What Is a Demand Letter from an Attorney Explained

So, what exactly is a demand letter from an attorney? Think of it as the formal opening shot in the settlement negotiation process for a personal injury case. It’s not a lawsuit. Instead, it’s a strategic proposal designed to resolve a dispute before anyone steps foot in a courtroom.

This letter lays out the facts, establishes who's at fault, and clearly states the compensation you're seeking for your client's injuries and other losses.

Decoding the Attorney Demand Letter

Imagine the demand letter as the opening move in a high-stakes chess match. It's far more than just a request for money; it's the complete blueprint of your personal injury claim, carefully constructed to persuade the insurance company that settling is their most logical move.

This single document presents your client's entire story, backed by solid evidence, and sets the tone for every negotiation that follows. It's your primary tool for kicking off pre-litigation discussions.

Specifically, the letter is meant to:

- Establish Liability: Clearly articulate why the other party is legally responsible for the accident and your client’s injuries.

- Detail Damages: Provide a comprehensive breakdown of all losses, from medical bills and lost wages to non-economic damages like pain and suffering.

- Present a Formal Demand: State the exact dollar amount needed to settle the claim and avoid a lawsuit.

- Create a Factual Record: Put the opposing party on formal notice of the claim's details and your intent to pursue legal action if a fair settlement isn't reached.

The Foundation of Settlement Negotiations

Demand letters are a cornerstone of pre-litigation strategy, especially for personal injury law firms fighting for client compensation. They are built to showcase the strength of a case so convincingly that the insurance adjuster has no choice but to negotiate in good faith. You can see how this comes together in our complete guide to a personal injury demand letter template.

To put it simply, here is a quick breakdown of the demand letter's role.

Demand Letter at a Glance

| Element | Description |

|---|---|

| Primary Function | To formally initiate pre-litigation settlement negotiations. |

| Key Audience | The opposing party's insurance adjuster or legal counsel. |

| Strategic Goal | To present a compelling case that persuades the other side to settle fairly and avoid a lawsuit. |

This table highlights how the demand letter isn't just a formality but a calculated tool with a clear purpose and audience.

A well-crafted demand letter is arguably the most critical document in a personal injury case. It frames the entire negotiation, showcasing the claim's strengths while signaling a readiness to litigate if necessary. It’s the first, and often most important, opportunity to make a powerful impression.

The numbers back this up. In the United States, around 400,000 personal injury claims are filed each year. Yet, an overwhelming 95% of these cases are resolved through a pre-trial settlement.

That means only one in twenty cases actually goes to court. The demand letter is the engine driving this reality, making it an indispensable tool for any efficient and effective legal practice.

Breaking Down a High-Impact Demand Letter

A truly effective demand letter is more than just a list of facts; it’s a masterclass in persuasive storytelling backed by cold, hard evidence. To really get what a demand letter from an attorney accomplishes, you have to dissect its core components and see how they build a compelling case on paper. This isn't about ticking boxes on a checklist, but understanding the strategic purpose behind each element.

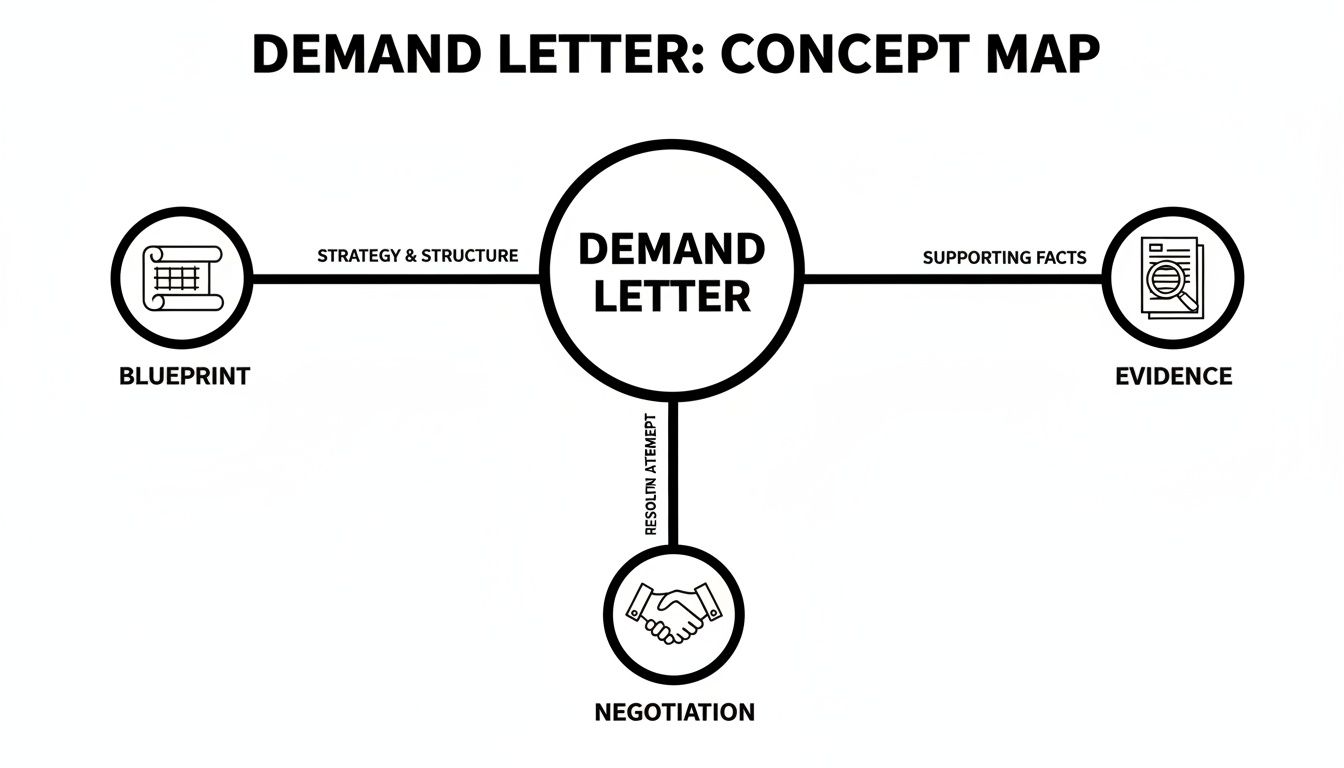

Think of the demand letter as having three primary functions: it's a blueprint for your entire case, a container for all your critical evidence, and the opening move in the negotiation game.

When each piece works in concert, you create a document that an insurance adjuster simply can't ignore, giving you a powerful framework to maximize the settlement.

The Narrative and Legal Argument

The first pillar is the narrative. This is where you bring the client's story to life. You move beyond the dry facts of the police report to tell the human story of the incident and, more importantly, its aftermath. This builds an emotional connection and frames the victim not as a case file, but as a real person whose life has been turned upside down.

Right alongside the story is the legal argument, which is all about establishing undeniable liability. This section meticulously lays out the facts, connects them to relevant laws and statutes, and proves why the other party is at fault. It’s the logical, evidence-based foundation that sends a clear message: we are ready to win this in court if we have to. To make this part especially sharp, it helps to improve your legal copywriting to convey your client's position with absolute clarity.

The Medical Summary and Damages

Next up is the detailed medical summary. This is the objective proof of your client’s suffering. It chronologically outlines every single diagnosis, treatment, and doctor’s visit, translating the client’s pain into a clear, factual record that quantifies the physical toll of the injury.

Finally, the letter must present the itemized damages. This is the financial heart of the demand, where every single loss is calculated and justified. A thorough letter will break down all economic damages—hospital bills, therapy costs, lost wages—before making a strong case for non-economic damages like pain, suffering, and emotional distress.

The letter culminates in a specific monetary demand. This number is almost always higher than the final amount you'd be willing to accept, which is a standard strategic move to leave room for negotiation.

A powerful demand letter harmonizes these four components. The narrative creates empathy, the legal argument establishes fault, the medical summary proves the injury, and the damages section quantifies the loss. When combined, they form a cohesive and persuasive argument that pressures the insurer toward a fair settlement.

Understanding how to weave these parts together is the key to success. For a practical example, take a look at our article with a sample settlement demand letter that shows these principles in action.

Understanding the Strategic Timing and Purpose

In settlement negotiations, timing isn't just important—it's everything. Sending a demand letter too early is a rookie mistake, a bit like showing your hand in a high-stakes poker game before all the cards are on the table. The real power of a demand letter comes from presenting a complete, bulletproof picture of your client's losses.

This is why experienced personal injury lawyers practice strategic patience. They hold off on sending the demand until the client has reached what's known as Maximum Medical Improvement (MMI).

Why Maximum Medical Improvement Is the Green Light

MMI is a critical milestone in any personal injury case. It’s the point where a doctor concludes that a client's condition has stabilized and isn't likely to get any better, even with more treatment. Waiting for this moment is non-negotiable, and for one simple reason: you can't accurately calculate damages until you know the full scope of the harm.

If you jump the gun and send a demand before your client reaches MMI, you’re essentially guessing about the claim's true value. You won't have the final word on:

- Future Medical Needs: Does the client need more surgeries? Will they require years of physical therapy or ongoing care?

- Permanent Impairment: Is there a lasting disability that will cripple their ability to earn a living in the future?

- Total Medical Bills: The final tally of medical expenses remains a question mark until all treatment is finished.

Demanding a settlement with so many unknowns almost guarantees you'll undervalue the claim. It means leaving money on the table that your client desperately needs and rightfully deserves. This gamble can lock your client into a settlement that won't cover their long-term costs, a risk no responsible attorney is willing to take.

The Two-Fold Purpose of a Demand Letter

A great demand letter does more than just ask for money. It serves two crucial strategic functions that set the tone for every negotiation to follow.

First and foremost, it’s a tool of persuasion. The goal is to lay out a case so compelling and backed by such solid evidence that the insurance adjuster sees settling as their most logical and financially sound option.

A well-timed demand letter does more than just state facts; it anchors your negotiating position. It creates a formal record of your claim's strength and signals a credible threat of litigation, compelling the insurer to take the claim seriously from the very beginning.

Second, the letter acts as a formal legal record. If settlement talks break down and you have to file a lawsuit, that demand letter becomes a key piece of evidence. It proves you made a good-faith effort to resolve the dispute out of court and locks in your client's initial arguments and damage calculations. It’s the document that truly sets the stage for every conversation and legal maneuver that comes next.

Avoiding Common Mistakes That Weaken Your Claim

A single misstep can drain the power from an otherwise solid demand letter, turning a strong negotiating position into a weak one. Think of it this way: you can build a fantastic case, but if the final presentation is flawed, you're leaving money on the table. These common errors immediately signal inexperience to an insurance adjuster and practically invite a lowball offer.

To dodge these traps, you have to remember what a demand letter from an attorney is for. It’s a tool for persuasion, not a forum for venting. Every sentence must be professional, factual, and strategically sound to withstand the scrutiny it will inevitably face.

Premature Demands and Incomplete Evidence

One of the most frequent—and damaging—mistakes is sending the letter before the client reaches Maximum Medical Improvement (MMI). As we've covered, doing this makes it impossible to calculate the full extent of the damages, particularly future medical costs. The result is almost always an undervalued claim.

Just as harmful is a demand that lacks robust medical evidence. A letter that simply states a client was injured, without attaching comprehensive records, reports, and itemized bills, is just an empty assertion. The adjuster’s job is to verify everything; you have to make it easy for them by providing all the necessary proof upfront.

A demand letter is not the place for emotional appeals or aggressive language. Stick to a professional, fact-based tone. The strength of your claim lies in the evidence you present, not in the volume of your rhetoric. An objective, logical argument is far more persuasive to an insurance adjuster.

Unrealistic Demands and Emotional Arguments

Another error that kills credibility is demanding a wildly unrealistic amount. While it’s standard practice to ask for more than you expect to settle for, an astronomical figure with no basis in the evidence will get your letter dismissed as unprofessional. It tells the adjuster you aren't serious about negotiating in good faith.

Similarly, avoid letting emotion drive the narrative. The client’s suffering is real and should absolutely be described, but the letter’s arguments must be grounded in facts. An angry or accusatory tone only serves to undermine your professionalism and can put the adjuster on the defensive, making a fair negotiation much harder to achieve.

To help you stay on the right track, it's useful to contrast what to do versus what to avoid.

Common Pitfalls vs. Best Practices

The table below provides a quick reference to help you sidestep the most common errors we see and adopt the practices that get better results.

| Common Pitfall | Best Practice |

|---|---|

| Sending Before MMI | Wait until all medical treatments are complete and future costs can be accurately projected. |

| Missing Medical Records | Attach all relevant medical bills, treatment records, and physician reports to substantiate the injuries. |

| Emotional or Aggressive Tone | Maintain a professional, objective, and firm tone throughout the entire letter. |

| Exaggerated Demand Amount | Calculate a demand that is well-supported by the evidence, leaving reasonable room for negotiation. |

| Vague Damage Descriptions | Itemize all economic and non-economic damages clearly, explaining how each figure was calculated. |

By sidestepping these common mistakes, your demand letter becomes a much more formidable tool. It demonstrates that you've built a meticulous, evidence-backed case and are fully prepared to defend it. This is what compels the insurance company to approach negotiations with the seriousness your client’s claim deserves.

How Technology Is Changing the Game for Demand Letters

Anyone who's ever drafted a high-impact demand letter knows the grind. It’s a mountain of work. Paralegals and attorneys can easily burn dozens of hours digging through disorganized medical records, trying to stitch together a clear timeline and manually adding up the damages. It's not just slow; it’s a process where one missed detail can undermine an otherwise solid case.

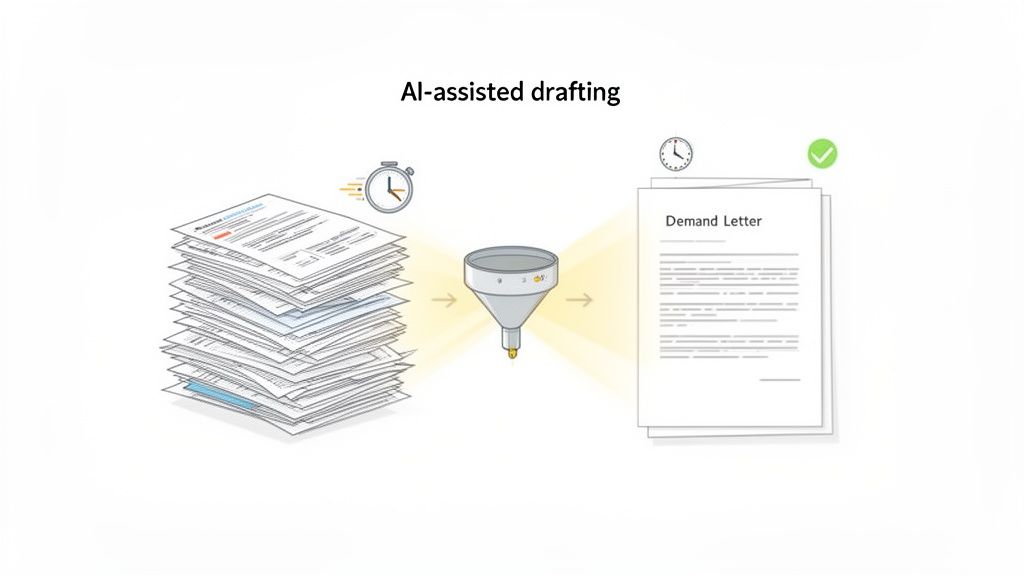

Thankfully, that old, time-consuming way of doing things is on its way out. Modern legal tech, especially AI-powered platforms, now gives us a smarter, faster, and more accurate way to handle the heavy lifting involved in drafting a demand.

Automating the Toughest Parts of the Job

Think about turning a chaotic, 500-page medical file into a perfectly structured, chronological summary. What used to take days can now be done in minutes. This is where new legal tech tools really shine. Instead of a paralegal manually reading every single page, the legal team can simply upload the entire case file and let an AI system handle the initial, painstaking review.

But this isn't just about moving faster. It's about getting it right with incredible precision. These platforms are built to:

- Pinpoint Key Data: They can automatically spot and pull out critical details like diagnoses, treatment dates, specific providers, and billing codes.

- Create a Clear Timeline: The system arranges every event into a logical, chronological narrative, telling the client’s medical story from the day of the injury onward.

- Simplify Complex Records: They can take dense, jargon-filled physician notes and hospital charts and turn them into clear, easy-to-read summaries.

This kind of automation gets legal professionals out of the administrative weeds. It frees them up to spend their valuable time on what truly matters: case strategy, crafting legal arguments, and talking to clients.

Turning Raw Information into a Winning Story

The real magic of using technology here is its ability to find the narrative hidden in the data. A strong demand letter tells a compelling story that an insurance adjuster can't ignore. AI tools are exceptionally good at structuring all that raw information to build that story.

By methodically organizing every medical visit, procedure, and cost, AI ensures that nothing gets missed. This builds a rock-solid, evidence-based foundation for your demand. It shows the adjuster you've done your homework and strengthens your negotiating position right from the start.

This structured approach practically eliminates the risk of overlooking a key diagnosis or miscalculating the medical bills. Every single dollar you demand is clearly justified by the evidence in the records. The final product is a more accurate, persuasive, and data-driven demand letter that’s much harder for an insurance company to push back on. For firms ready to make this shift, it's worth exploring how to use AI for personal injury lawyers to get better results.

The change is undeniable. What once required days of manual review by a skilled team can now be done far more accurately in a tiny fraction of the time. This newfound efficiency means firms can manage more cases without ever compromising the quality of their work, leading to better, faster settlements for their clients.

Common Questions About Demand Letters

Even after you understand the basics, you'll probably have more questions as you get deeper into the settlement process. Let's tackle some of the most common ones that come up for clients and attorneys alike.

What Happens After the Demand Letter Is Sent?

Once you send the demand letter and all its backup documents, the insurance adjuster gets to work. They'll start digging into your claim, scrutinizing your arguments, the extent of the injuries, and how solid your evidence really is. This is where they decide how seriously to take your case.

After their review, you can usually expect one of three things:

- Acceptance: They agree to pay exactly what you asked for. Honestly, this almost never happens.

- Denial: They reject the claim outright and will give you a reason why.

- Counteroffer: They come back with a lower settlement figure. This is by far the most common response and is the starting pistol for the negotiation phase.

A counteroffer isn't a bad thing; it means they're willing to talk. This is where the real back-and-forth begins.

Is a Demand Letter Legally Binding?

Nope. A demand letter isn't a contract. Think of it as a formal proposal—an opening offer to settle a legal dispute before it ends up in a courtroom. Neither side is legally locked into the terms just because the letter was sent.

That said, it’s a serious legal document that carries a lot of weight. It officially notifies the other side that you're prepared to sue if you can't reach a fair agreement. What you say in the letter can even be brought up in court later to show you made a good-faith effort to resolve the issue amicably.

A demand letter isn't a contract, but it's a formal declaration of intent. It tells the other side: 'Here is our case, here is our proof, and here is your chance to resolve this reasonably before we take formal legal action.'

How Long Does the Other Side Have to Respond?

A good attorney will always put a response deadline in the letter, usually 30 days. There's no law that dictates this timeframe; it's a professional standard meant to create urgency and keep the process moving.

This deadline sets a clear expectation. If the other side blows past it without a word, it signals they might not be negotiating in good faith. That silence is often the trigger for your attorney to take the next step: filing a lawsuit to force their hand and move the case forward.

Can I Write My Own Demand Letter Without a Lawyer?

Technically, anyone can write a letter asking for money. But in a serious personal injury case, it's a really bad idea. Insurance adjusters are professionals trained to minimize what their company pays out. A letter from an individual just doesn't carry the same weight as one from a law firm they know will take them to court.

An experienced personal injury attorney knows exactly how to:

- Build a powerful legal narrative.

- Calculate the full scope of damages, including things like future medical costs and pain and suffering.

- Use the real threat of a lawsuit to bring the adjuster to the table with a fair offer.

Going it alone almost always means leaving money on the table—often a lot of it. You'll likely end up with a settlement far lower than what a professional could have gotten for you.

Ready to eliminate the manual work of drafting demand letters and summarizing medical records? Ares uses AI to turn hours of tedious work into minutes of strategic review, empowering your firm to secure higher settlements, faster. See how you can transform your personal injury practice at https://areslegal.ai.