A Winning Personal Injury Demand Letter Sample and Guide

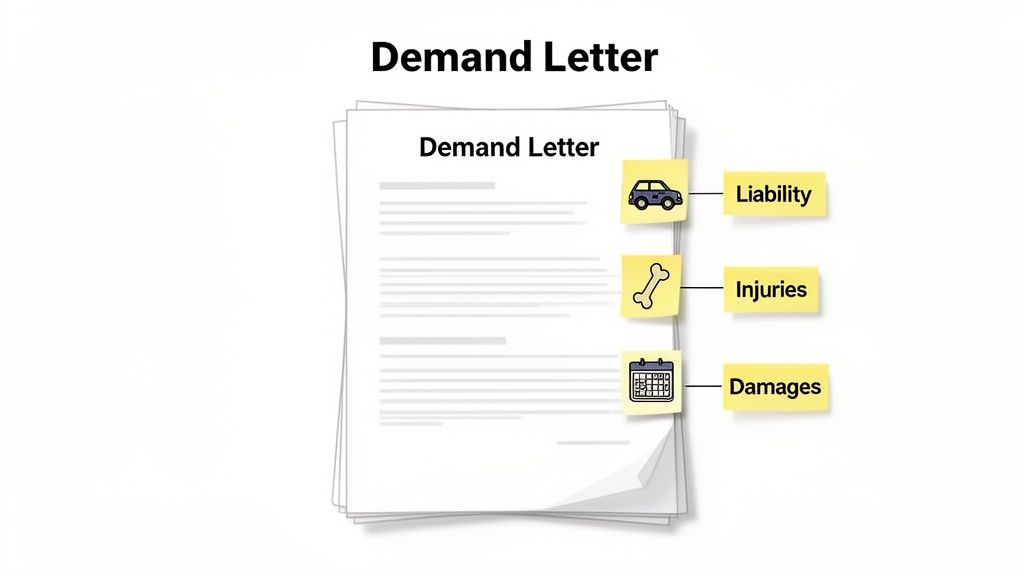

Before you even think about filing a lawsuit, there’s a crucial first step that sets the stage for everything to come: the personal injury demand letter. This isn't just a simple request for money; it's the formal document that officially kicks off settlement negotiations with the insurance company.

Think of it as your opening argument, a comprehensive case you present that outlines exactly why the other party is liable, details the full extent of your client's injuries and damages, and makes a specific monetary demand to resolve the claim.

Why Your Demand Letter Is a Game Changer

It’s easy to dismiss the demand letter as just another piece of administrative paperwork. That’s a massive mistake. In reality, this document is your opening move in the high-stakes chess match of settlement negotiation. It's your first—and often best—chance to tell your client's complete story to the insurance adjuster, the very person holding the purse strings.

A well-crafted letter does far more than just state facts. It establishes the tone for the entire negotiation, anchoring the initial settlement value in the adjuster's mind. More importantly, it frames the narrative around your client's suffering, transforming them from a faceless claim number into a real person.

The Power of a Strong First Impression

Think of the demand letter as the script you’re handing the adjuster. A weak, poorly organized, or unsupported letter practically invites a lowball offer. It signals that you might not have a firm grasp on the case's true value or the evidence required to win in court.

On the other hand, a persuasive, meticulously documented letter commands a serious, good-faith response. It shows you're prepared and confident.

This single document is often the difference between a quick, fair resolution and a protracted, expensive court battle. Its primary goal is to present a case so compelling that the insurer sees settling as its best and most logical option.

The numbers don't lie. The vast majority of personal injury cases never see the inside of a courtroom. Settlement intelligence data shows that over 95% of cases are resolved before a trial verdict, and it’s the demand letter that drives these negotiations.

In fact, an estimated 98.2% of all civil cases settle before a lawsuit is even filed, which underscores just how critical this initial communication really is.

Shaping the Narrative from Day One

A truly effective letter is built on a foundation of solid evidence woven into a clear, persuasive story. It connects the dots for the adjuster, showing exactly how the defendant's negligence directly caused the documented injuries and financial losses. This is where you lay it all out.

To do this effectively, you need a firm grasp on the key elements that make a demand letter work.

Here is a quick look at the non-negotiable components every successful personal injury demand letter must contain to be effective.

Key Elements of a High-Impact Demand Letter

| Component | What It Achieves | Essential Information |

|---|---|---|

| Clear Liability Argument | Establishes fault and proves the insured's responsibility. | Facts of the incident, relevant laws/statutes, evidence of negligence. |

| Detailed Injury Description | Paints a vivid picture of the client's suffering and recovery. | Initial diagnosis, treatment timeline, ongoing symptoms, prognosis. |

| Quantified Economic Damages | Itemizes all tangible financial losses with proof. | Medical bills, lost wages, property damage receipts, out-of-pocket costs. |

| Compelling Non-Economic Damages | Argues for the value of pain, suffering, and emotional distress. | Impact on daily life, loss of enjoyment, emotional trauma, personal stories. |

| Specific Monetary Demand | Sets the negotiation anchor and clearly states the settlement goal. | A specific dollar amount, justified by the total calculated damages. |

| Supporting Documentation | Provides irrefutable proof for every claim made in the letter. | Police reports, medical records, photos, witness statements, expert reports. |

A well-structured letter, supported by organized evidence, makes it easy for the adjuster to see the strength of your case and incredibly difficult for them to justify a low offer.

For a deeper dive into these fundamentals, our guide on what a demand letter is breaks down how it functions in the settlement process. Ultimately, your goal isn't just to present facts—it’s to build an airtight case for settlement from the very first page.

Building a Rock-Solid Case Before You Write

A powerful demand letter isn't won with fancy writing. It's won with proof. Before you type a single word of the narrative, your most important job is to meticulously organize the evidence. This prep work is what separates a demand that commands a serious offer from one that gets brushed aside.

Think of it this way: you're building a fortress of facts. Every claim you make, from the severity of your client's injuries to the other party's liability, needs to be reinforced with indisputable evidence. Insurance adjusters are trained to poke holes in your story, looking for any unsupported claim or inconsistency. Your mission is to give them nowhere to go.

Gathering Your Core Documentation

First things first, you need to pull together all the essential documents that frame the incident and its immediate fallout. This isn't just about ticking boxes on a checklist; it's about curating a file that tells a clear story of negligence and its devastating consequences.

Your initial evidence file should always contain:

- The Official Police Report: This is often the first thing an adjuster looks at. It provides a neutral, third-party account of what happened, who was involved, and often includes an initial opinion on fault.

- Photographs and Videos: Visuals are incredibly powerful. You need every photo of the scene, vehicle damage, property damage, and of course, any visible injuries. If they're timestamped, even better.

- Witness Statements: Get signed statements and contact information from anyone who saw what happened. An independent account that backs up your client's story can completely neutralize attempts to shift the blame.

- Client Communications: Keep your notes from initial meetings, along with any relevant emails or texts. These documents capture your client's immediate pain and the disruption the accident caused in their own words.

When building a case, accuracy is everything. Many firms find that using a professional service for audio transcription for lawyers is invaluable for converting recorded statements or depositions into precise written records.

Taming the Medical Records Beast

Here’s where many cases get bogged down. The medical documentation is, without a doubt, the most critical part of your evidence file—and it's almost always the most disorganized. Records tend to flood in from different providers as a chaotic mix of billing codes, doctor's notes, and imaging reports. Leaving them in that state is a rookie mistake.

Your job is to take that mountain of paper and turn it into a clean, chronological narrative of your client's medical journey. This means methodically arranging every document, from the first ER visit to the last physical therapy appointment. When an adjuster can easily trace the line from injury to treatment to prognosis, the credibility of your claim skyrockets.

A well-organized medical chronology does more than just list treatments. It demonstrates a clear causal link between the defendant's negligence and the resulting physical harm, making your damages difficult to dispute.

Organizing this file isn't just for your own sanity; it's a strategic weapon. You're making the adjuster's job easier, which removes any excuse they might have to delay or devalue the claim due to "missing" or "confusing" information. This preparation is non-negotiable. If you need a refresher on the best way to tackle this, our guide on how to organize medical records provides a great framework.

Translating Losses into a Defensible Dollar Figure

Calculating the true value of a personal injury claim is where a good demand letter becomes an irrefutable one. This isn’t just about adding up bills; it’s the art of translating every single aspect of your client’s loss—physical, financial, and emotional—into a clear and defensible dollar figure.

Remember, the adjuster’s job is to poke holes in your math. Your calculations have to be airtight. The final number is a two-part equation, and you have to get both parts right: the hard costs and the human costs. Giving short shrift to either one means leaving your client’s money on the table.

Tallying the Tangible Economic Damages

These are what we call "special damages"—the straightforward, out-of-pocket losses that have a clear paper trail. Every penny must be itemized and, more importantly, backed up by a document. This part of your demand should leave zero room for interpretation.

Make sure your checklist covers everything:

- All Medical Expenses: This is more than just the big surgery bills. Think ambulance rides, ER visits, physical therapy, prescriptions, and even the mileage your client racked up driving to and from doctor's appointments.

- Lost Income and Earning Capacity: You'll need pay stubs and a letter from the employer to document every dollar of lost wages. If the injuries are long-term and will impact your client's future earning ability, you’ll likely need a vocational expert's report to project that loss.

- Property Damage: This is usually the cost to repair or replace a vehicle, but don't forget other personal property destroyed in the incident, like a laptop, phone, or glasses.

- Out-of-Pocket Costs: Little things add up. Did your client need to hire household help or a babysitter during recovery? Did they have to pay for home modifications like a ramp or grab bars? Track it all.

This simple workflow is key to turning a mountain of receipts and records into a powerful financial argument that an adjuster can't ignore.

It really is that simple: gather the proof, organize it logically, and then use it to tell a compelling story that justifies your final number.

Assigning Value to Non-Economic Damages

Here’s where the real advocacy begins. "General damages" are meant to compensate your client for the immense human cost of their injury—the pain, the suffering, the emotional distress, and the complete disruption to their life. Because these losses are subjective, you can't just pull a number out of thin air. You need a logical, accepted method to quantify them.

An adjuster won't pay for pain and suffering based on emotional appeals alone. They respond to a logical calculation that connects the severity of the injury to the monetary demand.

The two most common methods for calculating these damages are the multiplier method and the per diem approach.

- The Multiplier Method: This is the industry standard. You total up all the economic damages and multiply that sum by a number, typically between 1.5 and 5. A minor sprain with a quick recovery might get a 1.5 multiplier. A catastrophic, life-altering injury could easily justify a multiplier of 5 or even higher.

- The Per Diem Approach: This method assigns a daily rate for your client’s pain and suffering, running from the date of the accident until they reach Maximum Medical Improvement (MMI). The daily rate is often tied to the client's daily earnings, based on the argument that enduring constant pain is at least as difficult as going to work for a day.

The financial stakes here are massive. In 2023 alone, 62 million people in the U.S. needed medical attention for injuries. The average cost for a single medically consulted workplace injury was $43,000, which underscores the huge economic burden these incidents create.

Choosing the right method and justifying your figure is crucial. For a much deeper dive into this, check out our guide on how to calculate pain and suffering damages. Your goal is to present a total demand figure that isn't just ambitious, but is logically derived and fully supported by the story of what your client has been through.

Crafting a Narrative That Persuades and Wins

You have all the pieces: the evidence is organized and the damages are calculated. Now, it’s time to put them together. The best demand letters don't just list facts and figures; they tell a compelling story that makes the insurance adjuster see your client as a person who has genuinely suffered, not just another claim number in a massive file.

This is where you connect the dots. You need to show the adjuster exactly how the defendant’s negligence turned your client’s life upside down. A persuasive narrative is assertive and built on a foundation of facts, but it’s also deeply personal. It’s the difference between stating, "the client broke her leg," and explaining how that fracture meant she couldn't pick up her toddler for three months, leaving her feeling helpless and disconnected.

Setting a Professional Tone from the Start

Your opening paragraph sets the stage for the entire negotiation. It needs to be professional, direct, and immediately command respect. State clearly who you represent, the date and nature of the incident, and that this letter is a formal demand for settlement under the at-fault party's insurance policy.

This is not the place for aggressive language or emotional accusations. Let the facts of the case do the talking. An adjuster is far more likely to engage with a logical, well-supported argument than one filled with angry, over-the-top rhetoric.

For example, instead of writing, “Your reckless client plowed into my client,” try a more measured, factual approach: “This letter concerns the collision on May 1st, 2024, caused by the failure of your insured, John Smith, to yield the right-of-way. This failure resulted in significant injuries to our client, Jane Doe.”

This approach immediately establishes you as a serious, professional advocate who is ready to argue the case on its merits.

Weaving Facts into a Compelling Story

The body of the letter is where your storytelling skills really shine. You need to walk the adjuster through a clear, chronological account of events, embedding your evidence at every key point.

The Incident: Describe precisely how the accident happened. Be sure to reference the police report number and quote any key findings that support your liability argument. Mention witness statements that back up your client's version of events.

The Immediate Aftermath: Paint a picture of the scene. Talk about the ambulance ride, the chaos of the emergency room, and the initial shock and pain your client felt. This section helps humanize the trauma.

The Medical Journey: This is the heart of the story. Don't just give them a list of medical treatments; narrate the recovery process. Explain the why behind each surgery, the grueling reality of physical therapy, and the specific medications needed just to manage the daily pain.

The most effective narratives seamlessly integrate medical records directly into the story. Instead of just attaching a bill, you can write, "As documented in Dr. Allen's report dated June 15th, the MRI confirmed a herniated disc at L4-L5, which directly corresponds to the debilitating back pain Ms. Doe has experienced since the collision."

This technique forces the adjuster to confront the evidence within the context of your client’s real-world suffering, making it much harder to dismiss or devalue.

AI Drafting Tools Are Changing the Game

Let's be honest: crafting this detailed narrative by hand is incredibly time-consuming. The personal injury legal market is a massive $61.7 billion industry, handling nearly 400,000 claims each year. This volume creates a huge bottleneck for firms. Manually reviewing hundreds of pages of medical records and drafting a comprehensive personal injury demand letter sample can easily burn through 10 hours of paralegal or attorney time per case.

This is where modern tools are making a real difference. AI-powered platforms can ingest a mountain of medical records, pull out the key data points, and generate a perfectly organized chronological first draft in minutes. This doesn't replace a lawyer's expertise—it amplifies it. By automating the administrative grind, you can focus your time on refining the legal arguments and polishing the human story at the heart of the claim. You can learn more about how these industry trends are shaping legal practice on gainservicing.com.

Closing with a Firm Demand for Action

Your closing needs to be just as strong and clear as your opening. Start by summarizing the total economic and non-economic damages you calculated earlier, arriving at a single, specific monetary demand.

It’s standard practice to set a deadline for a response—typically 30 days. This creates a sense of urgency and keeps the process moving. You should conclude by stating that you are prepared to file a lawsuit if a fair settlement cannot be reached within that timeframe. This isn’t a threat; it’s a professional statement of intent, showing you are serious about protecting your client's rights.

Annotated Personal Injury Demand Letter Samples

Theory is one thing, but seeing how it works in practice is what really makes it click. So, let's move from concepts to concrete examples with two complete, annotated personal injury demand letter samples. These aren't just generic templates; they're practical illustrations designed to show you exactly how all the pieces fit together to build a persuasive argument for a fair settlement.

We'll break down each sample to explain the strategic thinking behind the language, the structure, and how the evidence is presented. The goal here is to give you an inside look at how a compelling letter is really constructed, piece by piece.

Sample 1: The "Straightforward" Soft Tissue Car Accident

Our first example is a bread-and-butter case for any PI firm: a rear-end collision that caused whiplash and other soft tissue injuries. While these cases might seem simple on the surface, they're often where adjusters push hardest to minimize payouts. That's why a strong narrative and crystal-clear documentation are absolutely essential.

[Your Law Firm Letterhead]

Date: [Date]

To: [Insurance Adjuster Name] [Insurance Company Name] [Insurance Company Address]

RE: Claim for Jane Doe Insured: John Smith Claim Number: [Claim Number] Date of Loss: May 1, 2024

FOR SETTLEMENT PURPOSES ONLY

Dear [Mr./Ms. Adjuster Name],

Annotation: Your opening needs to be direct and professional. Always include "FOR SETTLEMENT PURPOSES ONLY" right at the top. This is standard practice that prevents the letter from being used as an admission of liability in court if settlement talks break down.

As you are aware, our firm represents Jane Doe for the injuries she sustained due to the negligence of your insured, John Smith, on the date referenced above. This letter constitutes our formal demand for settlement. The evidence unequivocally shows that your insured’s complete failure to pay attention was the sole cause of this collision and the painful injuries Ms. Doe has had to endure.

How the Collision Happened

On May 1, 2024, around 3:15 PM, Ms. Doe was lawfully stopped in traffic on Elm Street near the Oak Avenue intersection. Without warning, your insured, John Smith, failed to stop his vehicle and crashed violently into the rear of Ms. Doe’s car. The Police Report (No. 24-12345), which is attached as Exhibit A, confirms Ms. Doe’s vehicle was stationary and places your insured entirely at fault for the incident.

Injuries and Medical Treatment

The force of the impact subjected Ms. Doe to acute cervical and lumbar strain—classic whiplash. She was transported by ambulance from the scene to City General Hospital for immediate care. Her full medical journey is documented in the records attached as Exhibit B and included the following:

- City General Hospital (May 1, 2024): Diagnosed with cervical strain, prescribed muscle relaxants, and advised to follow up with her primary care physician.

- Dr. Susan Jones (May 3, 2024): Confirmed the whiplash diagnosis after Ms. Doe's pain and stiffness persisted, referring her for a course of physical therapy.

- Oak Physical Therapy (May 6 - July 1, 2024): Ms. Doe attended 16 sessions of physical therapy over eight weeks, working to restore her range of motion and manage her pain.

After completing her treatment plan, Ms. Doe was released from care on July 1, 2024, having reached Maximum Medical Improvement (MMI).

Sample 2: The More Serious Slip and Fall with a Fracture

This next demand letter sample digs into a more complex premises liability case. Here, the client suffered a fractured wrist after slipping on a wet floor in a grocery store. This type of injury immediately brings future damages and permanent impairment into the conversation, justifying a much higher demand.

[Your Law Firm Letterhead]

Date: [Date]

To: [Claims Adjuster Name] [Insurance Company Name] [Insurance Company Address]

RE: Claim for Robert Chen Insured: SuperMart Grocers, Inc. Claim Number: [Claim Number] Date of Loss: June 15, 2024

FOR SETTLEMENT PURPOSES ONLY

Dear [Mr./Ms. Adjuster Name],

This letter is a formal demand to settle the claim of Robert Chen for the severe injuries he suffered at the SuperMart Grocers located at 123 Main Street. Your insured's failure to maintain a safe environment for its customers directly caused Mr. Chen to fall and sustain a serious wrist fracture that required surgical intervention.

Liability Is Clear

On June 15, 2024, at about 10:00 AM, Mr. Chen was walking down Aisle 5 when he slipped on a large, unmarked puddle of clear liquid. There were absolutely no "wet floor" signs or other warnings to alert shoppers to this obvious hazard. A witness statement from one of the store's own employees, included in the incident report (attached as Exhibit A), confirms the spill had been on the floor for at least 20 minutes before Mr. Chen fell. This is a textbook example of a breached duty of care.

Injuries and Damages

As a direct result of the fall, Mr. Chen sustained a comminuted fracture of his right distal radius. His injury was severe enough to require an open reduction and internal fixation surgery, during which a plate and screws were permanently installed in his wrist.

His economic damages are calculated as follows:

- Medical Bills: $28,500.00

- Lost Wages: $6,200.00 (missed 8 weeks of work)

- Total Economic Damages: $34,700.00

Beyond the numbers, Mr. Chen’s orthopedic surgeon, Dr. Evans, notes in his final report (see Exhibit C) that he will likely carry a 10% permanent impairment rating to his dominant right hand. Dr. Evans also anticipates a high probability of post-traumatic arthritis, which could require additional medical care in the future.

Annotation: When dealing with complex injuries like this, it's crucial to spotlight any permanent impairment rating and the potential for future medical issues. This is your leverage. It justifies a much higher multiplier for pain and suffering and firmly plants the concept of future damages into the negotiation from the very beginning.

Settlement Demand

Based on your insured's clear liability and the significant, permanent nature of Mr. Chen’s injury, we hereby demand $145,000.00 to fully and finally resolve this claim. We look forward to your response within the next 30 days.

Frequently Asked Questions About Demand Letters

Crafting a powerful demand letter is part strategy, part art. It's perfectly normal to have questions about the finer points of the process. I've gathered some of the most common questions I've heard over the years to help you sharpen your approach and sidestep some frequent missteps.

Let's dive into what you need to know.

What Are the Biggest Mistakes to Avoid?

The most costly errors usually happen before a single word is written. The biggest one? Sending a demand before your client has reached Maximum Medical Improvement (MMI). If you do that, you're just guessing at future medical needs and you risk leaving a huge amount of money on the table.

Another all-too-common mistake is getting emotional or aggressive in your tone. Insurance adjusters are professionals; they're trained to see right through angry rhetoric. They respond to a calm, methodical presentation of the facts. Let your evidence do the talking for you.

The fastest way to get your demand letter tossed into the low-ball pile is to include a settlement figure that seems like it was pulled out of thin air. You absolutely have to show your work. Failing to provide a clear, logical breakdown of how you arrived at your number—especially for non-economic damages—is just asking for a fight.

Finally, don't fall into the template trap. A generic, one-size-fits-all letter screams that you haven't put much effort in, and it immediately devalues the claim in the adjuster's eyes. Every case has a unique human story, and your letter needs to tell it.

How Long Should I Expect to Wait for a Response?

In my experience, you should generally expect to hear something back within 30 to 60 days. It’s standard practice—and a good idea—to state a clear response deadline in your letter. Thirty days is the typical ask.

This gives the adjuster enough runway to do their job: review your evidence, evaluate their insured's liability, and get the internal authority they need to make a legitimate offer. It's a professional courtesy that also keeps the case moving.

What if your deadline comes and goes with radio silence? It's time to pick up the phone. A firm, professional follow-up call is the next step. Reiterate your demand and make it clear that you're prepared to file a lawsuit if a serious settlement discussion doesn't start right away. That usually gets their attention.

Can AI Really Write a Good Demand Letter?

The best way to think about AI is not as a lawyer replacement, but as the most efficient paralegal you've ever had. An AI-powered tool is brilliant at handling the most tedious, time-consuming parts of drafting.

For example, it can plow through hundreds of pages of medical records, organize a perfect treatment timeline, and spit out a data-rich first draft of a personal injury demand letter sample in minutes. We're talking about saving 10+ hours of manual work on a single case.

But the final strategic calls? That's still all you. Your expertise is irreplaceable for:

- Telling the story: Weaving the facts into a compelling human narrative.

- Applying the law: Crafting legal arguments based on statutes and case law.

- Setting the number: Using your judgment to land on the right settlement anchor.

- Guiding the strategy: Making the final call on when to push and when to hold.

AI builds the factual skeleton of the case; you're the one who gives it a mind and a voice. It handles the "what" so you can focus on the "why."

Should I Ever Just File a Lawsuit Instead?

While a demand letter is the right first move in over 95% of PI cases, there are a few scenarios where it makes more strategic sense to head straight to the courthouse.

The most obvious reason is a looming statute of limitations. If you're up against that deadline, filing the suit is the only way to preserve your client's right to recovery. Another clear case is when liability is a complete non-starter for the other side, and you know you'll need formal discovery to prove your claim.

Finally, if you're up against a carrier with a known reputation for bad-faith dealings or stonewalling, filing a lawsuit immediately gives you leverage a letter just can't. The formal deadlines and structure of litigation force them to the table. For almost every other claim, though, the demand letter is still the quickest and most cost-effective route to a fair settlement.

Ready to eliminate the tedious hours spent on medical records and demand letter drafts? Ares provides an AI-powered platform that transforms chaotic case files into clear, settlement-ready narratives in minutes. Stop drowning in paperwork and start focusing on strategy. Claim bigger and settle faster by visiting the Ares website to see how it works.