A Winning Example Demand Letter for Personal Injury

A strong example demand letter for personal injury is much more than a simple list of facts. It's a strategic tool, your opening argument to the insurance adjuster. Get it right, and you set the tone for the entire negotiation, framing the narrative of your case from day one.

Why a Strong Demand Letter is Your Most Powerful Tool

Before a lawsuit is even a remote consideration, a well-crafted demand letter can unlock a favorable settlement. It’s the document that officially kicks off negotiations, detailing the incident, the extent of your client's damages, and the compensation you're demanding. This is your best, and often only, chance to make a compelling case directly to the person holding the purse strings.

A persuasive letter doesn't just recite the facts; it weaves them into a powerful, credible story. It connects the dots for the adjuster, showing exactly how their insured’s negligence caused real, tangible harm. A weak or disorganized letter, on the other hand, sends a clear signal: you might not be prepared to build a strong case. That’s an open invitation for a lowball offer or even an outright denial.

Setting the Stage for Negotiation

At its core, a demand letter's job is to present your claim so convincingly that the insurance company wants to settle rather than face the risks of litigation. It immediately establishes your firm’s credibility. When an adjuster sees a meticulously detailed and professionally organized demand package, they know they're up against a serious advocate who understands how to value a claim and is ready to prove it in court.

To be truly effective, your letter needs to hit several key marks:

- Establish Clear Liability: It must leave zero doubt about why their insured is at fault. This often means citing specific traffic laws or safety statutes.

- Document All Damages: Every single economic and non-economic loss must be itemized and, crucially, backed by evidence.

- Tell a Human Story: The letter has to go beyond the medical bills to convey the real-world impact the injuries have had on your client’s life.

A powerful demand letter frames the negotiation by showing the insurer exactly what a jury would see. It transforms a claim file from a set of numbers into a human story of loss, creating pressure for a fair resolution.

The Foundation of Your Case

Think of the demand letter as the blueprint for your entire case. The arguments you make, the evidence you present, and the calculations you provide will be the reference point for all future negotiations. This is where you lay out everything—from medical treatments and lost wages to the profound, personal toll of pain and suffering.

A comprehensive demand package demonstrates that you've done your homework. Insurance companies respect thorough preparation. It shows you've gathered all the necessary records, fully grasp the medical prognosis, and can accurately calculate the full extent of the damages. For a deeper dive, you can learn more about what a demand letter is and why it's so critical.

By presenting a solid, evidence-backed claim from the very beginning, you immediately place your client in a stronger negotiating position and dramatically increase the chances of a successful pre-litigation settlement.

Building the Narrative and Proving Liability

The heart of any powerful demand letter is the story. It’s where you lay out the facts of the incident so clearly and persuasively that the insurance adjuster has no choice but to see things your way. This isn't about dramatic flair; it’s about constructing an airtight argument that the other party’s negligence is the direct cause of your client's injuries.

Think of it this way: an adjuster sees hundreds of these claims. Yours needs to be the one that is impossible to poke holes in.

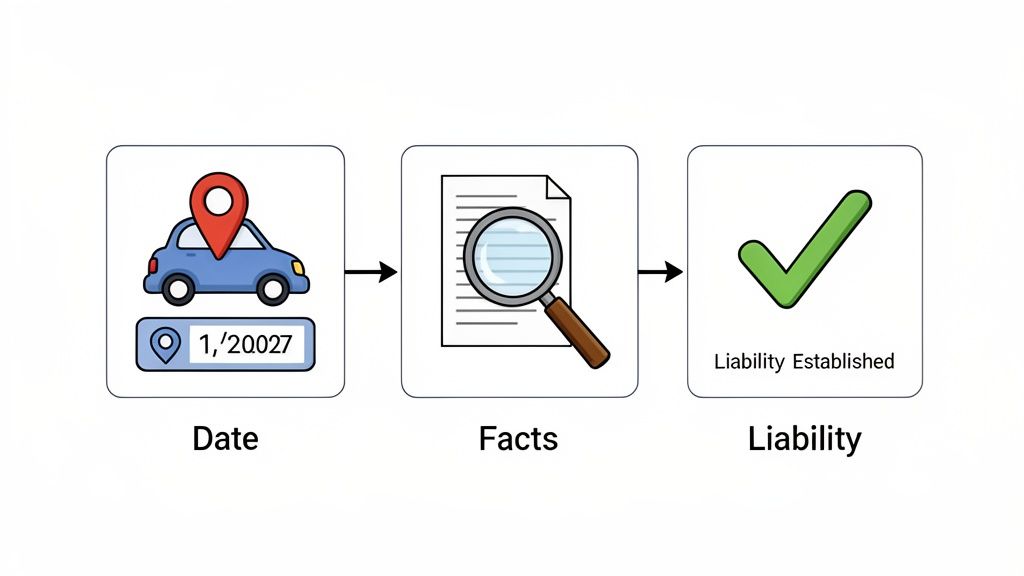

Start with the hard facts. Your account needs to be a straightforward, chronological narrative that begins with the exact date, time, and location of the incident. This anchors the claim in reality and immediately establishes a professional tone. From there, you'll walk the adjuster through what happened, step by step, using objective language.

Painting a Clear Picture of Negligence

Vague statements are your enemy. Saying the other driver was "careless" means nothing to an adjuster. Instead, you need to be specific.

Tell them the defendant "ran the red light at the intersection of Main and Center Street," or that they "were traveling 20 mph over the posted speed limit." For a slip-and-fall case, don't just say the floor was wet. Describe the "large, unmarked puddle of clear liquid in the middle of Aisle 7" and note the "complete absence of any 'wet floor' signage."

These details aren't just filler—they are the building blocks of your liability argument. They make it easy for the adjuster to follow the logic and arrive at the same conclusion you have: their insured is at fault.

Anchoring Your Claim with Legal Authority

A strong narrative becomes almost undeniable when you back it up with the law. Citing specific statutes or legal duties transforms your letter from a simple story into a formal legal claim. It shows the adjuster you’ve done your homework and are prepared to prove your case.

This is where you connect the dots for them:

- Car Accidents: Reference the specific vehicle code violation. Cite the statute for "Failure to Yield the Right-of-Way" or "Following Too Closely." Quoting the law removes any ambiguity.

- Premises Liability: Point to the property owner's legal duty to maintain a safe environment. You can reference state laws or even local ordinances that govern things like proper lighting, handrail installation, or clearing known hazards.

- Dog Bites: If applicable, cite your state’s "strict liability" or "one-bite rule" statute. This often establishes the owner's responsibility without needing to prove prior negligence.

By referencing the law, you're not just telling the adjuster what their insured did wrong; you're explaining precisely why they are legally responsible for the harm that followed.

Expert Insight: Remember, an adjuster's job is to manage financial risk for their company. A factually sound and legally grounded narrative dramatically increases their perceived risk of losing at trial. This simple fact is often the key to unlocking a much more reasonable settlement offer early on.

Ultimately, this section of your example demand letter for personal injury needs to be a masterclass in factual storytelling. Every sentence should build on the last, guiding the adjuster to the only logical conclusion: their insured was negligent, and that negligence caused real harm to your client. Get this part right, and you’ve set the stage for the rest of your demand.

Weaving the Medical Story: Documenting Injuries and Treatment Persuasively

Once you’ve established liability, the medical narrative becomes the absolute heart of your demand letter. This is your chance to transform dry, clinical records into a powerful story of your client's suffering and their fight to recover. Your job is to make the insurance adjuster see beyond the diagnoses and understand the real-world impact this incident has had on your client's life.

This section isn’t just about listing injuries. It’s about painting a clear, chronological picture of your client's medical journey, starting from the moment of the crash. Every ambulance ride, every ER visit, every physical therapy session needs to be directly and unequivocally tied back to the defendant's negligence.

From Diagnosis to Daily Reality

You should start by clearly listing every single diagnosis from the medical professionals. Use the precise terminology from the records—think "cervical strain," "lumbar herniation at L4-L5," or "post-concussion syndrome." This grounds your claims in hard medical evidence right from the start.

After listing the diagnoses, you need to walk the adjuster through the entire course of treatment. This is where you really start to build the value of the claim.

- Initial Treatment: Describe the emergency response in detail. Was there an ambulance? What happened in the ER? Mention specific procedures like X-rays, CT scans, and the first attempts at pain management.

- Specialist Consultations: Note every specialist the client saw, whether it was an orthopedist, a neurologist, or a pain management doctor. Briefly explain why they were referred and what the outcome was.

- Ongoing Therapies: Be specific about the therapies. Don't just say "physical therapy." Instead, state "three sessions per week for twelve weeks." Document the frequency and duration of every treatment, from chiropractic care to occupational therapy.

A winning medical narrative connects every single doctor's visit, prescription, and therapy session directly back to the incident. The adjuster must see an unbroken chain of causation, leaving no room for them to argue that the injuries are unrelated.

This detailed timeline does more than just rack up medical bills; it demonstrates a consistent effort to get better. It proactively shuts down the adjuster’s favorite arguments about gaps in treatment or pre-existing conditions.

The Power of Prognosis and Future Care

A truly effective demand letter doesn't just look backward; it looks to the future. You absolutely have to address the client's long-term prognosis. If a physician’s report mentions the potential for permanent impairment or the likelihood of future surgery, you need to quote it directly.

For example, a doctor's opinion that your client will probably need a future knee replacement or will live with chronic pain is a huge value driver. Highlighting this is how you justify the demand for future medical costs and build a case for significant pain and suffering damages.

Let’s be honest, though. Handling massive medical files is a grind. Sifting through hundreds—sometimes thousands—of pages to pull out every critical detail is not only time-consuming but also ripe for error. Miss one key note, and you could leave a lot of money on the table. For any attorney wanting to nail this part of the process, it's worth learning how to organize medical records effectively.

Using Technology to Build a Stronger Narrative

Today, smart firms are turning to technology to solve this problem. Manually reviewing and summarizing a client's medical history can easily eat up dozens of hours per case, creating a serious bottleneck in your workflow.

This is where AI-powered platforms can give you a real edge. Instead of doing it by hand, you can upload the records and let the system automatically extract the critical data points in just a few minutes. These tools can identify and summarize:

- All medical providers and treatment dates

- Official diagnoses and their ICD codes

- Every prescription and therapy administered

- Physician's notes on pain, suffering, and physical limitations

Automating this work means no crucial detail gets missed. It saves an incredible amount of time, but more importantly, it produces a more accurate and comprehensive medical summary. This gives you the solid, structured data you need to build a more compelling narrative in your example demand letter for personal injury, freeing you up to focus on high-level strategy instead of administrative legwork.

Calculating and Justifying Your Settlement Demand

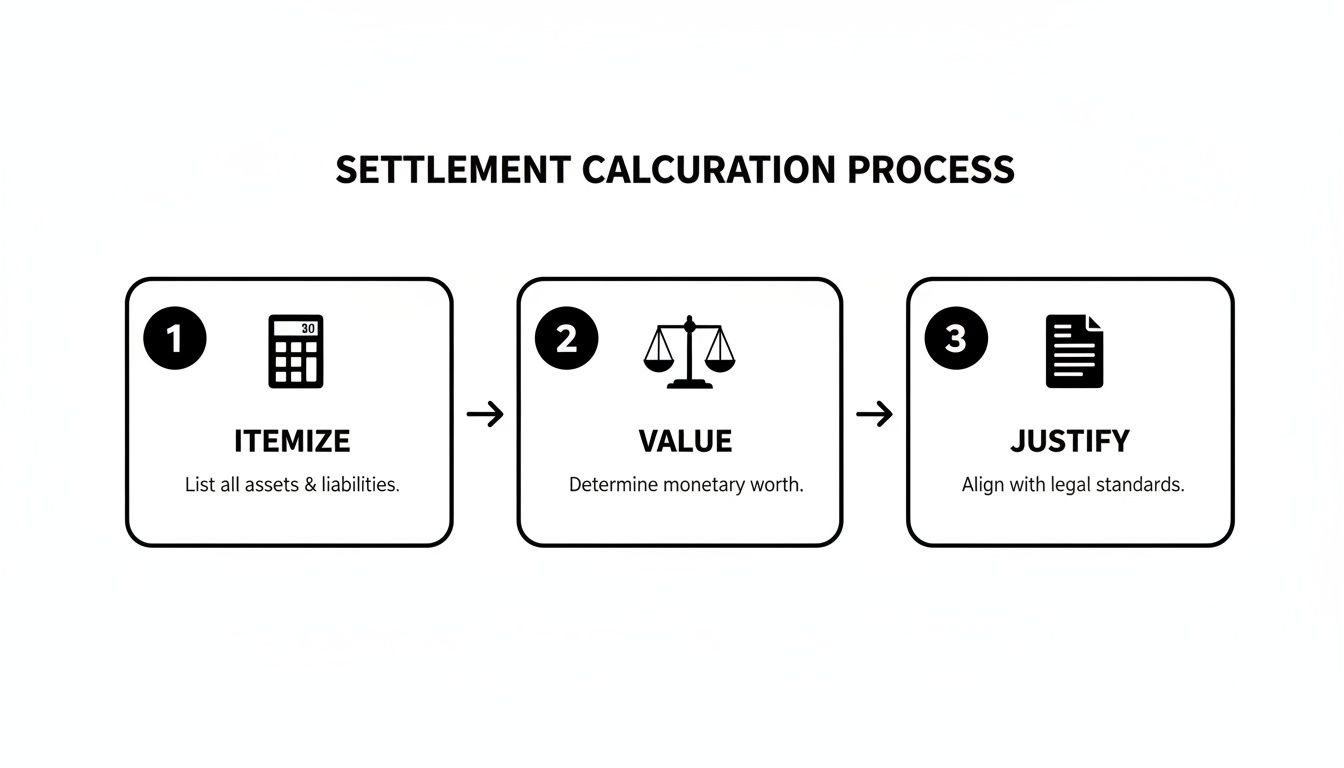

After you've laid out the facts and established clear liability, it’s time to get to the heart of the matter: the money. This section is the financial engine of your demand letter, where you translate your client's ordeal into a concrete, justifiable settlement figure. A well-calculated demand isn't just a number pulled from thin air; it's a carefully constructed argument that leaves an adjuster little room to maneuver.

The key is to present a figure that's both ambitious and completely grounded in evidence. Every single dollar you ask for must be directly tied to a documented loss—whether it's a hospital bill, a lost paycheck, or the profound, personal cost of your client's pain and suffering.

Breaking Down the Damages

To build a compelling case for your settlement number, you need to present a clear, organized breakdown of every loss your client has suffered. This is typically divided into two main categories: economic (the "specials") and non-economic (the "generals").

Here’s a quick overview of how these components fit together:

| Damage Category | Description | Examples |

|---|---|---|

| Economic Damages | These are the tangible, verifiable out-of-pocket costs and financial losses your client has incurred as a direct result of the incident. | - Medical bills (ER, surgery, physical therapy) - Lost wages and income - Future medical treatment costs - Lost earning capacity - Property damage - Out-of-pocket costs (prescriptions, travel) |

| Non-Economic Damages | These are the intangible, subjective losses that compensate for the human impact of the injury. They don't come with a receipt but are often the most significant part of the claim. | - Physical pain and suffering - Emotional distress and mental anguish - Loss of enjoyment of life - Permanent disability or disfigurement - Loss of consortium (for a spouse) |

Presenting your damages in a structured way makes it simple for the adjuster to follow your logic and understand the basis for your final demand.

Itemizing Your Economic Damages

First, let's talk about the hard numbers. Economic damages, also known as special damages, are the most straightforward part of your calculation because they represent direct financial losses. Precision is your best friend here. You need to create an exhaustive, itemized list supported by bills, receipts, and other official documents.

Your list of economic damages should cover everything:

- All Medical Expenses: Don't just list a final total. Detail every single provider, from the ambulance ride and ER visit to surgeons, physical therapists, and chiropractors. Remember to include costs for prescriptions and any necessary medical equipment.

- Lost Wages: Calculate the exact income your client lost while recovering. You’ll need pay stubs and a letter from their employer verifying their pay rate and the specific days they missed.

- Loss of Future Earning Capacity: This is a huge one. If the injuries are permanent and will prevent your client from returning to their old job or working at the same level, you need to account for that. This often requires bringing in a vocational expert to provide a formal calculation.

- Miscellaneous Costs: Think about all the smaller expenses that pile up—transportation to doctor's appointments, hiring household help during recovery, or even modifications made to a home or vehicle.

Organize these figures clearly in your letter. A simple table or a clean, bulleted list with a final subtotal works perfectly. This shows the adjuster you've done your homework and your math is based on concrete evidence, not wishful thinking.

Putting a Value on Non-Economic Damages

Now for the trickier part: non-economic damages, or general damages. This is compensation for intangible losses like pain, suffering, emotional distress, and the loss of enjoyment of life. While these don't come with a price tag, they are often the largest component of a personal injury settlement.

A common rookie mistake is to just throw out a number for pain and suffering without explaining where it came from. You have to connect that figure to the specific, human impact of the injuries and paint a vivid picture of how your client’s life has been turned upside down.

So, how do you actually put a number on suffering? The most common method used in negotiations is the multiplier approach. You take the total economic damages—your hard numbers—and multiply them by a factor, which typically falls between 1.5 and 5.

- A multiplier of 1.5 to 3 is often used for less severe injuries with a full and relatively fast recovery, like soft tissue strains.

- A multiplier of 4 or 5, or sometimes even higher, is reserved for catastrophic, permanent injuries like spinal cord damage, traumatic brain injuries, or severe disfigurement.

Your justification for the multiplier you choose is everything. You have to explain why you landed on that specific number. Reference the severity of the injuries, the length and intensity of the recovery process, the permanency of any scarring or disability, and the overall disruption to your client's life. For a deeper dive into this, check out our guide on how to calculate pain and suffering damages.

Anchoring Your Final Demand

Finally, you bring it all together. Combine your total economic damages with your calculated non-economic damages to arrive at your final settlement demand. It's crucial that this number is grounded in reality and reflects current settlement trends. The personal injury landscape is always shifting, and jury awards have been climbing. The average settlement hovers around $52,900, but that figure is highly variable. More telling is the fact that from 2014 to 2020, the median jury award in personal injury cases nearly doubled, jumping from $75,000 to $125,000. You can find more personal injury settlement statistics from Milberg.

By presenting a meticulously itemized list of special damages and a logically justified figure for general damages, you provide the adjuster with a clear, evidence-based rationale. This transforms your demand from a simple request into a compelling argument for the full and fair compensation your client deserves.

A Real-World Demand Letter, Annotated by an Expert

It’s one thing to talk about the theory behind a demand letter, but it's another to see how a well-crafted one actually works. Let's walk through a complete demand letter based on a common car accident scenario.

This isn't just a boilerplate template you can copy and paste. I'm going to break down each section with annotations from my own experience, explaining the strategy behind the language, the evidence placement, and how it all comes together to present a compelling case.

Setting the Scene: The Factual Foundation

We'll use a straightforward scenario: our client, "Jane Doe," was rear-ended while stopped at a red light. This is about as clear-cut as liability gets, which is always the strongest position to start from. It leaves no room for the adjuster to argue about who was at fault.

The letter should immediately look professional. It starts with your firm's letterhead, the date, and the adjuster's contact information. Right away, you reference the essentials: the claim number, date of loss, and the insured's name. This small detail tells the adjuster you’re organized and ready to get down to business. If you're ever unsure about the layout, a modern guide to business letter format can be a helpful reference.

Example Introduction:

RE: Jane Doe vs. John Smith

Claim Number: 123-ABC-456

Date of Loss: January 15, 2024Dear Ms. Adjuster,

As you know, this firm represents Ms. Jane Doe for the significant injuries she sustained as a direct result of the negligence of your insured, John Smith. This letter serves as a formal demand for settlement of Ms. Doe’s claim.

My Take: This opening is perfect. It's direct, professional, and gets straight to the point. You've established who you are and why you're writing, setting a firm, business-like tone from the outset.

Building the Case, Section by Section

A persuasive demand letter doesn't just dump information on the adjuster. It guides them through a logical narrative where each part builds on the last, making your final number feel inevitable.

Liability: Leave No Doubt

This is where you recount the incident using objective, factual language. State clearly that your client was fully stopped at a red light when the insured crashed into her from behind. This is the moment to bring in your evidence—reference the police report by its number and cite the specific traffic statute the insured violated, like "Failure to Maintain a Safe Following Distance."

The Medical Narrative: From Injury to Impact

Next, you pivot from the crash itself to its very real consequences. Start with the immediate aftermath, listing the diagnoses from the emergency room visit (e.g., "cervical sprain/strain," "lumbar contusion"). Then, you methodically walk the adjuster through the entire treatment journey. Detail the physical therapy sessions, the visits to specialists, the medications prescribed. This creates a clear, undeniable timeline of your client's pain and her efforts to recover.

Damages: The Financial Reckoning

This is the heart of your letter, where you quantify the losses. I always break this down into two distinct parts:

- Economic Damages: This is the hard math. You provide an itemized list of every single medical bill, documentation for lost wages, and receipts for any out-of-pocket costs like prescriptions. Every single dollar amount here should be backed up by an attached document. No exceptions.

- Non-Economic Damages: Here's where you tell the human story behind the numbers. Don't just say your client was in pain. Explain how the chronic neck pain meant she couldn't lift her toddler for months, or how she had to give up her weekend gardening hobby. This justification is what gives your pain and suffering calculation its power.

As this shows, the process is straightforward but critical. You itemize the concrete costs, you value the human impact, and you justify the final number with the story and evidence you've laid out.

The Final Demand and Supporting Evidence

After building your case, the letter arrives at its destination: the settlement demand. Based on everything you've presented, you calculate the total damages and make a clear, confident ask.

Example Demand Calculation:

- Total Medical Bills: $12,500

- Total Lost Wages: $3,000

- Total Economic Damages: $15,500

- Non-Economic Damages (Multiplier of 3x): $46,500

- TOTAL SETTLEMENT DEMAND: $62,000

My Take: The letter should explicitly state the multiplier you used (3x in this case) and briefly explain why. Tying it to the six months of painful physical therapy and the significant disruption to Jane's daily life makes the number feel calculated, not pulled out of thin air.

Pro Tip: A strong demand letter doesn't just present facts; it weaves them into a persuasive argument. You lead the adjuster on a journey—fault, injury, cost, suffering—making your final demand the only logical conclusion.

To wrap it all up, the letter should conclude with a list of all attached documents. Think of this as a checklist for the adjuster, making their job easier. The evidence package should be complete: the police report, every medical record and bill, a lost wage verification from Jane's employer, and photos showing the vehicle damage and, if available, any visible injuries.

By breaking down a real-world example, you can see how each piece contributes to a powerful, persuasive whole. This structure provides a solid roadmap for drafting a letter that doesn't just inform the insurance company—it convinces them to pay what your client deserves.

How Automation Can Fast-Track Your Demand Letter Process

In a competitive legal market, efficiency isn't just a nice-to-have; it's a matter of survival. As we've walked through, drafting a compelling demand letter is a detailed, time-intensive craft. The manual labor involved—combing through hundreds of pages of medical records, organizing stacks of bills, and piecing together a coherent story—creates a serious operational drag for many personal injury firms.

This administrative load is exactly where modern technology can make a huge impact. In the traditional workflow, it's not uncommon for attorneys and paralegals to lose dozens of hours on a single case just wrangling disorganized files. That’s precious time that could be spent on high-level strategy, client communication, or growing the firm's caseload.

The Move from Manual Drudgery to Intelligent Automation

AI-powered platforms are completely changing this dynamic by automating the most grueling parts of building a demand letter. Forget manually reading every page of a medical file. Now, you can upload the entire case file and let intelligent software do the heavy lifting for you.

These systems are built to read and understand massive amounts of unstructured data, then turn it into organized, useful information. In a matter of minutes, they can pinpoint and extract:

- Key Medical Providers: A clean list of every doctor, hospital, and therapist who treated your client.

- Treatment Timelines: A chronological summary of every appointment, test, and procedure.

- Official Diagnoses: A catalog of all documented injuries and their medical codes.

- Prognosis and Future Care: Physician notes on the long-term outlook or necessary future treatments.

This automated review doesn't just save an incredible amount of time; it also dramatically improves accuracy. Human error is a real risk when you're dealing with a mountain of documents. Automation ensures no critical detail gets missed, making the foundation of your demand that much stronger.

Reclaiming Billable Hours and Handling More Cases

The demand letter is the cornerstone of settlement negotiations, but building one has always been a huge drain on attorney resources. Modern AI tools are flipping the script. By cutting out 10+ hours of manual review and drafting per case, firms can take on a larger caseload without sacrificing quality or burning out their staff.

This isn't a small thing, especially when you consider that personal injury filings jumped 78% in the year ending March 31, 2024. The ability to automate demand letter generation is quickly becoming a major competitive edge. You can find more insights about how AI is speeding up the demand letter process on Casepeer.com.

By handing off the administrative work to technology, you empower your legal team to focus on what they do best: advocating for clients. The software acts as a force multiplier, allowing attorneys to dedicate their expertise to negotiation strategy and case development instead of document management.

This newfound efficiency directly impacts your firm's bottom line. Faster drafting means demands go out the door sooner, which can speed up settlement timelines and improve your cash flow. It lets you take on more cases without having to hire more people. Beyond just case management software, thinking about how proactive IT support for legal practices to enhance efficiency can provide the robust tech backbone your firm needs for smooth automation.

Ultimately, this isn't about replacing lawyers with technology. It’s about augmenting their skills. When you delegate the repetitive, data-entry tasks to an automated system, you free up your most valuable resource—your team's legal expertise—to secure better outcomes for your clients and drive real growth for the firm. This strategic use of technology is what separates thriving modern law practices from those stuck in the past.

Ready to eliminate the administrative grind and create powerful demand letters in minutes? Ares is the AI-powered platform built for personal injury firms that want to save time, claim bigger, and settle faster. See how our automated medical record review and demand letter drafting can transform your workflow.