8 Powerful Settlement Letter Examples Proven to Maximize Claims in 2026

Crafting a compelling settlement demand letter is both an art and a science. It's the pivotal document that transforms months of case building into a successful resolution. Get it right, and you accelerate settlement and maximize claim value. Get it wrong, and you invite lowball offers, protracted negotiations, and unnecessary litigation.

This guide moves beyond generic templates, offering 8 powerful settlement letter examples, each dissected for its strategic value. We will explore specific, replicable frameworks tailored for different personal injury scenarios, including:

- Complex medical chronologies

- Data-driven comparative analyses

- Insurance policy limit demands

- Impact statement-centered narratives

For each example, we provide a deep strategic analysis, breaking down the tactics and actionable takeaways that personal injury attorneys and their paralegals can implement immediately. The goal is to equip you with a diverse playbook for constructing persuasive demands that resonate with adjusters and opposing counsel. While the focus here is specific to settlement negotiations, exploring various formal letter templates and guides can offer broader insights into effective communication strategies for any significant legal correspondence.

We will also highlight how modern tools can automate the foundational work of medical record review and timeline creation. By handling the tedious data organization, your team is freed up to focus on the high-value strategic narrative that truly drives negotiation and secures better client outcomes. Let's dive into the examples.

1. Structured Demand Letter Settlement Template

A structured demand letter settlement template provides a logical, hierarchical framework that guides an insurance adjuster through the claim's narrative efficiently. This approach is foundational for clarity and persuasiveness, starting with a formal case caption and party identification, followed by a chronological presentation of facts, injuries, and damages. Its primary goal is to present a complex medical and financial narrative in a simple, linear format, establishing a clear cause-and-effect relationship between the incident and the resulting damages.

This method shines in cases with extensive treatment histories, such as a slip and fall claim involving 18+ months of orthopedic care or a motor vehicle accident with multiple providers. By structuring the letter with clear headings for Liability, Medical Treatment, and Damages, you prevent the adjuster from getting lost in the details. The structure helps them quickly grasp the core arguments and justify the settlement demand to their superiors.

Strategic Application

When to use this approach:

- Complex Medical Histories: Ideal for cases with numerous providers, diagnostic tests, and a long treatment timeline. The structure organizes the chaos.

- Multiple Damage Categories: Use it when claiming medical specials, lost wages, and non-economic damages to present each component clearly.

- High-Volume Practices: A standardized template ensures consistency and quality control across all cases, which is crucial for efficiency.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, follow these best practices:

- Separate Liability from Damages: Dedicate distinct sections to the discussion of liability and the calculation of damages. This prevents confusion and allows the adjuster to evaluate each component independently.

- Lead with Strength: Open the damages section with the most significant medical evidence and the highest-value damage figures to immediately capture the adjuster’s attention.

- Attach a Medical Summary First: Place a one-page medical chronology and billing summary at the very beginning of your attachments. This gives the adjuster a quick-reference guide to the entire claim.

- Set Clear Expectations: Conclude the letter with a specific demand amount, the attorney's settlement authority, and a firm deadline for a response.

By implementing a well-defined structure, you streamline the review process for the insurer, demonstrating professionalism and a thorough command of the facts. For a more detailed breakdown, you can review this sample settlement demand letter to see these principles in action.

2. Medical Records Summary with Demand Letter Hybrid

An integrated medical records summary with a demand letter hybrid merges a detailed medical narrative directly with the settlement arguments. This approach eliminates redundancy by presenting the treatment history, diagnoses, and prognoses chronologically, then weaving the demand for damages into that factual context. The primary goal is to create a seamless, evidence-based document where each claim for damages is immediately substantiated by the medical data just presented.

This hybrid model is exceptionally powerful in cases where the medical complexity is the core driver of value. By presenting a unified document, you guide the adjuster through a logical progression from injury to diagnosis, treatment, and ultimately, financial impact. This prevents them from having to cross-reference a separate demand letter with hundreds of pages of medical records, streamlining their review and justification process.

Strategic Application

When to use this approach:

- Medically Complex Cases: Ideal for traumatic brain injury (TBI) claims with extensive neurological testing, chronic pain syndrome cases involving multiple specialists, or claims with surgical complications requiring detailed pre- and post-operative analysis.

- Cases Reliant on Nuance: Use this method when the claim's value lies in understanding the subtle, long-term impacts of an injury, which are best explained within the context of the medical journey.

- Firms Using AI: Perfect for practices leveraging AI-powered tools to generate initial medical summaries, which can then serve as a robust foundation for the demand.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, follow these best practices:

- Embed Demands in the Narrative: After describing a significant medical event, such as a major surgery, immediately follow with a paragraph detailing the associated costs, pain, and suffering.

- Use Subheadings as Signposts: Employ clear subheadings like "Neurological Treatment and Cognitive Decline" or "Post-Surgical Complications and Resulting Damages" to signal the shift from medical facts to legal arguments.

- Number Key Medical Events: Assign numbers to each major treatment episode or diagnosis. You can then reference these numbers in the final damages section for a clean, organized summary.

- Include a Medical Snapshot: Open the document with a one-page "Medical and Damages at a Glance" summary. This gives the adjuster a high-level overview before they dive into the detailed narrative.

By integrating the medical summary and demand, you create a compelling, evidence-driven argument that is both persuasive and easy for the insurer to process. To build a strong foundation for this type of letter, a well-structured medical record summary is essential.

3. Data-Driven Comparative Settlement Template

A data-driven comparative settlement template anchors your demand in objective, verifiable market data, transforming a subjective request into a well-reasoned valuation. This approach leverages jury verdict reports, similar case resolutions, and claim valuation metrics to contextualize the demand. The core strategy is to preemptively address the adjuster's primary question: "How did you arrive at this number?" by providing a data-supported rationale from the outset.

This method is particularly effective in reducing arbitrary pushback by grounding the settlement figure in industry precedent. For example, a whiplash injury claim can be fortified by citing state-specific settlement averages for similar soft-tissue cases. Likewise, valuing a burn injury becomes more concrete when referencing medical cost databases and awards for comparable scarring. This data-driven framework shows the adjuster you have done your homework and are prepared to justify your valuation with more than just your client's story.

Strategic Application

When to use this approach:

- Unique or Subjective Injuries: For injuries like scarring, PTSD, or chronic pain, where damages are highly subjective, comparative data provides an objective benchmark.

- Negotiating with Data-Reliant Insurers: Large insurance carriers often use their own internal data to value claims. Presenting your own data levels the playing field.

- Cases Lacking Strong Liability: When liability is contested, a reasonable, data-backed demand can encourage a settlement by showing the potential exposure if the case proceeds.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, incorporate these best practices:

- Cite Recent and Relevant Data: Only use comparable case data from the last 3-5 years within the relevant jurisdiction to ensure credibility and relevance.

- Present Data as a Range: Instead of a single point estimate, provide a settlement range from your research. This frames your demand as reasonable and within market norms.

- Source Your Data Transparently: Use footnotes to cite the specific jury verdict databases, court records, or published surveys used. This transparency invites verification and builds trust.

- Organize Comparables Logically: Group your comparative data by key variables such as injury type, severity, jurisdiction, and plaintiff demographics to build a compelling and organized argument.

By integrating objective data, you shift the negotiation from a battle of opinions to a discussion based on established facts and industry trends, significantly strengthening your client's position.

4. Impact Statement-Centered Settlement Letter

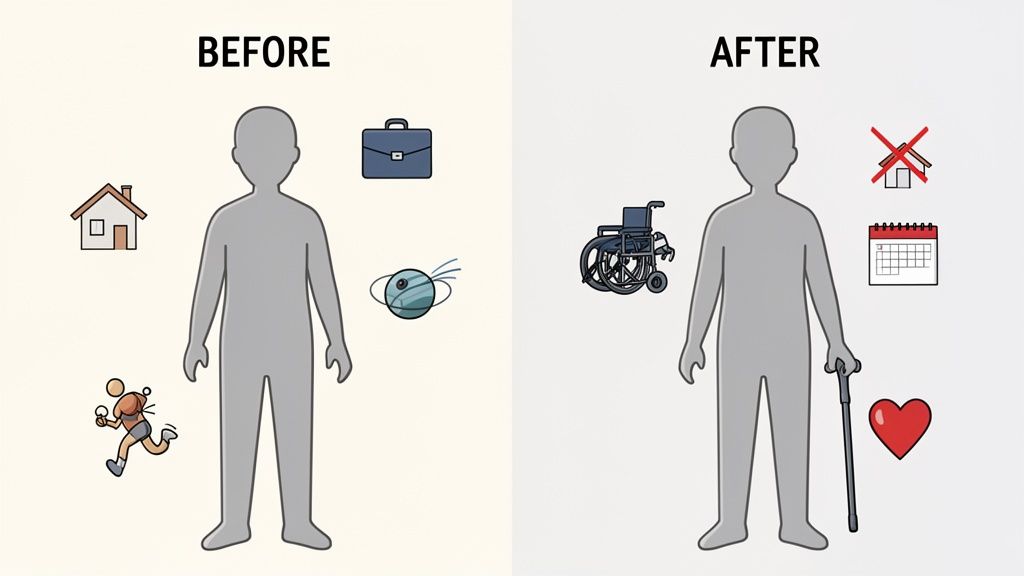

An impact statement-centered settlement letter frames the claim's narrative around the plaintiff's functional, emotional, and lifestyle changes rather than leading with dry medical facts. This approach humanizes the plaintiff by focusing on how the injury directly affected their daily life, work capacity, family relationships, and overall psychological well-being. Its goal is to build a powerful, emotionally resonant case for non-economic damages by telling a compelling story of loss.

This method is highly effective in cases where the medical bills do not fully reflect the severity of the client’s suffering. For example, a construction worker with chronic pain who can no longer perform his skilled trade, or a parent with a spinal injury who can no longer lift their child. By detailing the client’s pre-injury life and contrasting it with their post-injury reality, you create a tangible sense of what was taken from them, justifying a higher valuation for pain and suffering.

Strategic Application

When to use this approach:

- Significant Non-Economic Damages: This is the ideal strategy when the primary value driver is pain, suffering, and loss of enjoyment of life.

- Permanent or Life-Altering Injuries: Use it for claims involving permanent functional limitations, scarring, or psychological trauma that will affect the client for years to come.

- Low Medical Specials, High Impact: Perfect for cases like chronic pain syndromes or psychological injuries where treatment costs are relatively low but the life impact is profound.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, follow these best practices:

- Use Specific, Tangible Examples: Instead of saying the client "has limitations," describe how they "can no longer carry a bag of groceries or pick up their toddler." Specifics are more powerful than generalizations.

- Incorporate Third-Party Statements: Include brief, powerful statements from family members, employers, or caregivers that validate the plaintiff’s claims about their diminished quality of life.

- Connect Impact to Clinical Findings: Draw a direct line from specific notes in the medical records to the functional limitations you are describing. For example, "The MRI finding of a disc herniation at L4-L5 is the direct cause of the radiating leg pain that prevents Mr. Smith from sitting for more than 15 minutes."

- Calculate Costs of Lifestyle Changes: Quantify the impact by including the costs of necessary lifestyle modifications, such as therapy, assistive equipment, or home-help services, to anchor your non-economic damages demand.

5. Insurance Policy Limits Analysis Settlement Template

An insurance policy limits analysis settlement template strategically frames the demand around the defendant's known insurance coverage. Instead of focusing solely on the total value of the damages, this letter acknowledges the practical constraints of the policy limits and presents a demand that represents a reasonable and efficient resolution within those confines. The core purpose is to demonstrate that settling for the policy maximum is the insurer's most logical and financially prudent course of action, often by subtly highlighting their potential exposure to a bad faith claim if they fail to do so.

This approach is crucial in cases where catastrophic injuries result in damages far exceeding the available insurance coverage. For example, a motor vehicle accident claim with over $500,000 in medical bills against a defendant with a standard $250,000 liability policy. By centering the narrative on the policy limits, you shift the conversation from "how much is this claim worth" to "why you must tender your full policy to protect your insured." This method leverages the insurer's duty to its policyholder to secure a prompt and full-policy settlement.

Strategic Application

When to use this approach:

- High-Damage, Low-Limit Cases: Essential when the claimant's damages clearly and substantially exceed the available policy limits.

- Potential Bad Faith Claims: Use it to lay the groundwork for a future bad faith action by giving the insurer a clear and documented opportunity to settle within limits.

- Multiple Insurance Sources: Effective when dealing with primary, umbrella, and UIM/UM policies, as it forces each carrier to evaluate their exposure.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, consider these best practices:

- Frame as an Opportunity: Present the policy-limit demand not as a concession but as a time-sensitive opportunity for the insurer to protect its insured from an excess judgment and fulfill its contractual duties.

- Document the Disparity: Clearly itemize all damages, even those far exceeding the policy limit. This creates a stark contrast that underscores the reasonableness of your demand for the full policy.

- Introduce Bad Faith Concepts: Gently discuss the insurer's duty to its insured and the potential costs of litigation and an excess verdict. This pressures the adjuster to escalate the file for policy-limit authority.

- Use Specific Language: Incorporate phrases like "we hereby demand your insured's full and available policy limits" and "this offer to settle within limits will remain open for 30 days" to create a clear record.

By focusing the demand on the practical reality of the insurance policy, you create powerful leverage that compels the carrier to act decisively, often resulting in a faster and more predictable recovery for your client.

6. Defense Litigation Risk Cost-Benefit Settlement Letter

A defense litigation risk cost-benefit settlement letter reframes the settlement discussion from a debate over damages to a pragmatic business decision. This approach targets claims managers and defense counsel by presenting settlement as a financial risk management tool. Instead of focusing solely on the plaintiff's injuries, it quantifies the projected costs of litigation, including attorney fees, expert witness expenses, and discovery costs, presenting them alongside the uncertainty of trial.

This method is particularly effective in complex cases where litigation costs are substantial and predictable. For example, in a product liability case requiring multiple engineering experts or a medical malpractice claim with a protracted discovery process, the cost of defense can quickly escalate. By outlining these expenses, this settlement letter example demonstrates that an early settlement is a financially prudent choice that mitigates risk and ensures a predictable outcome.

Strategic Application

When to use this approach:

- High-Cost Litigation: Essential for cases with guaranteed high defense costs, such as medical malpractice, product liability, or complex commercial disputes.

- Cases with Uncertain Liability: When liability is contestable, this letter shifts the focus to the guaranteed costs of defense versus the uncertain risk of an adverse verdict.

- Corporate or Institutional Defendants: This financial-centric argument resonates strongly with business-minded defendants and insurance carriers focused on budget certainty.

Actionable Tips for Implementation

To maximize the effectiveness of this cost-benefit analysis, follow these best practices:

- Use Credible Cost Projections: Ground your litigation cost estimates in reality. Research and cite typical attorney billing rates, expert witness fees for relevant specialties, and e-discovery costs in your jurisdiction to build credibility.

- Quantify Uncertainty with Data: Frame the risk of trial by presenting recent jury verdict data for similar cases in the venue. This transforms abstract risk into a tangible financial range.

- Format for Clarity: Present the cost-benefit analysis in a simple table or chart. A visual comparison of "Guaranteed Litigation Costs" versus a "Proposed Settlement Amount" is far more impactful than a dense paragraph.

- Emphasize Business Certainty: Conclude by framing the settlement not as an admission of fault but as a strategic business decision that eliminates financial exposure and provides certainty. This allows the defense to view the proposal as a win for their bottom line.

7. Structured Medical Records Chronology Settlement Template

A structured medical records chronology settlement template organizes the entire demand around a detailed, date-sequenced medical timeline. This approach makes the medical journey the central pillar of the narrative, with all other arguments, such as liability and damages, built upon this chronological foundation. Its primary goal is to demonstrate a clear, undeniable progression of injury, treatment, and consequence, making it easy for an adjuster to follow the evidence.

This method is particularly effective in cases where the sequence of medical events is critical to proving causation and damages. For instance, a traumatic brain injury case involving initial ER care, followed by ICU stabilization, neurological follow-ups, and long-term rehabilitation, is best presented chronologically. This format allows the adjuster to see how each treatment logically led to the next, reinforcing the severity and legitimacy of the claim.

Strategic Application

When to use this approach:

- Long Treatment Durations: Perfect for claims with an 18+ month treatment arc, such as a spinal injury requiring physical therapy, multiple imaging studies, and specialist consultations.

- Complex Causation: Use when connecting post-surgical complications or a delayed diagnosis back to the initial incident, as the timeline establishes the direct link.

- Cases with Treatment Gaps: The chronological format allows you to proactively address and explain any gaps in treatment, framing them as part of the client's recovery story.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, focus on clarity and accessibility:

- Create a Summary Timeline: Begin with a one or two-page executive summary timeline. This gives the adjuster a high-level overview before they dive into the detailed chronology.

- Use a Scannable Table Format: Organize the detailed chronology in a table with columns for Date (MM/DD/YYYY), Provider, Description of Service, and a cross-reference to the exhibit number. This makes it easy for reviewers to scan.

- Highlight Critical Events: Use bold text or highlighting to draw attention to key milestones like surgeries, significant imaging findings (e.g., MRI results), or a formal diagnosis change.

- Cross-Reference Everything: Ensure every entry in the chronology references a specific exhibit number in your attached medical records. This traceability builds credibility and simplifies the adjuster's verification process.

By building your settlement letter around a medical chronology, you provide a powerful, evidence-based narrative that is difficult for an adjuster to dispute. This structured approach showcases a meticulous command of the case facts and streamlines the valuation process for the insurer.

8. Comprehensive Damages Framework Settlement Template

A comprehensive damages framework settlement template itemizes every category of loss, transforming your demand from a simple request into a detailed financial accounting. This approach separates the liability discussion from the damages analysis, allowing the letter to function as both a persuasive narrative and an undeniable financial ledger. Its core strength lies in presenting a granular, evidence-based breakdown of economic and non-economic damages, leaving no room for ambiguity.

This method is essential for cases with significant financial implications, such as an auto accident with $85,000 in medical bills and $35,000 in lost wages, or a catastrophic injury claim requiring future care cost projections. By creating distinct sections for Economic Damages (medical costs, wage loss) and Non-Economic Damages (pain, suffering, impairment), you provide the adjuster a clear roadmap to justify your demand. This level of detail demonstrates meticulous preparation and strengthens your negotiating position.

Strategic Application

When to use this approach:

- Catastrophic or Wrongful Death Cases: Essential for claims involving life care plans, future medical expenses, and significant loss of earning capacity.

- Cases with Permanent Impairment: Use it to quantify the financial impact of a permanent partial disability rating, including vocational rehabilitation costs.

- Claims with High Economic Damages: Ideal when medical bills and lost income form a substantial portion of the total demand, requiring clear documentation.

Actionable Tips for Implementation

To maximize the effectiveness of this settlement letter example, follow these best practices:

- Create a Damages Summary Table: Begin the damages section with a high-level summary table that lists each category (past medical, future medical, lost wages, non-economic) and its total. This gives the adjuster a concise overview before they dive into the details.

- Explain Your Multiplier: When calculating non-economic damages, explicitly state the multiplier or per diem rate used and provide a brief rationale based on the severity of the injuries, duration of treatment, and impact on the client’s life.

- Use Visual Aids: For complex financial data like future care costs or lost wage projections, include charts or graphs in the appendices to visually represent the numbers, making them more persuasive and easier to digest.

- Reference Exhibits Clearly: For every claimed damage, from a medical bill to an expert’s report on future care, reference the corresponding exhibit number directly in the text. This organized approach simplifies the adjuster's review process.

By using a detailed damages framework, you provide the insurer with a transparent and well-supported valuation of the claim. To refine your approach, you can learn more about how to calculate pain and suffering damages and articulate these figures effectively in your demand.

8-Point Settlement Letter Comparison

| Template | Implementation complexity | Resource requirements | Expected outcomes | Ideal use cases | Key advantages |

|---|---|---|---|---|---|

| Structured Demand Letter Settlement Template | Medium — structured drafting and organization required | Complete medical records, time to synthesize, optional AI summaries | Faster insurer review and higher settlement acceptance rates | Personal injury with multiple providers, claims under ~$250k | Organized, easy-to-scan medical narrative that facilitates quick review |

| Medical Records Summary with Demand Letter Hybrid | High — skilled integration of medical narrative and demand language | AI-generated medical summaries, full records, skilled drafter | Stronger causation linkage, fewer insurer follow-ups | Medically complex claims valued $100k–$500k | Unified single document that eliminates duplication and strengthens narrative |

| Data-Driven Comparative Settlement Template | Medium–High — research and data compilation required | Verdict/databases, analytics tools, jurisdictional comparables | Defensible, benchmarked demands and reduced insurer pushback | Cases with available comparables, claims $75k–$1M+ | Anchors demands to objective benchmarks to strengthen negotiation |

| Impact Statement-Centered Settlement Letter | Medium — detailed client interviews and corroboration needed | Client questionnaires, family/employer statements, medical support | Greater recovery for non-economic damages, emotional resonance | Permanent impairment, PTSD, career-impacting injuries | Humanizes claim and persuasively supports pain & suffering awards |

| Insurance Policy Limits Analysis Settlement Template | Medium — coverage investigation and careful framing | Policy documents, asset searches, possible coverage experts | Realistic demand aligned with recoverable funds, fewer coverage surprises | High-damage cases exceeding policy limits, multi-party claims | Aligns demand with insurance reality and identifies creative recovery paths |

| Defense Litigation Risk Cost-Benefit Settlement Letter | High — accurate cost modeling and economic framing required | Litigation cost data, expert estimates, market billing rates | Accelerates settlement by reframing as financial risk decision | Complex litigation with high defense costs or outcome uncertainty | Appeals to claims managers by quantifying defense costs and uncertainty |

| Structured Medical Records Chronology Settlement Template | High — exhaustive record collection and verification needed | Complete chronological records, AI extraction tools, time | Clear timeline of injury and treatment, supports causation and experts | Long treatment arcs, multiple providers, delayed diagnosis claims | Provides temporal clarity and simplifies multi-provider medical review |

| Comprehensive Damages Framework Settlement Template | High — detailed financial and actuarial analysis required | Medical bills, wage docs, vocational/actuarial input, AI assistance | Transparent, auditable damages valuation and fewer methodological disputes | High-value claims needing detailed damages justification | Itemized, defensible damages calculations that facilitate verification |

Integrating Strategy and Technology for Superior Settlements

The diverse collection of settlement letter examples explored in this article underscores a fundamental truth in personal injury law: a one-size-fits-all approach is a recipe for mediocrity. The most effective demand letters are not mere summaries of facts; they are precision-engineered instruments of persuasion, each calibrated to the unique leverage points of a specific case. By mastering these varied templates, you transform a standard procedural step into a powerful strategic advantage.

We have seen how different frameworks can dramatically shift the negotiating landscape. The cold, hard logic of a data-driven comparative analysis can dismantle an adjuster's lowball offer, while the visceral narrative of an impact statement-centered letter can convey human suffering in a way that raw medical bills never will. The key is to recognize which tool is right for the job.

Synthesizing the Core Takeaways

Reflecting on the eight distinct templates, from the structured medical chronology to the defense litigation risk analysis, several core principles emerge as universally critical for elevating your settlement demands:

- Strategic Customization is Non-Negotiable: The "why" behind your choice of template is as important as the content itself. A catastrophic injury case demands a different narrative structure than a soft-tissue case with a clear liability argument. Always begin by identifying your strongest leverage point and build your letter around it.

- Data is Your Foundation: Whether you are presenting a detailed medical summary, a comparative verdict analysis, or a cost-benefit breakdown, your arguments must be built upon a bedrock of accurate, well-organized data. Vague assertions are easily dismissed; substantiated claims command respect and force a meaningful response.

- Narrative Drives Value: Adjusters are human. A compelling story that connects the medical facts to the plaintiff's lived experience, pain, and future challenges can significantly increase the perceived value of a claim. Weaving a narrative through your chosen framework is essential.

- Clarity and Organization are Paramount: An adjuster should be able to grasp the core of your argument, the extent of the damages, and your demand amount within minutes. Using clear headings, bullet points, and strategic formatting, as shown in the examples, prevents your key points from getting lost in dense paragraphs.

Actionable Next Steps: From Theory to Practice

Moving forward, the goal is to integrate these concepts into your firm’s daily workflow. Start by auditing your current settlement letter process. Are you using a single, static template for all case types? If so, begin by adapting one or two of the settlement letter examples from this article for your next appropriate cases.

Consider creating an internal playbook that matches case archetypes to specific demand letter strategies. For instance, any case with projected future medical costs over a certain threshold could automatically trigger the use of the Comprehensive Damages Framework. Similarly, cases with clear liability but disputed damages might benefit from the Defense Litigation Risk Cost-Benefit approach. This systematizes strategic thinking and ensures consistency across your team. As you refine these documents, consider how to improve the efficiency of the drafting process itself. For those aiming to streamline the drafting process and integrate modern tools, exploring options like legal dictation software can be highly beneficial.

Ultimately, mastering the art of the settlement letter is about more than just securing higher offers. It’s about fulfilling your duty as an advocate. It’s about ensuring that your client's story is told with the force and clarity it deserves, compelling the opposing side to recognize the true value of what has been lost. The examples provided are your toolkit; a powerful demand is the structure you build to achieve justice.

Ready to build your most powerful settlement demands on a foundation of speed and accuracy? Ares uses AI to instantly extract critical data from medical records, creating the organized chronologies and summaries you need to implement these advanced strategies in a fraction of the time. Transform your firm’s efficiency and empower your team to focus on high-value advocacy by visiting Ares today.