in—organizing the medical records, calculating the case value, and drafting a solid demand letter—has all been leading up to this. The negotiation. This is where your strategy, patience, and a clear understanding of the adjuster's playbook will turn all that hard work into a win for your client.

Let's be clear: negotiating with an insurance adjuster isn’t just a conversation; it’s a specific skill. These are trained professionals. Their entire job is to close claims for as little as possible. Your job is to make it impossible for them to ignore the facts—that your valuation is credible, your evidence is airtight, and you won’t hesitate to go to trial if they don't make a fair offer.

Setting the Stage for the First Offer

Once you’ve sent the demand package, the ball is in their court. That first call from the adjuster is a critical moment. Your tone should be calm, confident, and in control. And a word of advice: always let the adjuster make the first offer. Never, ever bid against yourself by dropping your demand before they've even put a number on the table.

Predictably, their first offer will be low. Sometimes, it’s insultingly low. This is a classic tactic meant to anchor the negotiation in their favor and see if you’ll flinch. Don't take it personally. A lowball offer isn't an insult; it's the opening move in a strategic game. Just acknowledge it, state that it's nowhere near a reasonable range, and tell them you’ll follow up with a detailed response.

Crafting a Compelling Counteroffer

Your counteroffer is where you systematically pick apart their low valuation. Don't just throw out a new number. You need to show them why theirs is unacceptable.

A strong counteroffer will:

- Reiterate your key strengths: Briefly remind them of the clear liability and the real-world severity of the injuries.

- Point to what they missed: Highlight specific evidence, like a note from a treating physician, that they conveniently undervalued in their assessment.

- Connect the dots on damages: Explicitly link the medical evidence to your client's day-to-day suffering to make the pain and suffering damages feel real and tangible, not just an abstract number.

For instance, you might say, "Your offer doesn't seem to account for Dr. Smith's note on page 42, which confirms a permanent 15% impairment rating. That has a direct impact on our client's future earning capacity and fully supports the higher figure we've calculated for non-economic damages." This shows you know your file cold.

The three pillars of any strong demand or counteroffer are always liability, damages, and the exhibits that prove both.

This simple framework is your guide. Each element builds on the last, creating a persuasive argument that an adjuster can't easily dismiss.

The Power of Strategic Patience

Patience is probably your most underrated tool. Adjusters are almost always under pressure to close files. If you rush, you're playing their game and leaving money on the table. It's perfectly fine—and often smart—to let some time pass after making a counteroffer. Silence can be a powerful tactic.

It shows you aren't desperate and you're confident in your position. This patient, methodical approach is grounded in reality. The vast majority of these cases never see the inside of a courtroom. In fact, research shows that approximately 95% of personal injury lawsuits end in a pre-trial settlement. You can find more insights about legal settlement trends and why this negotiation phase is so crucial. For all practical purposes, this back-and-forth is the main event.

Pro Tip: Document every single conversation. After a call with an adjuster, send a quick follow-up email confirming what was discussed and any offers made. This creates a paper trail and prevents any "misunderstandings" later on.

Knowing the Adjuster’s Limits

You have to remember that every adjuster has a cap on their settlement authority. If you hit a wall and the negotiation stalls, it might not be because your arguments are weak. It could simply be that the person you're talking to doesn't have the authority to write the check your case is worth.

When you reach that impasse, don't be afraid to politely ask to speak with a supervisor. This isn't an aggressive move; it's a practical one. You're just trying to get the case in front of someone who has the power to make a final, fair decision. Ultimately, winning the negotiation is about building leverage, proving your case's value, and making it clear you're ready to litigate if a reasonable outcome can't be reached.

Finalizing Your Settlement and Avoiding Common Pitfalls

Getting the adjuster to agree on a number feels like a victory, but don't pop the champagne just yet. The truth is, the period between that verbal "yes" and your client getting their check is riddled with potential traps. This is where a good settlement can go sideways if you're not paying close attention.

The final paperwork isn't just a formality; it's as crucial as the negotiation itself. One poorly worded release or a mismanaged lien can cost your client dearly and even put your firm on the hook.

Memorialize the Agreement Immediately

The second you hang up the phone with a verbal agreement, your first move should be to put it in writing. Don't delay. A quick, clear email confirming the terms is all it takes.

This isn't the final contract, but it serves as a crucial written record. It prevents any convenient "misunderstandings" or memory lapses down the road. Make sure your email specifies:

- The total settlement amount.

- Confirmation that this is a "full and final settlement of all claims."

- A request for the defense to send over the settlement release documents for your review.

This simple act locks in the deal and gets the final paperwork moving.

Scrutinize the Settlement Release

The settlement release is a contract written by the defense, for the defense. Their priority is protecting their client and the insurance company—not yours. You need to review this document with a fine-toothed comb before your client ever lays eyes on it.

Be on high alert for overly broad language. A standard release resolves the specific claim from the incident. But sometimes, they’ll try to sneak in clauses releasing them from "any and all claims, known or unknown, from the beginning of time." That’s a massive red flag. Your client is only settling the claims from this incident. Period.

Never let your client sign a release that waives rights unrelated to the current case. It’s your job to strike any language that could compromise their future legal options, no matter how unrelated they may seem.

Always push back on these boilerplate, overreaching terms and demand they be revised. A reasonable adjuster knows this is part of the process and will almost always agree to narrow the scope back to the specific incident.

Navigate the Complexities of Lien Resolution

Before your client sees a dime, you have to identify and resolve every valid lien against the settlement. This isn't optional. Failing to properly satisfy liens from Medicare, Medicaid, private health insurers, or child support can create a world of pain for both your client and your firm.

Get a head start on this. As soon as a settlement looks likely, reach out to all potential lienholders for their final payoff amounts. More often than not, their initial numbers are negotiable. I always argue that my fees and costs have already reduced the client’s net recovery, so the lienholder should grant a proportional reduction. Even a 10-20% reduction can put thousands of extra dollars in your client's pocket.

Managing your client's expectations here is key, as this can take time. If you want a deeper look at this part of the process, our guide on the typical personal injury settlement timeline breaks down what happens after you've agreed on a number.

Lump Sum vs. Structured Settlement

The final piece of the puzzle is advising your client on how they'll receive their money. The choice generally comes down to a lump-sum payment or a structured settlement.

| Payment Type | Description | Best For |

|---|---|---|

| Lump Sum | The client gets the entire net settlement in one single payment. | Most standard cases and clients who have a solid financial plan for the money. |

| Structured Settlement | The funds are paid out over time in a series of guaranteed, tax-free payments, typically through an annuity. | Catastrophic injury cases, claims involving minors, or any client who needs guaranteed, long-term financial security for future care. |

For most straightforward injury cases, a lump sum is the clean, simple choice. But for a client facing a lifetime of medical needs, a structure can provide incredible peace of mind. This decision has huge financial implications, so it demands a careful conversation to ensure your client makes the choice that truly serves their future.

A Few Common Questions About Personal Injury Negotiations

Even lawyers who have been in the trenches for years run into tricky situations when negotiating personal injury settlements. Every case brings its own unique set of facts and personalities, but the bedrock principles of solid preparation and evidence-backed arguments never change.

Here are some straightforward answers to the questions that pop up most often during this make-or-break phase of a case. Consider it a quick field guide to sharpen your strategy and stay one step ahead of the adjuster.

What’s the Single Biggest Mistake to Avoid When Starting Negotiations?

Walking into a negotiation with a messy, disorganized case file. It’s the fastest way to kill your credibility. If you’re on the phone with an adjuster and can’t immediately pull up a specific medical bill, a treatment date, or a key diagnostic finding, you’re signaling weakness.

Insurance adjusters are paid to spot and exploit hesitation. When they see you fumbling for information, it tells them you might not have a solid handle on your own case, which is basically an open invitation for them to throw a lowball offer on the table.

Your most powerful negotiating tool is confidence, and true confidence comes from being meticulously prepared. An organized file isn't just about being neat; it's about having every fact at your command so you can control the conversation.

This is where a little prep goes a long way. Using a platform to generate an automated medical chronology before you even pick up the phone puts you in the driver's seat. It shows the adjuster you’re ready for a serious, fact-based discussion from the get-go.

How Do You Put a Real Number on Pain and Suffering?

Calculating pain and suffering can't just be about plugging numbers into a formula. You have to build a compelling narrative, grounded in evidence, that makes your client's experience tangible and gives your number real weight. The goal is to connect the cold medical facts to the very real human cost.

Instead of simply saying, "My client is in pain," use their own medical records to paint a vivid picture.

- Trace the timeline of treatments that didn't work. Show the progression from conservative care to more invasive procedures.

- Show the escalation in pain medication. A shift from over-the-counter pills to prescribed opioids tells a powerful story on its own.

- Pull direct quotes from physician’s notes that describe your client's functional limitations or their own reports of severe, ongoing pain.

This medical evidence is your foundation. From there, you connect those facts to the client's day-to-day reality. Did they have to give up a hobby they loved, like playing golf or working in their garden? Can they no longer pick up their grandkids? These specific, relatable details are what turn an abstract concept into a concrete, justifiable damage figure. It shows the adjuster you're not just asking for money; you're demanding fair compensation for a documented, life-altering experience.

When Is It Time to Reject a "Final" Offer and Head to Court?

Deciding to reject what the other side calls their "final" offer isn't an emotional call—it's a strategic one. You walk away when their number is still miles below your carefully researched case valuation, even after you’ve clearly laid out your justification.

But before you draw that line in the sand, you need to have a very frank conversation with your client. They must understand what litigation truly means: higher costs, a much longer timeline, and the very real risk of a trial. You have to be clear that a jury's decision is never a sure thing.

Your strongest negotiating position comes when your threat of litigation is genuinely credible. If an adjuster knows your case file is buttoned up and you're ready for trial, their "final" offer suddenly has a funny way of becoming a "revised final" offer. That credibility, built on a foundation of painstaking preparation, is the ultimate leverage you have.

Ready to stop drowning in administrative work and start building more powerful, credible demand packages? Ares automates the tedious parts of reviewing medical records and drafting demand letters, turning hours of work into minutes of high-level strategy. See how you can claim bigger and settle faster with Ares.