Personal injury demand letter example: Proven tips for a strong claim

A well-written personal injury demand letter is far more than just a form you fill out—it’s your opening argument. This is the document that frames the entire conversation with the insurance adjuster, laying the groundwork for negotiations and, in many cases, helping you avoid a long, drawn-out court battle.

Why Your Demand Letter Is Your Most Powerful Tool

Think of your demand letter as the complete blueprint for your settlement. It’s your first real chance to tell your client’s story, prove the other party’s fault beyond a doubt, and lay out exactly what they’re owed. A truly compelling letter can often lead to a fair settlement without ever having to file a lawsuit.

This document really does a few critical things right from the start:

- It Sets a Professional Tone: A polished, fact-driven letter immediately signals to the insurance company that you mean business and are fully prepared to take the case further if they don’t come to the table with a reasonable offer.

- It Creates the Official Record: This is where you formally document every aspect of the claim—the facts of the incident, the full scope of the injuries, and all the financial and personal losses that followed.

- It Kicks Off Negotiations: The demand letter is the official starting pistol for settlement talks. It presents your side of the story in a structured way that adjusters are trained to respond to.

The Foundation of Every Settlement

You really can't overstate the importance of this document. An overwhelming majority of personal injury cases—over 95%—settle before they ever see a trial. That makes the demand letter the single most important tool for securing compensation. It’s the primary engine driving recovery in the massive $50+ billion personal injury market here in the U.S.

A demand letter isn't just a request for a check. It’s a carefully built argument designed to convince an insurance adjuster that settling with you now is a much smarter, more cost-effective decision than facing you in court later.

In short, it gives the insurance company a full picture of their risk. When they see a strong letter backed by solid evidence, it becomes much harder for them to justify denying the claim or lowballing their offer. Understanding what is a demand letter is the first step, and the sections that follow will break down exactly how to build one.

Here's a quick look at the essential parts we'll be covering.

Core Components of a Persuasive Demand Letter

| Component | Its Strategic Purpose |

|---|---|

| Statement of Facts | Establishes a clear, undisputed narrative of what happened. |

| Liability Analysis | Proves why the insured party is legally at fault for the incident. |

| Damages Breakdown | Details all economic (specials) and non-economic (general) losses. |

| Medical Chronology | Summarizes the injury journey from the incident through treatment and recovery. |

| The Demand | Presents a specific, justified monetary figure for settlement. |

| Supporting Exhibits | Provides the hard evidence (bills, records, photos) to back up every claim. |

Each of these sections plays a specific role in building a case that is too compelling for an adjuster to ignore. Now, let’s get into how to draft each one.

Building the Anatomy of an Effective Demand Letter

A great personal injury demand letter isn’t just a random assortment of facts and numbers. It’s a carefully constructed, persuasive argument. Think of it as building your case brick by brick, where each section logically supports the next, guiding the insurance adjuster to the only reasonable conclusion: settling is their best move.

To draft a letter that truly commands attention, you have to break it down into its core parts. Every component has a distinct strategic purpose, from painting a clear picture of what happened to justifying every single dollar you're demanding. If you need a solid starting point, a proven demand letter template can provide an excellent framework to build upon.

Let's dissect the anatomy of a demand letter that gets results.

This flow chart visualizes the three pillars of a powerful demand letter: telling the story, proving liability, and making your formal request for resolution.

This visual really hammers home the sequence. A clear story of the facts directly supports the legal conclusion of who was at fault, which, in turn, justifies the financial demand you're making.

Crafting a Compelling Factual Narrative

This is where you tell the story. Your goal here is to provide a clean, chronological account of the incident itself. Keep it objective and stick to the facts—this isn't the place for emotional language or accusations.

Your narrative absolutely must answer the essential questions:

- Who was involved?

- What happened, step-by-step?

- Where did it all go down?

- When did it occur (date and time)?

This isn't just a simple summary. It’s about framing the events in a way that naturally leads to the conclusion that the other party was negligent. By presenting an easy-to-follow, logical sequence, you make it much harder for an adjuster to poke holes in your client's story or misinterpret the facts.

Firmly Establishing Liability

Once you've laid out what happened, it's time to connect the dots legally. The liability section is where you explain why the insured is responsible for your client's injuries. This is where the letter shifts from pure storytelling to sharp legal analysis.

Here, you need to articulate the other party’s duty of care—for instance, a driver's duty to obey traffic laws or a store owner's duty to maintain a safe floor. Next, you explain precisely how they breached that duty with their negligent actions. Finally, you have to draw a straight line from that breach to your client's injuries, establishing causation.

The liability section is the legal backbone of your demand. It transforms the letter from a simple complaint into a formal claim, showing the adjuster you grasp the legal principles at play and are ready to prove them.

Detailing Your Damages and Losses

This is where you put a number on the impact this incident has had on your client's life. Damages are broken down into two main categories, and organizing them this way makes your claim crystal clear for the adjuster to follow.

1. Economic Damages (Special Damages)

These are the tangible, calculable financial losses your client has suffered. They have a specific dollar value backed up by bills, receipts, and pay stubs. These include:

- All medical bills (ambulance, ER, hospital stays, follow-up visits, physical therapy, prescriptions)

- Lost wages from time off work

- Future lost earning capacity if their ability to work is permanently impacted

- Property damage, like vehicle repair or replacement costs

- Other out-of-pocket expenses, such as transportation to medical appointments

2. Non-Economic Damages (General Damages)

These are the intangible losses that don't come with a neat price tag but are just as real and devastating. This category covers the immense human cost of the injury:

- Pain and suffering

- Emotional distress and mental anguish

- Loss of enjoyment of life

- Permanent disability or disfigurement

Calculating non-economic damages is certainly more subjective, but it's a vital part of any serious personal injury claim. It forces the insurer to acknowledge that the harm done goes far beyond what shows up on a bank statement. The final step, of course, is to present a clear, justified monetary demand that covers all of these documented losses.

Seeing Personal Injury Demand Letters in Action

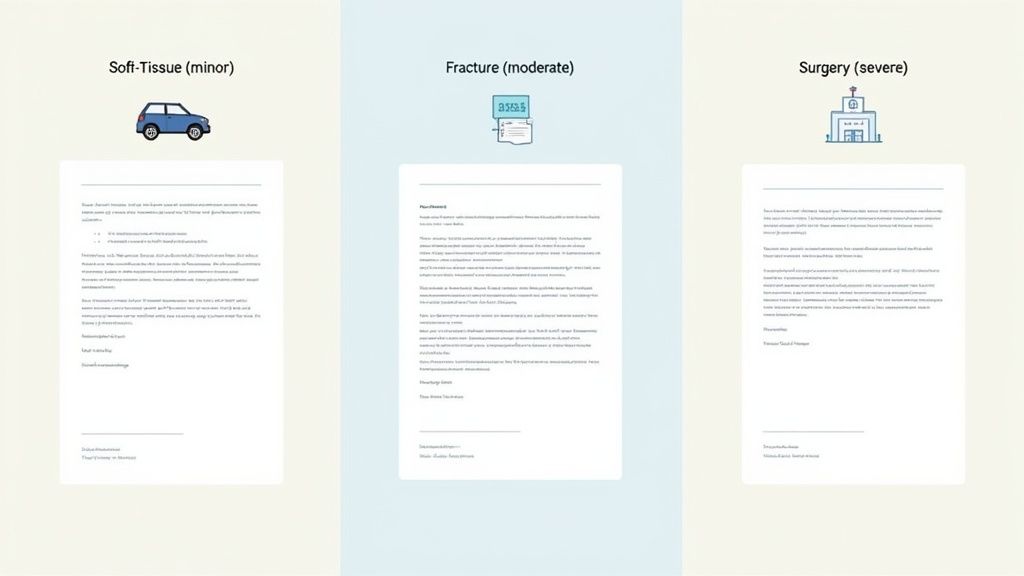

Knowing the essential parts of a demand letter is one thing, but seeing how they come together in a real case is where the rubber meets the road. A personal injury demand letter example for a minor fender-bender should look and feel completely different from one for a career-ending injury. The tone, the amount of detail, and of course, the final number—it all scales with the severity of the case.

To make this crystal clear, let's walk through three distinct, annotated examples. You’ll see exactly how the story, the liability argument, and the settlement demand are molded by the unique facts of each scenario. Think of these as proven blueprints that show the strategic thinking behind every single word.

Before diving into the full examples, it's helpful to see a high-level comparison of how the core components of a demand letter shift based on the case's severity.

How Injury Severity Shapes Your Demand Letter

| Element | Minor Injury (Soft Tissue) | Moderate Injury (Fracture) | Severe Injury (Surgery) |

|---|---|---|---|

| Tone | Firm, professional, straightforward. | Assertive, detailed, legally grounded. | Authoritative, urgent, non-negotiable on key facts. |

| Liability | Brief and factual, often citing a police report. | More detailed, using legal terms like "breach of duty." May mention witnesses. | Overwhelming, citing multiple sources (police, witnesses, regulations). |

| Medical Narrative | Concise summary of diagnosis and treatment (e.g., ER visit, physical therapy). | More descriptive, naming specific diagnoses (e.g., "distal radius fracture") and procedures. | Highly detailed, outlining the entire medical journey, including failed treatments and surgical reports. |

| Damages | Simple list of medical bills and maybe a few days of lost wages. | Includes more complex damages like extended lost wages and the cost of specialized therapy. | Extensive, including future medical costs, expert reports on lost earning capacity, and life care plans. |

| Demand Amount | Primarily based on a multiple of medical bills (e.g., 2-3x). | Based on a higher multiple (e.g., 3-5x) plus significant pain and suffering. | Often approaches or demands the full policy limits, supported by extensive documentation. |

This table illustrates a key principle: your demand letter isn't a static document. It's a dynamic tool that must be carefully calibrated to the weight of the case you're presenting. Now, let's see this in practice.

Example 1: Minor Injury Car Accident

Our first personal injury demand letter example covers a very common scenario: a rear-end collision that leads to soft-tissue injuries like whiplash. The goal here is to be clear, professional, and to present the straightforward damages without unnecessary drama. The tone is firm but reasonable, reflecting a lower-value claim where a direct path to settlement is expected.

[Your Name/Law Firm Name]

[Your Address]

[City, State, ZIP]

[Phone Number]

[Email Address]

[Date]

[Claims Adjuster Name]

[Insurance Company Name]

[Insurance Company Address]

[City, State, ZIP]

FOR SETTLEMENT PURPOSES ONLY

RE: Claim Number: [Claim Number]

Insured: [At-Fault Driver’s Name]

Claimant: [Your Client’s Name]

Date of Loss: [Date of Accident]

Dear Mr./Ms. [Adjuster’s Last Name],

As you know, our firm represents [Client’s Name] for injuries he suffered in a car crash on [Date of Accident]. This collision was caused entirely by the negligence of your insured, [At-Fault Driver’s Name]. This letter is our formal demand to settle this claim.

Facts of the Incident

On [Date of Accident] around [Time], my client was stopped at a red light at the intersection of [Street Name] and [Street Name] here in [City]. Without warning, your insured failed to stop and slammed into the back of my client's car. The impact was violent enough to whip my client’s head forward and backward. The enclosed police report ([Report Number]) confirms your insured was cited for following too closely.

Expert Callout: Notice how direct and factual this is. By immediately citing the police report and the traffic ticket, we establish clear liability and give the adjuster very little room to argue about who was at fault.

Injuries and Medical Treatment

As a direct result of the crash, [Client’s Name] suffered an acute cervical and lumbar sprain—whiplash. He went to [Urgent Care/ER Name] for immediate medical care, where he was diagnosed and given prescriptions for muscle relaxants and anti-inflammatory medication.

To address the persistent neck and back pain, my client then completed a six-week course of physical therapy at [Physical Therapy Clinic Name]. This treatment was crucial for restoring his range of motion and was a necessary consequence of the collision your insured caused.

Expert Callout: The medical story here is chronological and to the point. For a minor case like this, a clean summary is much more powerful than a long, drawn-out explanation. The goal is to clearly link the treatment back to the incident.

Damages Breakdown

My client's economic damages are as follows:

- Emergency Room Visit: $1,250.00

- Physical Therapy (12 sessions): $1,800.00

- Prescription Medications: $85.00

- Lost Wages (2 days off work): $400.00

Total Economic Damages: $3,535.00

On top of these financial losses, [Client’s Name] dealt with significant pain and discomfort for weeks. It disrupted his daily routine, made it hard to sleep, and took a real toll on his quality of life.

Demand for Settlement

Based on your insured’s clear liability and the documented damages, we demand the sum of $9,500.00 to resolve this claim.

We expect a response to this demand within 30 days. If we don’t hear from you, we will have no choice but to file a lawsuit to protect our client’s rights.

Sincerely,

[Your Name/Attorney Name]

Example 2: Moderate Injury Slip and Fall

This next personal injury demand letter example steps up the complexity. It involves a slip-and-fall on a commercial property that resulted in a fracture. The liability argument needs to be more thorough, and the damages for pain and suffering are justifiably higher because the recovery was longer and the impact on our client's life was much greater.

[Your Name/Law Firm Name]

[Your Address]

[Date]

[Claims Adjuster Name]

[Insurance Company Name]

FOR SETTLEMENT PURPOSES ONLY

RE: Claim Number: [Claim Number]

Insured: [Store Name]

Claimant: [Your Client’s Name]

Date of Loss: [Date of Incident]

Dear Mr./Ms. [Adjuster’s Last Name],

This letter is a formal demand for settlement for my client, [Client’s Name]. She was seriously injured on [Date of Incident] because of a dangerous condition at your insured’s store, [Store Name], located at [Store Address].

Liability of Your Insured

On that day, my client was shopping at [Store Name]. As she walked down Aisle 5, she slipped in a large, unmarked puddle of clear liquid from a leaking refrigeration unit. There were no "wet floor" signs, cones, or any warnings to alert customers to the hazard. Your insured had a clear duty to keep its premises safe for shoppers. It breached that duty by failing to clean the spill or warn customers about it in a reasonable time. This negligence was the direct and proximate cause of my client's injuries. We have a statement from another shopper who saw her fall and has confirmed there were no warning signs.

Expert Callout: Here, we use stronger legal language—"duty," "breached," "proximate cause." We also immediately mention a witness. This tells the adjuster that we have corroborating evidence ready to go, making it much harder for them to deny the claim.

Injuries and Medical Treatment

The fall caused Ms. [Client’s Last Name] to suffer a displaced fracture of her left wrist (a distal radius fracture). An ambulance took her to [Hospital Name], where X-rays confirmed the break. An orthopedic surgeon had to perform a closed reduction to set the bone before putting her arm in a cast for eight weeks.

After the cast came off, Ms. [Client’s Last Name] needed three months of occupational therapy to get back basic strength and function in her hand. To this day, she still deals with stiffness and aching pain when the weather gets cold.

Expert Callout: For a moderate injury, the description gets more specific. We name the exact type of fracture and the procedure ("closed reduction") to underscore the seriousness of the injury beyond just a simple "broken bone."

Damages and Impact on Life

The economic damages in this matter are significant:

- Ambulance Transport: $900.00

- Hospital Emergency Services: $3,400.00

- Orthopedic Surgeon Fees: $2,500.00

- Occupational Therapy: $4,200.00

- Lost Wages (Unable to work as a graphic designer): $6,000.00

Total Economic Damages: $17,000.00

But the numbers don't tell the whole story. Ms. [Client’s Last Name] endured tremendous pain and a major loss of enjoyment of life. For two months, she couldn't drive, cook for herself, or even manage basic personal care without help. That loss of independence was frustrating and caused her real emotional distress.

An injury like a broken wrist isn't just a medical event; it's a complete disruption of a person's independence. This loss of autonomy is a core component of non-economic damages and must be clearly articulated.

Demand for Settlement

Given your insured's clear negligence and the substantial harm Ms. [Client’s Last Name] has suffered, we hereby demand $65,000.00 to settle this matter in full. We look forward to your response within the next 30 days.

Sincerely,

[Your Name/Attorney Name]

Example 3: Severe Injury Requiring Surgery

Our final personal injury demand letter example is for a high-stakes case involving a severe injury that led to major surgery. This letter is longer, the medical details are much more granular, and we introduce the very real possibility of future medical expenses. The tone is authoritative and leaves no doubt about the gravity of the claim.

The stakes in these cases are completely different. These are the kinds of claims that drive the market where average settlements can hit $52,900, with outcomes ranging from $3,000 to over $75,000. But the hard truth is that nearly 30% of claimants get nothing, often because their initial demand wasn't backed by a powerful, evidence-based letter like the one below. You can find more insights about these personal injury claim statistics.

[Your Law Firm Name]

[Your Address]

[Date]

[Senior Claims Adjuster Name]

[Insurance Company Name]

FOR SETTLEMENT PURPOSES ONLY

RE: Claim Number: [Claim Number]

Insured: [Trucking Company Name]

Claimant: [Your Client’s Name]

Date of Loss: [Date of Accident]

Dear Mr./Ms. [Adjuster’s Last Name],

This firm represents [Client’s Name] in connection with the catastrophic injuries he sustained on [Date of Accident]. His injuries were caused by the reckless actions of a driver employed by your insured, [Trucking Company Name]. This demand will outline the indisputable liability and the profound, permanent damages my client has been forced to endure.

Factual Background and Undisputed Liability

On the morning of [Date of Accident], Mr. [Client’s Last Name] was driving northbound on [Highway Name]. A tractor-trailer owned by your insured and operated by [Driver’s Name] made a sudden, illegal lane change directly into his path, forcing his vehicle off the road and into a guardrail. Eyewitnesses and the official police report both confirm your insured's driver was operating the truck erratically moments before the crash. To make matters worse, a post-accident investigation revealed the driver had violated federal hours-of-service regulations. The liability of your insured is unequivocal.

Expert Callout: In a severe case, you build an ironclad liability argument with multiple layers of proof: eyewitnesses, the police report, and regulatory violations. This puts immense pressure on the insurance company to accept full responsibility.

Devastating Injuries and Extensive Medical Journey

The collision left Mr. [Client’s Last Name] with a complex herniated disc at the L4-L5 level of his spine. Before resorting to surgery, he exhausted all conservative treatment options. He underwent a series of painful epidural steroid injections and committed to months of physical therapy, but nothing could stop the debilitating back pain and sciatica radiating down his leg.

As a result, on [Date of Surgery], Mr. [Client’s Last Name] had no choice but to undergo a lumbar microdiscectomy, performed by Dr. [Surgeon’s Name] at [Hospital Name]. While the surgery provided some relief, his doctors have confirmed that he will have permanent lifting restrictions and will likely need ongoing pain management for the rest of his life. There is also a significant probability he will need a future fusion surgery.

Expert Callout: This section paints a full picture of the treatment journey, highlighting the failed conservative care to justify why surgery was a last resort. Critically, it introduces permanent impairment and the need for future medical care—two factors that dramatically increase a claim's value.

Quantification of Damages

The financial and personal cost to Mr. [Client’s Last Name] has been staggering.

- Ambulance and Initial Hospitalization: $18,500.00

- Spinal Surgeon Fees: $25,000.00

- Anesthesiologist Fees: $6,000.00

- Hospital Facility Charges for Surgery: $45,000.00

- Post-Surgical Physical Therapy: $9,500.00

- Pain Management (past and projected): $15,000.00

- Lost Wages to Date: $28,000.00

- Future Lost Earning Capacity (Vocational Expert Report Attached): $250,000.00

Total Special Damages: $397,000.00

This single event has permanently changed my client's life. He was an active father who can no longer coach his son’s baseball team or enjoy the outdoor activities he once loved. His chronic pain has led to a battle with depression and anxiety, casting a shadow over every part of his life.

Settlement Demand

In light of the egregious negligence of your insured’s driver and the permanent, life-altering injuries suffered by Mr. [Client’s Last Name], we demand the policy limits of $1,000,000.00 to resolve this claim.

Please ensure this demand is forwarded to the appropriate decision-makers for their immediate evaluation. We expect a substantive response within 21 days.

Sincerely,

[Senior Attorney Name]

Assembling Your Evidence and Supporting Documents

A demand letter without proof is just an opinion. To an insurance adjuster, your claims are nothing more than words on a page until you back them up with hard evidence. Think of this stage as building an airtight case file—a professional, organized package of exhibits that validates every single assertion you make.

This collection of documents is what transforms your client's story into a factual record. Each piece of evidence serves a specific, strategic purpose, systematically shutting down any room for doubt and compelling the insurer to recognize the true extent of the damages.

The Core Evidence Checklist

Your goal here is to create an appendix of exhibits that the adjuster can flip through to instantly verify your claims. A messy pile of papers screams disorganization. A well-structured file, on the other hand, quietly communicates that you’re prepared to litigate if necessary.

Your essential evidence package must include:

- The Official Police or Incident Report: This is ground zero for establishing liability. It’s an objective, third-party account of what happened and often includes an initial determination of fault.

- Photographs and Videos: Never underestimate the power of visual evidence. You need clear photos of the accident scene, any property damage, and of course, the visible injuries—bruises, cuts, casts, you name it. Photos showing the healing process over time can also paint a powerful picture.

- Medical Records and Bills: This is the bedrock of your damages claim. Collect every single document related to the injury: ambulance reports, ER records, hospital discharge summaries, doctors' notes, physical therapy logs, and even prescription receipts.

- Proof of Lost Wages: You must clearly document any income your client lost because of the injury. The standard here is a letter from your client’s employer, on company letterhead, confirming their pay rate and the exact dates they were unable to work.

Documenting Your Medical Journey

The mountain of medical paperwork in even a minor case can be overwhelming. The National Safety Council reports that 62 million Americans seek medical attention for injuries each year, which gives you a sense of how much documentation a single case can produce. For an adjuster sifting through some of the nearly 400,000 personal injury claims filed annually, a clear, chronological presentation isn't just helpful—it's essential.

For a systematic approach, see our guide on how to organize medical records: https://areslegal.ai/blog/how-to-organize-medical-records.

Your evidence file should tell a complete story on its own. An adjuster should be able to look at your exhibits and understand the accident, the injuries, and the financial impact without having to question the validity of your claims.

One final, critical point: if any of your documents are not in English, you must have them professionally translated. To ensure they're accepted without issue, look into the specific certified and notarized translation requirements. This isn’t a step you can skip; it ensures your evidence meets the legal standards for credibility and gives the adjuster no excuse to dismiss it.

Common Mistakes That Weaken Your Demand Letter

Crafting a powerful personal injury demand letter is as much about avoiding pitfalls as it is about including the right information. Certain missteps can instantly tank your credibility with an insurance adjuster, signaling that you're either inexperienced or that your claim rests on shaky ground. Steering clear of these common errors is critical to keeping the upper hand.

One of the most frequent mistakes is getting overly emotional or aggressive. Your client's experience is, of course, frustrating and painful, but the demand letter is a business document—not a personal vent. Its power comes from cold, hard facts, solid evidence, and clear legal reasoning, not from angry accusations or dramatic storytelling.

An adjuster reads hundreds of these letters. They're trained to see right through emotional appeals. A professional, fact-based tone commands respect and shows you’re ready to argue the case on its merits, which is a far more effective way to negotiate.

By learning what not to do, you ensure your message comes across as a serious legal claim, not an unprofessional complaint.

Exaggerating Claims and Ignoring Weaknesses

Another classic blunder is puffing up the facts or making claims you can't back up with evidence. If you write that your client suffers from "debilitating, constant pain" but the medical records show a minor sprain and just two weeks of physical therapy, you've just lost all credibility. Adjusters are experts at spotting these gaps, and once they find one, they’ll start scrutinizing everything else in your letter.

Along those same lines, pretending weaknesses in your case don't exist is a losing strategy. If your client was partially at fault—say, they were texting when the collision happened—ignoring this is just naive. Trust me, the insurance company already knows about it.

- What to Avoid: Blanket statements like "my client's life is ruined" without providing specific, documented examples of how their life has actually changed.

- What to Do Instead: Address any comparative negligence head-on. Acknowledge it briefly, then pivot to explain why their insured’s liability is still the overwhelming cause of the injuries. This shows you’re a realistic and serious negotiator, not someone who can be easily dismissed.

Demanding an Unrealistic Settlement Amount

Finally, pulling a settlement figure out of thin air is a rookie move that can shut down negotiations before they even start. Demanding $500,000 for a soft-tissue injury with $5,000 in medical bills tells the adjuster you don't understand how claims are valued. It doesn't make you look like a tough negotiator; it makes you look uninformed.

Your demand has to be anchored in reality and tied directly to the documented damages. This includes both the hard numbers (economic damages like medical bills and lost wages) and a justifiable calculation for pain and suffering (non-economic damages). A well-reasoned demand, even if it's on the higher end of what's reasonable, is always more effective than an astronomical number with no logic behind it. As you can see in each personal injury demand letter example we've provided, the final figure is a direct result of the evidence presented.

Using Modern Tools to Draft a Stronger Letter

Let's be honest: manually digging through a mountain of medical records to piece together a demand letter is a grind. It’s slow, tedious work that eats up hours you could be spending on higher-level strategy. Today, modern tools can act as a powerful legal assistant, helping you organize the facts, calculate the damages, and draft a much stronger, data-driven letter in a fraction of the time.

Specialized software can dive into those dense medical files and instantly pull out the crucial details—diagnoses, treatment dates, provider names, and billing codes. This completely automates the painful process of building a medical chronology, making sure no critical detail gets missed. The goal here isn't to replace you; it's to get the clerical work off your plate so you can focus on building the case.

Technology is not about replacing professional judgment; it's about enhancing it. By automating the extraction of facts, these tools free you up to build a stronger, more persuasive narrative based on a foundation of perfect accuracy.

Making the Drafting Process More Efficient

The single biggest win here is efficiency. Think about it: instead of spending hours flipping between documents, you can get a neatly structured summary in minutes. This is a game-changer for complex cases involving multiple providers and a long, complicated treatment history.

These platforms can help in a few key ways:

- Medical Chronology: Instantly arranges every appointment, procedure, and diagnosis into a clear, easy-to-follow timeline.

- Damage Calculation: Automatically adds up all medical bills and helps you calculate lost wages with precision.

- Draft Generation: Creates a solid first draft of your demand letter, pre-populated with all the key facts pulled directly from the records.

Tools built with artificial intelligence are particularly good at speeding up this workflow. You can learn more about the specific applications of AI for personal injury lawyers and see how it’s helping firms put together more accurate demands, faster.

This approach ensures your letter is built on a rock-solid foundation of verifiable evidence, which puts you in a much stronger negotiating position right from the start.

Common Questions About Demand Letters

As you dive into the personal injury claim process, a lot of questions are bound to pop up. Here are some straightforward answers to the most common queries we see from attorneys and paralegals preparing to draft and send a demand letter.

When Is the Right Time to Send a Demand Letter?

This is all about strategy. You should never, ever send a demand letter until your client has reached what's known as Maximum Medical Improvement (MMI). In simple terms, this is the point where they are as "healed" as they're going to get.

Why wait? If you send it too early, you're flying blind. You won't have a complete picture of the medical expenses, the need for future care, or whether the injury is permanent. Holding off until MMI ensures your demand is built on a solid foundation of all past, present, and future damages. It’s the only way to walk into negotiations from a position of strength.

What Should I Expect After Sending the Letter?

Once the letter is sent, the waiting game begins. The insurance company will assign an adjuster to review every detail of the claim, from your medical chronology to the police report. This can take anywhere from a few weeks to a couple of months, so don't be alarmed by the initial silence.

A slow response doesn't mean they're ignoring you. The adjuster is carefully calculating their risk and dissecting your arguments before they ever pick up the phone.

The first response is almost never an acceptance of your demand. Instead, prepare for one of three things:

- A request for more information or clarification.

- A flat-out denial of the claim (this is often just a hardball negotiation tactic).

- A counteroffer, which will likely be far below what you demanded.

That first counteroffer is your signal—the negotiation has officially started.

Can I Write This Letter Without a Lawyer?

Technically, yes, for a minor fender-bender with a few scrapes. But should you? For anything involving serious injuries, complex liability, or significant medical bills, going it alone is a huge gamble.

Insurance adjusters negotiate for a living; their job is to pay out as little as possible. A seasoned personal injury lawyer knows the playbook. They understand how to accurately value a claim, dismantle lowball offers, and use the real threat of a lawsuit to bring the adjuster to a fair number. Without that expertise, you’re almost guaranteed to leave money on the table.

Ready to draft stronger demand letters in a fraction of the time? Ares automates the tedious work of medical record review, turning hundreds of pages into a clear, actionable summary. See how our AI-powered platform can help your firm settle faster and claim bigger. Learn more about Ares Legal.