A Winning Sample of Demand Letter for Personal Injury

A strong personal injury demand letter isn't just a template you fill in; it's a strategic narrative that frames your entire case. This document is your first, and often most critical, opportunity to lay out a compelling argument for both liability and damages. It truly sets the tone for the entire negotiation.

Why Your Demand Letter Is Your Most Powerful Tool

Forget the idea that a demand letter is just a formality. Think of it as your opening argument—the strategic foundation on which a successful settlement is built. A masterfully written letter establishes control, frames the story in your client’s favor, and immediately puts the insurance adjuster on the defensive.

Instead of just listing facts, a powerful letter tells a persuasive story of liability, suffering, and the real-world financial fallout. This approach is your best defense against an initial lowball offer and can significantly speed up the timeline to a fair settlement. When you get it right, this document becomes a serious legal instrument that signals to the insurer that you're prepared to go the distance.

The Strategic Importance of a Well-Crafted Demand

Nearly 400,000 personal injury claims are filed in the U.S. each year, and the demand letter is the critical opening move in the negotiation process. It’s what sets the stage for the settlements that resolve an overwhelming 95-99% of cases long before they ever see a courtroom. For more personal injury law statistics, check out this report on Clio.com.

Ultimately, the letter has three primary jobs:

- Establish Clear Liability: It must present an undeniable account of how the at-fault party’s negligence caused the incident, backed by hard evidence like police reports and witness statements.

- Narrate the Human Cost: It translates cold medical records into a coherent story of your client's pain, the grueling treatment process, and the ongoing impact on their life.

- Justify the Financial Demand: Every single dollar requested must be anchored to specific, documented losses—from medical bills and lost wages to the very real, but intangible, cost of suffering.

A great demand letter makes it incredibly difficult for an adjuster to justify a low offer. By laying out every fact, documenting every injury, and calculating every loss, you force them to negotiate on your terms, not theirs.

The Core Components That Drive Results

A truly effective demand letter is built on a few essential pillars. Each one supports the others to build an irrefutable case for the compensation your client deserves. Understanding what a demand letter is and its core components is the first step toward drafting a document that gets results.

We'll break down these key elements in detail, but first, here's a quick overview of what turns a simple request into a powerful legal tool.

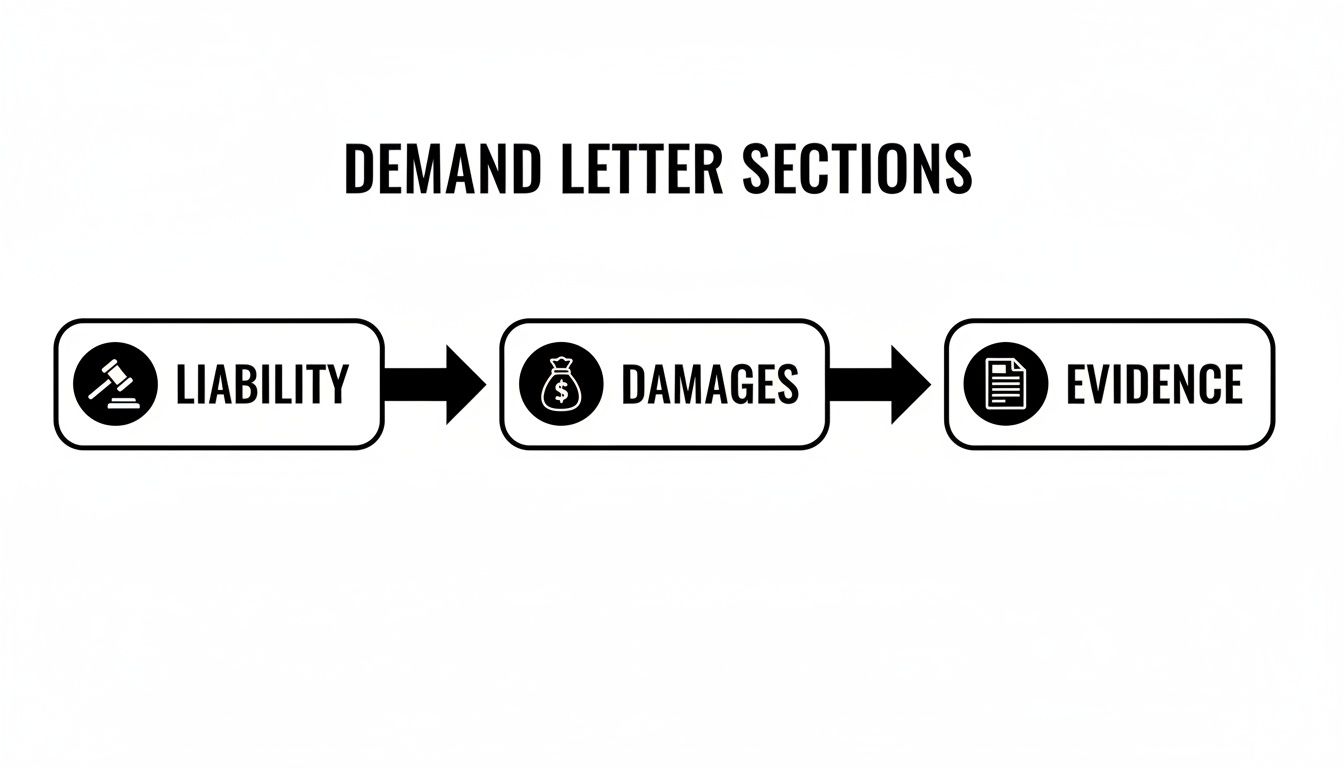

Before diving into the full walkthrough, it's helpful to see the core anatomy of a winning demand letter at a glance. Each section has a distinct purpose and requires specific information to be persuasive.

Core Components of an Effective Demand Letter

| Component | Purpose | Key Information to Include |

|---|---|---|

| Liability | To prove the other party was unequivocally at fault. | Police report details, witness accounts, relevant statutes, and photos/video. |

| Medical Narrative | To detail the extent of injuries and the full treatment journey. | A chronological summary of medical care, diagnoses, and the long-term prognosis. |

| Damages | To quantify all economic and non-economic losses. | Medical bills, lost wage statements, property damage estimates, and pain & suffering calculations. |

| The Demand | To state the total settlement amount being requested. | A specific, justified dollar figure and a clear deadline for a response. |

Nailing each of these sections is crucial. A weak link in your liability argument or a poorly documented damages claim can undermine your entire effort and give the adjuster an easy opening to reduce their offer.

Let's Pull Apart a High-Impact Demand Letter

Theory is one thing, but seeing it in practice is where the real learning happens. Let’s break down a complete demand letter for a personal injury claim, built around a very common car accident scenario. This isn't just a fill-in-the-blanks template; it’s a strategic look under the hood to show you why certain phrases are used and how each section builds momentum.

We'll go through it piece by piece, and I’ll add commentary explaining the thinking behind the structure, the specific language, and the evidence mentioned. You’ll see how to frame a simple set of facts to shut down common insurance company defenses right from the start.

The idea is to give you a blueprint you can adapt. Once you understand the strategy behind a powerful letter, you can apply the same principles to get better results for your clients.

The Header and Introduction: Making a Strong First Impression

This first part is all about professionalism and efficiency. It needs to give the adjuster everything they need to find the file instantly. No fluff, no confusion—just the critical details that prevent administrative hold-ups.

[Your Law Firm Letterhead]

SENT VIA CERTIFIED MAIL

RETURN RECEIPT REQUESTED

[Date]

[Adjuster's Full Name]

[Insurance Company Name]

[Insurance Company Address]

RE: Our Client: Jane Doe

Claimant: Jane Doe

Insured: Robert Smith

Claim Number: XYZ-12345

Date of Loss: January 15, 2024

Dear [Mr./Ms. Adjuster's Last Name]:

Expert Insight: Always send a demand via Certified Mail. It creates an undeniable record of receipt, so the carrier can't later claim they never got it. The "RE:" line is your best friend—it puts all the key identifiers right at the top, allowing the adjuster to pull the file in seconds. This small step screams competence.

This letter constitutes our formal demand for settlement of Ms. Jane Doe's personal injury claim arising from the negligence of your insured, Robert Smith, on the date referenced above. As you know, your insured’s conduct caused Ms. Doe to suffer significant injuries, economic damages, and profound pain and suffering. Liability in this matter is clear and not open to dispute.

Expert Insight: The opening paragraph is polite but firm. We're immediately framing the conversation by stating liability is "clear and not open to dispute." This isn't aggressive; it's confident. It signals to the adjuster that we won't be wasting time debating who was at fault.

The Factual Narrative: Nailing Down Liability

This is where you tell the story of the crash. It’s not an emotional appeal. It’s a clean, fact-driven account that methodically proves the other driver’s negligence. Every sentence here should be backed up by evidence you’re enclosing, like the official police report.

On January 15, 2024, at approximately 2:30 PM, Ms. Doe was driving her 2022 Honda Accord northbound on Maple Avenue and approaching the intersection with Oak Street. Ms. Doe was proceeding through the intersection on a green light, traveling at the posted speed limit of 35 MPH.

At the same time, your insured, Robert Smith, was driving his 2019 Ford F-150 westbound on Oak Street. Mr. Smith ignored a steady red light and sped into the intersection, violently T-boning the passenger side of Ms. Doe’s vehicle. The impact was so severe that it deployed Ms. Doe's side-curtain airbags and threw her car into the southbound lanes of traffic.

Expert Insight: Notice the objective, specific details: street names, time, direction of travel, traffic signal status. Using a phrase like "ignored a steady red light" is a direct statement of the negligent act. We're not accusing; we're stating a fact we can prove.

The collision was investigated by Officer Mark Davis of the Anytown Police Department (Report #24-00123). In his report, Officer Davis cited your insured, Mr. Smith, for a violation of Vehicle Code § 21453(a) – Failure to Stop at a Red Signal. Furthermore, two independent witnesses, who are listed in the police report, provided statements confirming that Mr. Smith ran the red light. There is absolutely no evidence to suggest any comparative negligence on the part of Ms. Doe.

Expert Insight: Citing the specific vehicle code, the police report number, and the existence of witnesses adds incredible weight. It tells the adjuster, "We have the proof, and we're ready for court." This makes it much, much harder for them to argue about liability.

The Medical Story: From Injury to Impact

Here, you turn a dry stack of medical records into a coherent story. The goal is to show the adjuster the chronological journey of your client's injury, pain, treatment, and how it has completely upended their life.

Immediately after the crash, Ms. Doe felt severe pain in her neck and back and was taken by ambulance to Anytown General Hospital. The emergency room diagnosed her with acute cervical and lumbar sprain/strain—classic whiplash. They prescribed pain medication and muscle relaxers and told her to follow up with a specialist.

Because the pain and debilitating headaches wouldn't go away, Ms. Doe started physical therapy at Premier Physical Therapy on January 22, 2024. For eight weeks, she went to therapy three times a week to work on restoring her range of motion. Even with all that treatment, the pain continued to interfere with her daily activities and her ability to work as a graphic designer.

On March 25, 2024, an MRI of her cervical spine revealed a herniated disc at C5-C6, which explained the radiating pain and numbness she was feeling in her arm. Her orthopedist, Dr. Susan Jones, then administered two cervical epidural steroid injections to manage the severe nerve pain. Ms. Doe finally reached Maximum Medical Improvement (MMI) on June 1, 2024. However, Dr. Jones has stated in her report that Ms. Doe will likely suffer from chronic neck stiffness and intermittent flare-ups for the foreseeable future, which may require ongoing medical care.

Expert Insight: The narrative flows chronologically and uses specific medical terms ("herniated disc at C5-C6") to underscore the seriousness of the injury. Mentioning that problems will persist into the "foreseeable future" is crucial—it lays the foundation for claiming future damages and justifies a higher settlement demand.

Itemizing the Damages: Connecting the Story to the Numbers

This is where you show your math. Every single dollar you’re asking for must be tied to a specific, documented loss. This section has to be crystal clear and organized so the adjuster can easily follow along and verify everything with the documents you’ve enclosed.

As a direct result of your insured’s negligence, Ms. Doe has incurred the following economic damages to date:

Medical Expenses

- Anytown General Hospital (ER Visit): $4,250.00

- Dr. Susan Jones (Orthopedics): $3,800.00

- Anytown Imaging (MRI): $2,100.00

- Premier Physical Therapy: $4,800.00

- Prescription Co-pays: $175.00

- Subtotal: $15,125.00

Lost Wages

- Ms. Doe was physically unable to work for two full weeks following the collision. Her employer has verified her weekly income of $1,500.

- Subtotal: $3,000.00

TOTAL ECONOMIC DAMAGES: $18,125.00

Expert Insight: A clean, bulleted list of the "specials" (medical bills and lost wages) is essential. It's easy to read and shows your demand is anchored in real, provable financial losses. Never submit this section without attaching every corresponding bill, receipt, and wage verification letter to back it up.

How to Draft Each Section for Maximum Impact

Looking at a sample demand letter is one thing, but actually writing one that gets results is another. Let's break down how to draft each section to build an airtight case and give you the most leverage possible. This is where we move from theory to practice, turning the raw facts of a case into a persuasive legal argument that an adjuster can't easily dismiss.

Your goal here isn't just to state what happened. It's to tell a compelling story, backed by evidence, that proactively dismantles the insurance company's potential counterarguments before they even have a chance to make them.

Nailing Down Liability: Leave No Room for Doubt

The first job of your letter is to establish liability so clearly that it becomes indisputable. This section needs to read like a closed case, not the opening of a debate.

Start by anchoring your narrative in objective truth. I always lead with the police report, mentioning the officer's name and the report number right off the bat. It immediately signals that your version of events is based on official documentation, not just your client's word.

Then, you have to be direct. Use precise, factual language to describe exactly what the at-fault party did wrong. Don't say, "the other car hit my client." Instead, write something like, "Your insured violated Vehicle Code § X by running a red light, which was the sole cause of this collision."

Finally, you need to head off the comparative fault argument. It’s a classic adjuster tactic. A simple, confident statement like, "Our client was operating their vehicle in full compliance with all traffic laws, and there is no evidence to suggest any comparative negligence on their part," can shut that door before they try to open it.

Your liability section isn’t just about telling your client’s side of the story. It's about presenting the only version of the story the evidence can possibly support. The confidence you project here sets the tone for the entire negotiation.

Weaving a Compelling Medical Story

A thick stack of medical records is just data. It's your job to turn that data into a coherent narrative that shows the client's journey from the moment of impact through their entire course of treatment. You need to draw a straight, undeniable line from the collision to the pain, suffering, and medical care that followed.

I always start with the immediate aftermath—the ER visit, the initial shock, the first diagnoses. From there, build a clear chronological path. Show the progression from the emergency room to specialist consultations, physical therapy, and diagnostic imaging like MRIs. When you list specific procedures, like steroid injections, it paints a vivid picture of just how serious the injury has been.

As this flowchart shows, establishing clear liability is the foundation. That allows you to detail the damages, all of which must be backed by solid evidence.

When you're detailing this medical journey, don't just list the treatments—explain why they were necessary. For example: "After six weeks of physical therapy failed to resolve the persistent radiating pain in his arm, Dr. Smith ordered an MRI, which revealed a significant disc herniation at C5-C6." This demonstrates a logical medical progression, not just a client running up bills.

The Art of Calculating and Justifying Damages

This is where the rubber meets the road—the financial core of your demand. Every single dollar you ask for needs to be meticulously documented and justified. There should be no room for an adjuster to question your math.

Economic Damages (The "Specials")

These are the hard numbers, the tangible losses your client has incurred. I find it's best to present these as a clean, itemized list. It’s impossible to argue with.

- Medical Bills: List every single provider and the total amount they billed. Make sure you attach a copy of every corresponding invoice in your evidence package.

- Lost Wages: Calculate the exact income your client lost from being unable to work. This needs to be supported by a letter from their employer that verifies their pay rate and the specific dates they missed.

- Out-of-Pocket Costs: Don't forget the small stuff, because it adds up. This includes prescriptions, medical devices like a brace or crutches, and even mileage for travel to and from appointments.

Non-Economic Damages (Pain and Suffering)

This is where you have to quantify the unquantifiable, and it requires a strong justification. You can't just pull a number out of thin air. The multiplier method is a common and effective starting point, where you multiply the economic damages by a factor (usually between 1.5 and 5) based on the severity and impact of the injuries.

To justify the multiplier you choose, you have to tell the human story. Describe the client’s physical pain, their emotional distress, and their loss of enjoyment of life. Did they miss their daughter’s wedding? Can they no longer pick up their grandchild or go for their morning run? These personal, human details are what give real weight to your demand for non-economic damages. You can get a deeper look into this process by reviewing our guide on how to calculate pain and suffering damages.

Using tools like an AI legal assistant can be a great way to streamline the organization of facts and the preparation of these detailed sections, ensuring nothing gets missed.

Making the Final Demand with a Professional Tone

Your conclusion needs to be direct and unambiguous. State a clear, specific dollar amount for the total settlement. Avoid wishy-washy language like "a fair and reasonable settlement." Be plain: "Based on the clear liability and the significant damages documented above, we hereby demand the sum of $XX,XXX to settle this claim in full."

Throughout the entire letter, your tone should be firm, professional, and confident. You aren't asking for a favor; you are demanding the compensation that is rightfully owed for the harm their insured caused. This balanced approach signals to the adjuster that you're a serious professional who is prepared to litigate if a fair offer isn't forthcoming. In the $61.3-$61.7 billion U.S. personal injury market, this is critical. A well-substantiated demand is the engine that drives settlements, resolving up to 99% of cases before they ever see a verdict.

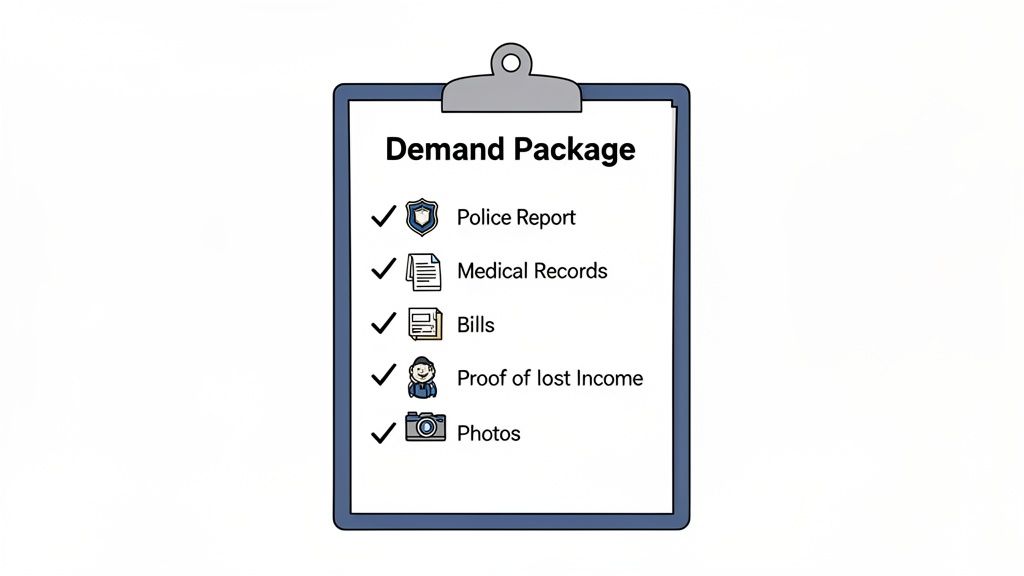

Building Your Demand Package Checklist

A personal injury demand letter is only as persuasive as the evidence that backs it up. The letter tells the story, but the demand package delivers the undeniable proof. Assembling a bulletproof package is a meticulous process where every document serves a strategic purpose, from proving who was at fault to justifying every penny of your settlement figure.

Think of it as building a case file so tight that it leaves an adjuster no room to question the validity of your claims.

Foundational Documents for Liability

Before you can even begin to talk about damages, you have to nail down liability. These documents are the bedrock of your argument that the other party was at fault, making it incredibly difficult for the insurer to try and shift the blame.

- Official Police or Incident Report: This is your starting point. It's the primary, objective account of what happened, complete with the officer's narrative, citations, witness info, and often a diagram of the scene.

- Witness Statements: Independent corroboration is pure gold. Gather written or recorded statements from anyone who saw the incident, zeroing in on details that confirm your client's story and the other party's negligence.

- Correspondence with the Insurer: Keep copies of every email, letter, and note from phone calls with the at-fault party's insurance company. This creates a clear paper trail. To ensure all verbal accounts, like depositions or witness statements, are captured precisely, a service for Legal Court Transcription can be invaluable.

Comprehensive Medical Evidence

This section is the heart and soul of your damages claim. It’s where you translate your client’s injuries and suffering into a documented, chronological record. Just throwing a stack of bills at the adjuster won't cut it; the records must tell a coherent story of diagnosis, treatment, and prognosis.

A well-organized medical file can be the difference between a fair settlement and a lowball offer. The goal is to draw a straight, unbroken line from the incident to every single medical intervention. For a deeper dive, we have a whole guide on https://areslegal.ai/blog/how-to-organize-medical-records for maximum impact.

Your medical evidence must include:

- Emergency Services Records: Ambulance reports and all ER intake forms and discharge summaries.

- Physician and Specialist Notes: Every record from the primary care doctor, orthopedist, neurologist, or any other specialist involved.

- Diagnostic Imaging Reports: Official radiologist reports for X-rays, MRIs, and CT scans that confirm diagnoses like fractures or herniated discs.

- Physical Therapy and Rehabilitation Records: Detailed notes showing the frequency of treatment, your client's progress, and any documented limitations.

- Prescription Receipts: A full list of all medications prescribed to manage pain or other injury-related symptoms.

An adjuster's primary job is to minimize their payout. A meticulously organized and complete medical package—with every visit, diagnosis, and treatment clearly documented—removes their ability to argue that an injury was pre-existing or that treatment was unnecessary.

Documenting Financial Losses

Every single dollar of your economic damages claim must be backed by tangible proof. These documents are straightforward but absolutely essential for recovering the quantifiable losses your client has suffered.

- Itemized Medical Bills: You need every single bill from every provider—hospitals, clinics, therapists, imaging centers, and pharmacies.

- Proof of Lost Income: Get a letter from your client's employer on official company letterhead. This needs to verify their pay rate, normal work schedule, and the exact dates they couldn't work because of their injuries.

- Property Damage Estimates: For car accidents, include multiple repair estimates or a valuation report if the vehicle was totaled.

- Out-of-Pocket Expense Receipts: Don't forget the small stuff. Keep receipts for everything from crutches and braces to mileage for driving to and from doctor's appointments. These costs add up fast.

Visual and Supporting Evidence

Finally, nothing brings the story to life like visual evidence. Photos and videos provide a visceral, undeniable gut-punch that words alone can't deliver, proving the incident's severity and its impact on your client.

- Photos and Videos of the Scene: Images showing vehicle positions, skid marks, traffic signals, and road conditions are crucial.

- Photos of Property Damage: Get detailed shots of all involved vehicles from every possible angle.

- Photos of Injuries: Take clear pictures of bruises, cuts, scars, and casts. It's important to document these throughout the recovery process to show the healing journey.

A truly comprehensive demand package requires a systematic approach to gathering and organizing these documents. Below is a checklist to help ensure nothing falls through the cracks.

Essential Demand Package Checklist

This table breaks down the critical supporting documents that should accompany any personal injury demand letter, outlining what they are and why they matter.

| Document Category | Specific Examples | Purpose in the Claim |

|---|---|---|

| Liability | Police Report, Witness Statements, Photos of the Scene | Establishes who was at fault for the incident and provides an objective narrative. |

| Medical Records | ER Reports, Physician Notes, PT Logs, Diagnostic Scans | Documents the nature, extent, and duration of injuries, linking them to the incident. |

| Medical Bills | Hospital Bills, Ambulance Invoices, Pharmacy Receipts | Quantifies the past medical expenses, forming the basis of economic damages. |

| Lost Wages | Employer Verification Letter, Pay Stubs, Tax Returns | Proves income lost due to time off work for recovery. |

| Property Damage | Repair Estimates, Total Loss Valuation Report | Substantiates the cost to repair or replace damaged property, like a vehicle. |

| Visual Evidence | Photos of Injuries, Vehicle Damage Photos, Scene Videos | Provides compelling, easy-to-understand proof of the accident's impact. |

| Out-of-Pocket Costs | Receipts for Mileage, Medical Equipment, Prescriptions | Recovers all incidental expenses incurred by the client as a direct result of the injury. |

By systematically building a demand package with this level of detail, you substantiate every element of your client's claim. This thorough preparation doesn't just support your demand—it signals to the adjuster that you are organized, serious, and ready for a successful negotiation.

Common Mistakes and Negotiation Pro Tips

Even the most meticulously crafted demand letter can fall flat if you stumble into a few common traps. A single misstep can tank your credibility, giving the insurance adjuster the exact opening they need to slash their settlement offer. Knowing what these pitfalls are is the first step to sidestepping them and keeping your negotiation on solid ground.

One of the most common mistakes I see is letting emotion run the show. It's completely understandable to be angry and frustrated after an injury, but letting that seep into your letter makes you look unprofessional, not sympathetic. Adjusters deal with emotional appeals all day; they respond to cold, hard facts, solid evidence, and a firm, business-like approach.

Another critical error is shooting for the moon with an unrealistic demand. When you inflate the settlement figure without a clear, evidence-based justification, you're signaling that you don't really know what your case is worth. This often backfires, causing the adjuster to dismiss your letter entirely and counter with an insultingly low offer, souring the whole negotiation from the get-go.

Mastering the Post-Demand Dance

Sending the letter is just the opening move. The real skill comes into play when you get a response and the negotiation truly begins. You have to remember, an adjuster's first offer is almost never their best—it's a probe, designed to see how well you know your claim's value and how ready you are to fight for it.

When that first counteroffer comes in, resist the urge to just look at the number. Dig into the adjuster's reasoning. Did they conveniently ignore the chiropractor's bills? Are they questioning the severity of your documented injuries? Their response is a roadmap, pointing directly to what they perceive as the weak spots in your case. This is your cue to shore up those exact points.

Your reply needs to be a direct rebuttal, backed by the evidence you've already gathered. If they question your physical therapy, you can fire back by quoting the physician's notes that prescribed it. Always tie your arguments back to your documentation.

A negotiation isn't an argument; it's an educational process. Your job is to systematically educate the adjuster on why their valuation is incorrect, using the evidence you've already provided to dismantle their position point by point.

Pro Tips for a Stronger Position

To really gain an edge, you need to think strategically from the moment you send the demand. These small tactical adjustments can make a huge difference in the final settlement and how smoothly the process goes.

- Set Firm Deadlines. In every letter and email, give the adjuster a reasonable but firm deadline for their response. Something like 10-14 business days works well. This creates a sense of urgency and stops them from letting your claim gather dust on their desk.

- Keep a Meticulous Log. Document every single interaction you have—phone calls, emails, letters, everything. Note the date, time, the person you spoke with, and a quick summary of what was discussed. This log becomes pure gold if you later need to argue the adjuster was negotiating in bad faith.

- Never Bid Against Yourself. This is a classic rookie mistake. After you make a counteroffer, wait for them to respond. Don't get impatient and send a lower offer a week later. Stand your ground and make them come to you.

- Know When It's Time to Escalate. If the adjuster is being completely unreasonable, stalls for weeks, or makes a final offer that’s just absurd, that’s your signal. You have to be prepared to file a lawsuit, and you should let them know it. Sometimes, just the act of filing the complaint is enough to suddenly get a much more realistic offer on the table. It shows them you're serious.

Answering Your Top Questions About Demand Letters

Even the most seasoned paralegal or attorney runs into tricky situations when drafting a demand. Here are some of the most common questions we see, along with practical, field-tested answers.

When Is the Right Time to Send a Demand Letter?

The golden rule is to wait until your client has reached Maximum Medical Improvement (MMI). At the very least, you need a crystal-clear long-term prognosis from their treating physicians.

Sending a demand too soon is a classic mistake. You simply can't know the full extent of the damages—medical bills, future care costs, lost earning capacity, or the true depth of their suffering. If you jump the gun, you risk leaving significant money on the table.

Of course, if MMI is a long way off, you should still send an initial notice of claim to put the carrier on alert. But the comprehensive demand package? Hold that until you have all the evidence locked down. This patience ensures your demand is built on a solid foundation and accurately reflects the claim's full value.

How Much Medical History Should I Include?

Think of it as telling a compelling story, not dumping a file cabinet on the adjuster's desk. Your focus should be laser-sharp: only include the medical history and treatment records that are directly related to the incident.

Your job is to connect the dots for the adjuster. Weave the key findings from the medical records into a clear, chronological narrative of your client's journey from injury to recovery. You want to highlight the cause and effect. While you need to be thorough, burying the adjuster in paperwork about a pre-existing condition that has no bearing on the current injuries will only dilute your argument. A concise, powerful summary is always more effective.

What Is a Reasonable Amount for Pain and Suffering?

This is the million-dollar question, and there's no magic formula. However, a widely accepted starting point is the "multiplier method." You take the total economic damages (your hard numbers like medical bills and lost wages) and multiply them by a number, usually between 1.5 and 5.

So, what determines the multiplier? It comes down to the human element of the case:

- How severe and permanent are the injuries?

- What was the recovery process actually like? Long, painful, and intensive?

- Is there visible scarring or a permanent disability?

- How has this fundamentally changed your client's day-to-day life?

For a catastrophic injury, that multiplier could go well beyond 5. The key is to justify your number. Don't just state it. Fill the demand letter with specific, personal examples of your client's physical pain, emotional trauma, and the life they've lost. That's what gives your number weight.

What Happens if the Insurance Company Ignores My Demand?

Don't panic, but don't let it slide. If the deadline you set (typically 30 days) comes and goes without a peep, your first move is a documented follow-up. Send another letter, make a phone call, and confirm they received the original package. Document every single attempt in your case file—this is crucial.

If the silence continues, or if you feel they're just stringing you along, it's a strong signal that it's time to escalate. For most attorneys, this means preparing to file a lawsuit. An insurer's refusal to engage with a well-documented, reasonable demand can sometimes be more than just a negotiation tactic. In some states, it can even be used as evidence of bad faith, opening up a whole new level of liability for the carrier.

Stop wasting hours on manual document review and drafting. Ares uses AI to turn mountains of medical records into a powerful, settlement-ready demand letter in minutes. See how much time you can save at https://areslegal.ai.